Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

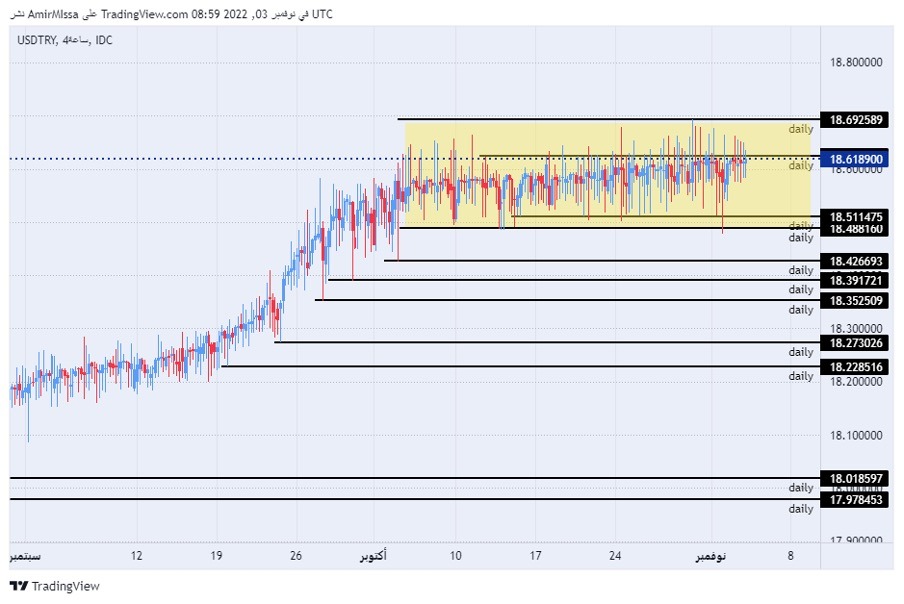

- Entering a long position with a pending order from levels of 18.50

- Set a stop-loss point to close below the 18.35 support level.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit of 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best-selling entry points

- Entering a short position with a pending order from levels of 18.99

- The best points for setting stop-loss are closing the highest levels of 19.15.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support level.

The price of the Turkish lira stabilized. It grew despite the great movement witnessed by most currencies and commodities around the world after the Federal Reserve in the United States raised the interest rate by 75 basis points. The green currency rose against most major currencies and emerging market currencies with the Fed’s insistence to adhere to the tightening monetary policy, which shows the Turkish Central Bank’s control of the lira’s exchange rate directly and indirectly as well.

This intervention also appears after negative data that did not affect the movement of the Turkish lira against global currencies, as data issued by the Turkish Statistical Institute revealed in early trading on Thursday that the country's consumer price index recorded an increase during the month of October by 3.54% on a monthly basis. The figure also set new records, amounting to 85.51% on an annual basis. The rises continue for the seventeenth consecutive month. In the details of the data, housing prices rose by 85% during the last month compared to the same period last year. Transportation prices also recorded an increase of 117% in conjunction with an increase in food prices by 99% on an annual basis. The rise in inflation comes in light of Turkish President Recep Tayyip Erdogan's promises to work on reducing the inflation rate at the end of this year and the beginning of next year.

TRY/USD Technical Analysis

On the technical front, the US dollar pair against the Turkish lira stabilized without changes during today's early trading, amid the pair's divergence in tight trading at the current averages. The pair continued to fluctuate within a limited and continuous range since the beginning of last month, as the pair is trading the highest levels of support, which are concentrated at 18.51 and 18.42 levels, respectively. On the other hand, the lira is trading below the psychological resistance levels at the correct number based at 19.00. In the meantime, the pair is trading above the 50, 100, and 200 moving averages on the time frame for the day, indicating the general bullish trend, while the pair is trading between these averages on the four-hour time frame.

This also happened on the 60-minute time frame, which shows the extent of volatility and trading in the narrow range that the pair is recording. Any drop for the pair represents an opportunity to buy back again with the aim of reaching the previous high recorded during the past year. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free currency signals? Here are the best Forex brokers to choose from.