Before the announcement of important US inflation figures, the price of the USD/JPY is trying to recover from its recent losses. The losses hit the support level 145.16, and it has recovered around the level of 146.70 at the time of writing the analysis. Besides today's data, the expected "red wave" of Republicans in the US midterm elections did not materialize, but the party is still expected to dominate the House of Representatives, a result that could be supportive of the US dollar in the near term, analysts say.

The US dollar exchange rates were higher as the midterm election results cleared up during the middle of the week, although the way the US currency ends the week will eventually align with the results of inflation data printed on Thursday.

Ahead of the data release

Data markets will be dominated by media reports confirming that although Republicans appeared ready to overturn their narrow Democratic majorities in the House of Representatives, expectations for a big win did not materialize. Early statistics from the midterm elections suggest that the Republican wave is unlikely to materialize. The most likely outcome is a divided Congress, with Republicans controlling the House and Democrats retaining the Senate.

If the result is confirmed by a final vote in light of the count, President Biden will have to resort to executive orders as his legislative powers will be drastically curtailed. Analysts widely regard the midterm elections as a minor factor in the dollar's outlook, but some say the results may nonetheless have some implications for price action in the near term. Commenting on this, Stephen Gallo, FX analyst at BMO Capital Markets says, "The midterm elections are likely to be the issue on the markets' minds." "If the Democrats shock the world and take over the House, we think that would be a negative for the US dollar, but not by more than 1% at most," the analyst added.

However, a number of analysts we follow and assess the results of the US midterm elections will eventually prove neutral to the forex markets, with any unexpected reactions proving to be short-lived.

Forecast of the dollar against the Japanese yen today:

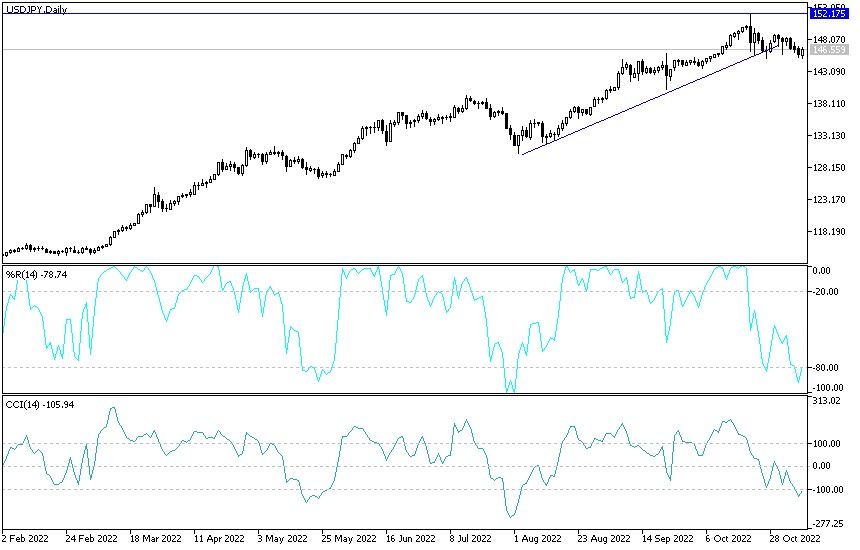

- According to the performance on the daily chart, the bulls are trying to control the performance of the USD/JPY currency pair.

- If the US inflation numbers come in stronger than expectations, the bulls may move the currency pair towards the resistance levels 147.70 and 148.60, respectively.

- These are important to emphasize controlling the upward trend.

On the other hand, and over the same time period, moving towards the support level 145.10 will be important to break the current bullish trend. The policy divergence of the Bank of Japan and the US Federal Reserve will favor the strength of the currency pair.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.