For the second day in a row, the price of the USD/JPY currency pair is trying to rebound higher. It is stable above the important psychological resistance 140.00. The pace of its sharp losses recently pushed it towards the support level 138.46. The attempts to rebound higher for the currency pair stopped at the resistance level 140.80, where it awaits a strong stimulus to rebound higher. This may find hints from US Federal Reserve officials this week, commenting on the recent weak US inflation figures.

Federal Reserve Vice Chair Lyle Brainard says “I think the latest US CPI inflation data suggests that perhaps the core PCE metric we're really focused on might also show a slight dip. When we get those October numbers later, his month could drop from about 0.5 per month — month after month — in August and September to 0.3. This would be welcome. I think the US inflation data was reassuring at first, only in terms of showing a slowdown in the categories I was expecting. So if you break it down somewhat, you know, obviously, food and energy — that reflects Putin's war, some weather issues. We really focus on those key numbers.”

In essence, we're finally starting to see commodity inflation starting to subside and that's consistent with the data we've seen in lower shipping times; Increased availability of automotive semiconductors, for example, wholesale prices on delivered used cars. I generally started seeing the prices of those commodities go down. This is a really important trend that we'll need to continue over the next year if we're going to see lower inflation overall.

Commenting from the Fed official about the future of raising US interest rates, she said, “I think it will probably be appropriate soon to move to a slower pace of increases. But I think it's really important to emphasize - we've done a lot, but we have extra work to do in terms of raising prices and maintaining restraint to bring inflation down to 2% over time. And we've raised rates very quickly by about four percentage points over the course of about nine months and have lowered the balance sheet, and you can see that in the financial conditions. You can see this in the inflation forecasts, which are well proven. You can see it in interest rate sensitive sectors.

But as we said in the last meeting, there are likely to be delays and it will take some time for this cumulative tightening to flow in. It makes sense to move to a more in-depth, data-driven pace as we continue to ensure that there are constraints that will lower inflation over time.”

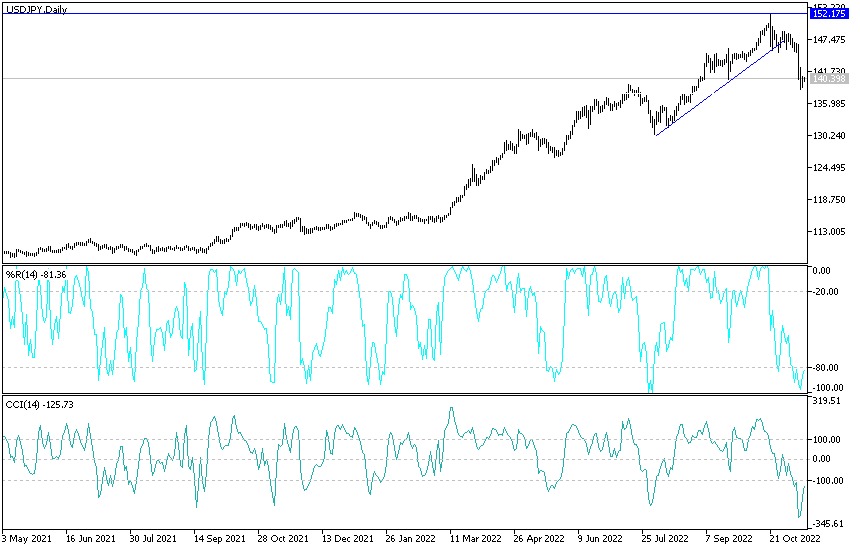

Forecast of the US dollar against the Japanese yen today:

- According to the performance on the daily chart below, the price of the USD/JPY currency pair is still in the path of a sharp descending channel that was formed recently after the disappointing US inflation numbers.

- The currency pair will not have a chance to recoup the upside without testing the resistance levels 142.40 and 145.00 respectively.

- The losses of the recent selling operations pushed the technical indicators towards oversold levels.

- Buying the pair can be considered as the divergence in the future of monetary tightening of global central banks will remain ultimately in favor of the US dollar.

The nearest important support levels for the dollar are currently 139.60 and 138.00 yen, respectively. Today, the US dollar will be affected by the announcement of the US inflation reading through the Producer Price Index, as well as the extent to which investors take risks or not.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.