For the fourth day in a row, the bears fail to push the USD/JPY currency pair below the support level of 137.67. This confirms that the technical indicators have reached strong and sharp oversold levels. The currency pair is awaiting a stimulus for an upward reversal at any time. Positive US retail sales numbers motivated the dollar-yen pair to stabilize around the 139.80 resistance level, on the cusp of the psychological resistance 140.00, the most important starting point.

Americans ramped up spending at retailers, restaurants and auto dealers last month, in a sign of consumer resilience as the holiday shopping season kicks off amid painfully high inflation and soaring interest rates. Accordingly, the government said that US retail sales rose 1.3% in October compared to September, up from the flat reading in September from August. The increase was driven by car sales and higher gas prices. However, excluding autos and gas, retail spending rose 0.9% last month. Even adjusting for inflation, spending increased at a solid pace. Prices rose 0.4% in October compared to September, a figure much lower than total sales. The strong government report contrasted with grim numbers on Wednesday from retail chain Target, which reported unexpectedly weak earnings as its increasingly price-sensitive customers cut back on spending.

The steady growth in jobs, higher wages, and increased savings after many people cut back on travel and leisure during the pandemic have enabled surprisingly steady spending by consumers, especially those with higher incomes. Economists pointed to two other factors that may have contributed to the gains. Amazon ran another Prime Day promotion last month, and California distributed inflation relief checks for up to $1,050.

However, there are persistent signs that cracks are forming in consumers' ability to keep up with the highest inflation rate in four decades. More households are relying on credit cards to pay bills, as credit card balances nationwide jumped 15% in the July-September quarter from a year ago, the largest year-over-year increase in two decades. Research last week by Bank of America found that consumers are increasingly looking for cheaper options when it comes to groceries and eating out. Transactions by Bank of America customers, using credit and debit cards, show they now visit cheaper fast-food restaurants more often than full-service restaurants, after eating at both on an equal footing for about a year after the spring of 2021.

The Bank of America report also found that, adjusting for inflation, grocery spending per household fell sharply, below pre-pandemic levels, although grocery store visits did not drop. This indicates that many people are looking for cheaper options when shopping for food. However, analysts said the government's report on US retail sales indicated a healthier economy than previously expected. Accordingly, Morgan Stanley revised its forecast for growth in the October-December quarter to 1.7% at an annual rate, up from a previous forecast of 0.7%. Strong consumer demand could keep inflation going, but other trends could work the other way. The retail sales report showed that U.S. auto sales jumped 1.3% last month, but that gain, as well as people replacing cars in Florida, partly reflected the removal of supply chain problems that made more auto parts and semiconductor chips available. Car production has rebounded, increasing supply, which could drive down prices.

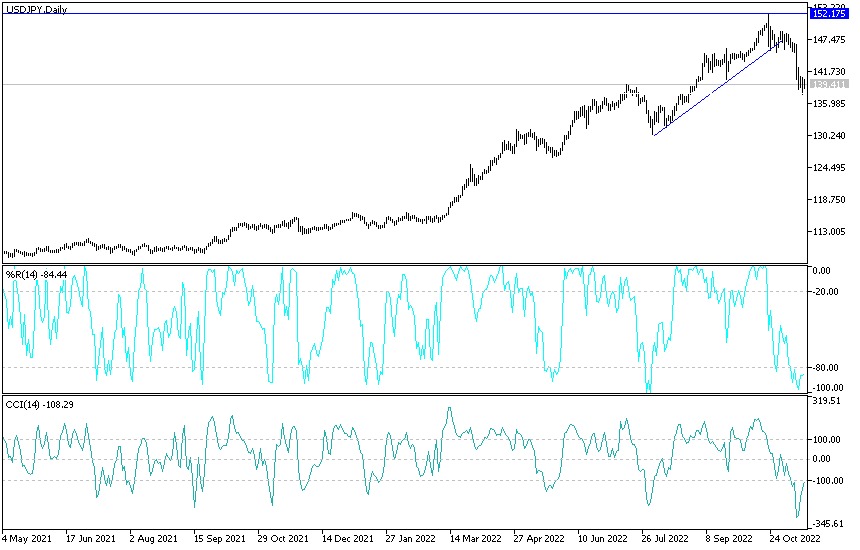

Forecast for the USD/JPY pair today:

There has been no change in my technical view of the price performance of the US dollar currency pair against the Japanese yen, USD/JPY, as the change in the recent sessions is constant.

- The general trend is still bearish, taking into account that the recent losses moved the technical indicators towards oversold levels.

- This is adhering to the pace of losses for several sessions constitutes a buying base for the currency pair, through which it is believed that it will restore the upward path.

- This is especially if the bulls move steadily towards the resistance levels of 141.80 and 143.00, respectively.

On the other hand, breaching the support level at 137.70 will increase the bears' control over the trend. I still prefer to buy the dollar yen from every downside level. Today, the dollar will interact with the announcement of the number of US weekly jobless claims, the reading of the Philadelphia Industrial Index and the US housing numbers.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex trading brokers in the industry for you.