Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a long position with a pending order from levels of 18.50

- Set a stop-loss point to close below the 18.25 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best-selling entry points

- Entering a short position with a pending order from levels of 18.99

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

The TRY/USD stabilized during the early trading this morning, after the decision of the Turkish Central Bank at the end of trading last week, where the Monetary Policy Committee of the Bank reduced the interest rate by 150 basis points. It brought the interest rate to 9%, a decision that the markets were waiting for, because of the Turkish president's insistence on reducing the interest rate to the single digits.

The bank's statement had expected inflation to remain higher than expected for some time due to the rise in energy imports. In the meantime, investors followed the statements of Turkish President Recep Tayyip Erdogan last Saturday that his country does not face problems in the extension of energy during the coming winter months, in contrast to some difficulties that are expected to face the European Union countries. In this regard, Erdogan said: “While European countries are thinking about how to spend the winter with the continuing energy crisis, we are entering the winter with peace of mind,” adding that Ankara is preparing to buy wheat through the Black Sea grain deal to produce flour for poor countries. The July agreement won Signed between Ukraine and Russia with the support of Turkey and the United Nations in order to facilitate food exports.

TRY/USD Technical Analysis

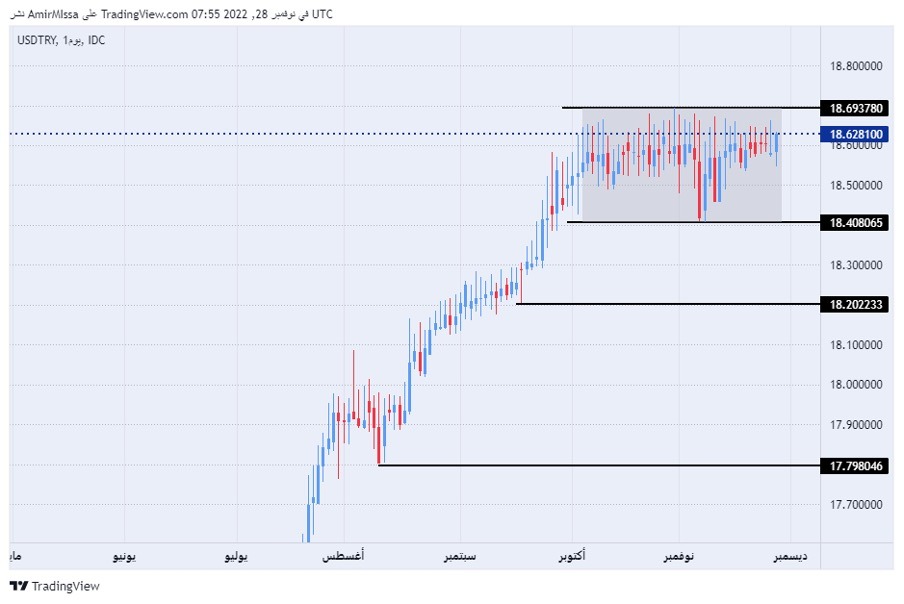

On the technical front, without major changes, the TRY/USD recorded stability within a narrow range that has continued for nearly two months, as the USD/TRY pair traded the highest moving averages 50, 100 and 200 on the time frame for the day. The price is also trading between these averages on the time frame.

At the same time, the pair settled within the rectangle range in the four-hour time frame, which is shown on the attached chart. Where it is trading the highest support levels that are concentrated at 18.40 and 18.20 levels, respectively. On the other hand, the pair is trading below the 18.70 resistance level as well as the psychological resistance at 19.00. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex brokers in the industry for you.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex brokers in the industry for you.