Advertisement

Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a long position with a pending order from levels of 18.50

- Set a stop-loss point to close below the 18.25 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best-selling entry points

- Enable a short position with a pending order from levels of 18.99

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels

The TRY/USD continued to trade in a limited range during early Tuesday trading. Investors followed optimistic statements by the country's President, Recep Tayyip Erdogan, who expected the volume of foreign reserves held by the Central Bank to expand by the end of the year. In this regard, Erdogan said that the central bank's foreign exchange reserves amounted to 123 billion dollars and is expected to reach 130 billion dollars by the end of this year.

At the same time, investors followed the statements of the country's Minister of Energy about gas prices with the approach of the winter season. Energy prices represented the biggest factor in the rise in the inflation rate in the country, which is recording its highest levels in nearly 25 years, as Fatih Donmez said. He also added that the country will not witness any crises in the extension of energy during the upcoming winter, which may keep inflation at the current limits or may register a slight increase.

TRY/USD Technical Analysis

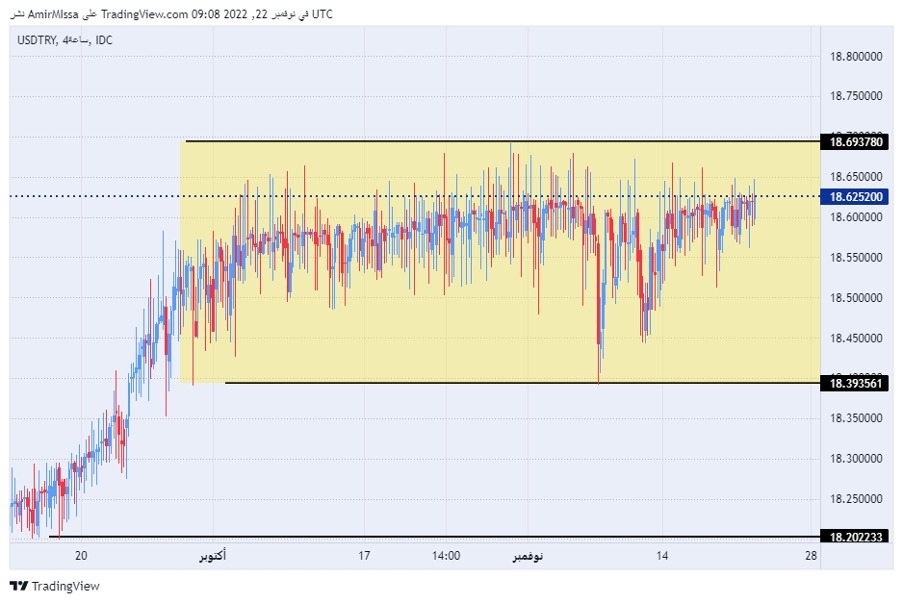

On the technical front, the Turkish lira's trading against the dollar stabilized with minor changes, as the pair continued trading within a narrow range that has been going on for nearly two months. The pair traded within the rectangle range shown in the four-hour time frame and shown on the attached chart. The pair maintained its highest levels of support, which are concentrated at 18.40 and 18.20, respectively.

On the other hand, the lira is trading below the resistance levels of 18.70 as well as the psychological resistance at 19.00. At the same time, the pair traded above the 50, 100, and 200 moving averages on the daily time frame, as the pair recorded a bounce from the 50 moving average. The price is trading between these averages on the four-hour time frame as well as on the 50-minute time frame, in an indication of the divergence it is recording medium-term pair. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our daily trading signals? Here’s a list of some of the best Forex trading platforms to check out.

Ready to trade our daily trading signals? Here’s a list of some of the best Forex trading platforms to check out.