Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a long position with a pending order from levels of 18.50

- Set a stop-loss point to close below the 18.25 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best-selling entry points

- Enable a short position with a pending order from levels of 18.99

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

The price of the TRY/USD stabilized during the early trading Thursday, as the Turkish Central Bank kept control of the currency rate, no longer moving due to economic data, but according to the interventions of the Central Bank of Turkey.

In terms of data, the country's Ministry of Finance revealed that it recorded a budget deficit of the central Turkish government during the month of October. This amounted to about 83 billion liras, equivalent to about 4.5 billion dollars, while revenues rose to 224 billion liras, which is double revenue if compared to the October revenues from Last year.

Tax revenues were the main contributor to the increase in revenues after they rose by 102% compared to the previous year. In other data, the statistics revealed that the volume of Turkish exports to the United States of America increased by 16%, to reach its highest level ever during the first ten years of this year. This happened after it recorded about 11.99 billion dollars. Then Italy came in second place with exports amounting to about 9.275 billion dollars.

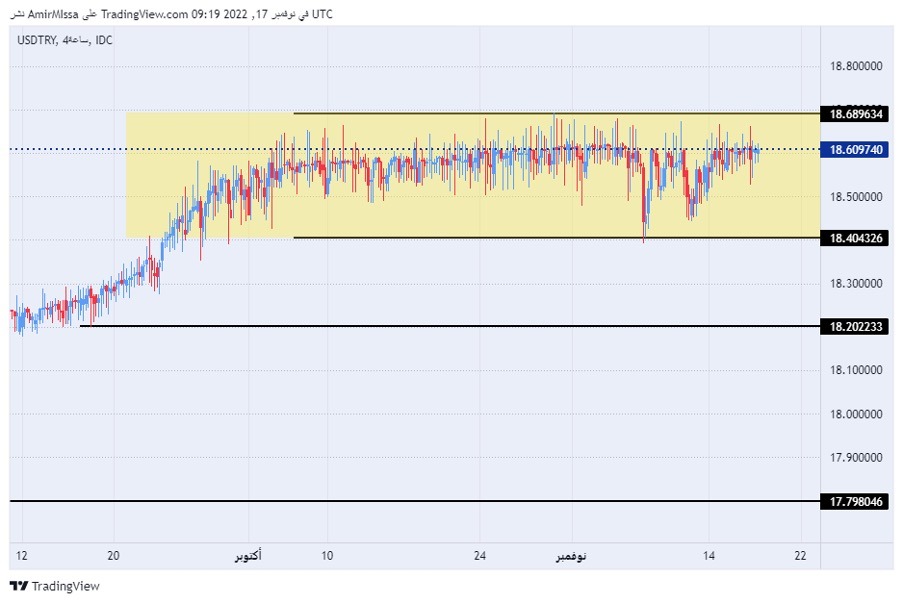

TRY/USD Technical Analysis

On the technical front, the Turkish lira stabilized against the dollar unchanged, as the pair maintained its trading within a narrow range that has been going on for several weeks. The pair stabilized within the rectangle range shown in the four-hour time frame, as shown on the attached chart. The pair maintained its highest levels of support, which are concentrated at 18.40 and 18.20, respectively.

On the other hand, the lira is trading below the resistance levels of 18.70 as well as the psychological resistance at 19.00. At the same time, the pair traded above the 50, 100, and 200 moving averages on the daily time frame, as the pair recorded a bounce from the 50 moving average. The price is trading between these averages on the four-hour time frame as well as on the 50-minute time frame, in an indication of the divergence recorded by the pair in the medium term. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free Forex currency signals? Here are some excellent Forex brokers to choose from.