Throughout last week's trading, the price of the USD/JPY currency pair attempted an upward rebound. The bulls did not gain momentum to overcome the resistance 140.75. The dollar yen pair closed the week's trading stable around the level of 140.37, and now it is on a date with a very short trading week.

The bank's hawkish policy still supports an upward path for the US dollar against the rest of the other major currencies.

Bank of Japan Governor Haruhiko Kuroda said he will monitor both upside and downside risks as the BoJ continues with monetary easing, comments that are likely to support continued speculation on policy adjustments in the long term. “The bank will closely study the outlook for economic activity and prices, as well as the upside and downside risks to the outlook,” Kuroda said last week in a speech to local business leaders in Nagoya, western Japan. “Based on the assessments, it will conduct appropriate monetary policy.”

Kuroda reiterated his view that the Japanese economy is still recovering from the pandemic and is asking for support from monetary easing now, suggesting there will be no immediate policy shift. However, his recent comments add to recent observations acknowledging price movements in Japan may be making progress toward sustainable inflation. “Although Japanese companies have long been cautious about raising prices, a wide range of products have seen price increases recently,” Kuroda added. Close attention to corporate behavior going forward is warranted. ”

Last week, the governor said that economic conditions toward a stable 2% BOJ inflation target are starting to emerge, and the target may get closer depending on the pace of wage growth in the next fiscal year. Meanwhile, Kuroda indicated that he remains very wary of the economic downturn by highlighting downside risks - which will mainly matter in the global economy, given rising inflation in the US and Europe, and aggressive tightening around the world. This indicates that his view is weighted more towards the downside.

Most BOJ watchers don't expect a pivot towards tightening before Kuroda steps down from his post in April. The central bank said Japan's price gains were driven by cost-benefit inflation, not the demand pull resulting from a virtuous economic cycle. The bank indicated that it will not tighten until strong wage growth is confirmed to create a sustainable form of inflation.

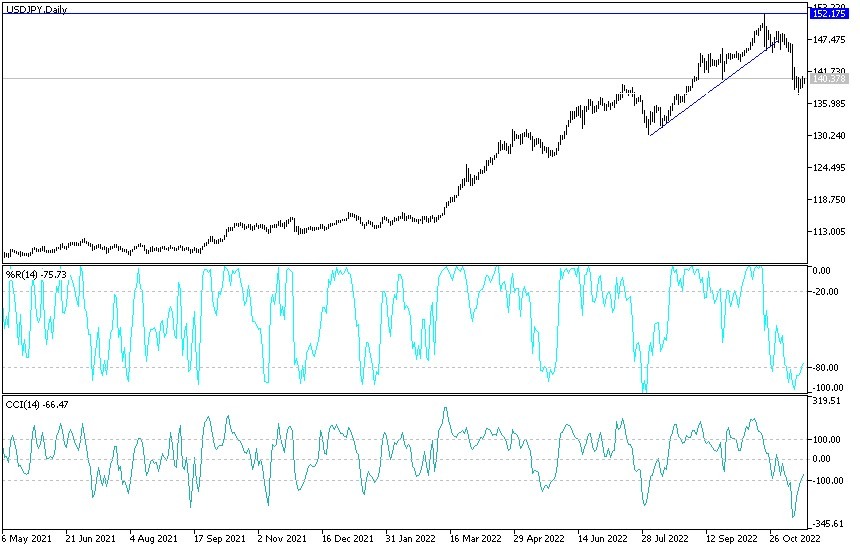

Technical forecasts for the dollar pair against the Japanese yen:

- In the near term, and according to the performance on the hourly chart, it appears that the USD/JPY is trading within a bullish channel formation.

- This indicates a slight bullish bias in the short term in the market sentiment.

- Therefore, the bulls will target short-term profits at around 140.759 or higher at the resistance 141.227.

- On the other hand, the bears will look to pounce on the gains at around 139.790 or below at the support at 139.305.

On the long run, and according to the performance on the daily chart, it appears that the USD/JPY is trading within the formation of a sharp descending channel. This indicates a strong long-term bearish bias in market sentiment. Therefore, the bears will look to pounce on profits at around 138.417 or below at support 136.095. On the other hand, the bulls will target long-term profits around 142.006 or higher at 144.117 resistance.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.