- For three trading sessions in a row, the losses of the USD/JPY currency pair stop at the 137.67 support level.

- This is the lowest level in two and a half months and settle around the 139.50 level at the time of writing the analysis, and it tried to stabilize above the 140.00 psychological resistance.

- The varying results of the US economic data this week prevented its continuation bounce up.

According to official figures, wholesale prices in the United States rose 8% in October compared to a year ago, the fourth consecutive decline. This indicates that inflation pressures in the United States are retreating from painfully high levels. The annual figure is down 8.4% in September. On a monthly basis, the government said the US Producer Price Index, which measures costs before they reach consumers, rose 0.2% in October from September. It was the same as the previous month, which was revised down from the initial reading of 0.4%.

The numbers came in lower than economists had expected and make it more likely that the Fed will raise the benchmark interest rate in smaller increments. It has raised its short-term price by three-quarters of a point for four consecutive meetings, but economists now expect a half-point increase at the December meeting. Accordingly, Rubella Farooqi, chief US economist at High-Frequency Economics, a forecasting firm, said that "The improvement in October inflation data, if it continues, supports the Fed's expectations of a slower pace of increases in the future."

Most of the monthly increase reflected higher gas prices at the wholesale level, which rose 5.7% in October alone. The cost of new cars fell 1.5% last month, which could lead to lower prices at the retail level as well. Excluding the volatile food and energy categories, core producer prices were unchanged in October from September, the lowest reading in nearly two years. Core prices rose 6.7% last month from a year ago, down from a 7.1% annual rate in September.

The cost of services, such as hotels, air travel, and healthcare, fell 0.1% in October compared to September, the first decline since November 2020.

The report comes on the heels of last week's best-known US Consumer Price Index, which showed that year-on-year inflation eased to a slower-than-expected 7.7% in October, down from 8.2% in September. Excluding volatile food and energy costs, that report also said that core prices rose only 0.3% in October from the previous month, half the increase recorded in the previous two months.

These consumer price inflation figures sent stock markets soaring as they indicated that the devastating price hikes of the past 18 months might finally moderate. The cost of used cars, clothing, and furniture fell, a sign that commodity prices reversed their big jumps last year when supply chain disruptions drove up inflation. In recent months, delays at major ports have been removed, ocean freight rates have fallen, and more stores are building larger stocks. All of these trends indicate that commodity prices could continue to fall.

USD/JPY Forecast

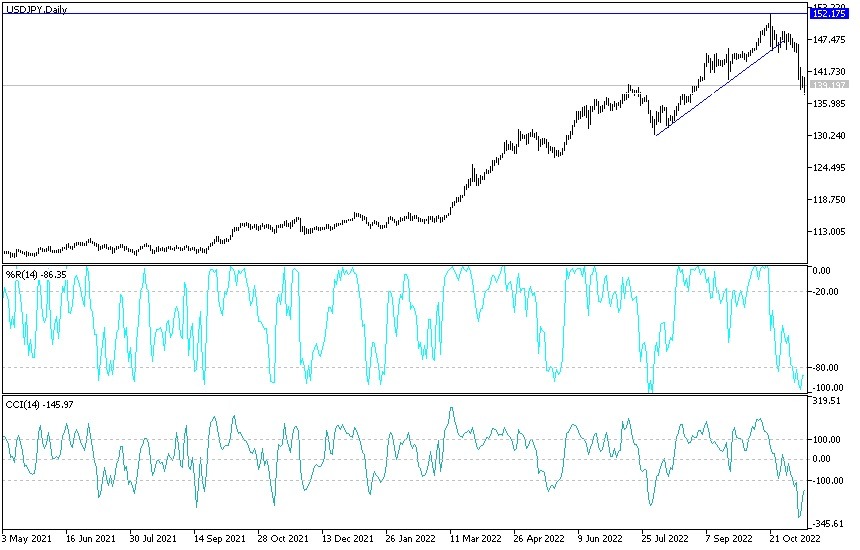

According to the performance on the daily chart, the bearish reversal of the USD/JPY currency pair is still valid, bearing in mind that the recent losses have moved the technical indicators toward oversold levels.

Adhering to the pace of losses for several sessions will be a buying base for the currency pair, which is believed to return the upward path through it, especially if the bulls move steadily towards the resistance levels of 141.80 and 143.00, respectively. On the other hand, breaching the 137.70 support level will increase the bears' control over the trend. I still prefer buying the USD/JPY from every descending level.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.