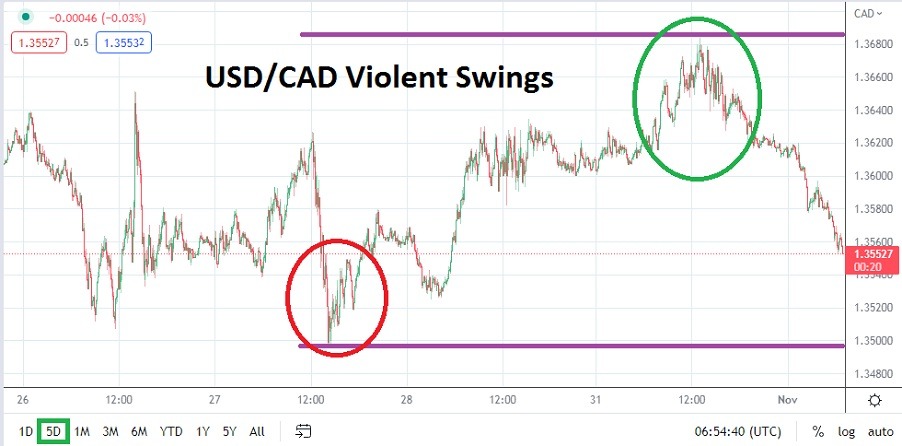

The USD/CAD is currently near the 1.35725 mark. Volatility in the currency pair has risen the past few days. In early trading yesterday, the USD/CAD climbed to near 1.36860 only to then display an impressive and quick reversal lower. Today’s downward motion is now within breathing distance of lows posted on Friday the 28th of October when the USD/CAD flirted with 1.35250.

Support Levels have been tested in the USD/CAD a few times the Past Week

Support levels in the USD/CAD have demonstrated several reversals in the past week, with the 1.35000 target below seemingly a target psychologically. However reversals upwards in the USD/CAD when this level has come into technical perspective have proven strong. Tomorrow the U.S Federal Reserve will increase its interest rate, but more importantly will be their guidance regarding future potential hikes.

The USD/CAD has been showing signs of speculative plays lower. Having been within the grasp of a rather strong bullish stance the past year, selling action may have genuine reasons for finally coming to an end. However speculators should remain slightly skeptical of the selling action and practice a solid risk taking approach. Choppy conditions seen the past week with important support coming into sight, then followed by strong reversals upwards are evidence of fragile trading conditions.

If the 1.35100 becomes Vulnerable a Spark Lower could ignite in the USD/CAD

- Traders who want to be ahead of the potential speculative curve, and sell the USD/CAD now based on the belief the U.S Federal Reserve will sound more dovish regarding its interest rate policy tomorrow will be taking a dangerous risk.

- Speculators should expect a vast amount of volatility in the near term and make sure their choice of leverage doesn’t allow for money vanishing from their accounts with costly mistakes.

The downwards trend in the USD/CAD has been halted several times in the past week. While there are signs the trend lower may in fact become stronger and break through key support levels near the 1.35100 mark, there are no guarantees. Traders should remain realistic regarding their targets and not allow their pursuit of lower values in the USD/CAD cloud their judgment.

Reversals are sure to happen in the USD/CAD higher too; choppy conditions have been fast and over the next 30 hours will likely remain a key ingredient. Speculators who want to sell the USD/CAD when it touches perceived resistance levels, and looking for quick hitting results lower may be making a worthwhile wager.

Canadian Dollar Short Term Outlook:

Current Resistance: 1.35800

Current Support: 1.35510

High Target: 1.36310

Low Target: 1.35040