- Amidst the bullish momentum enjoyed by the performance of the USD/JPY currency pair, the pair is awaiting important and influential US economic data.

- This will be led by the announcement of the content of the minutes of the last meeting of the US Federal Reserve.

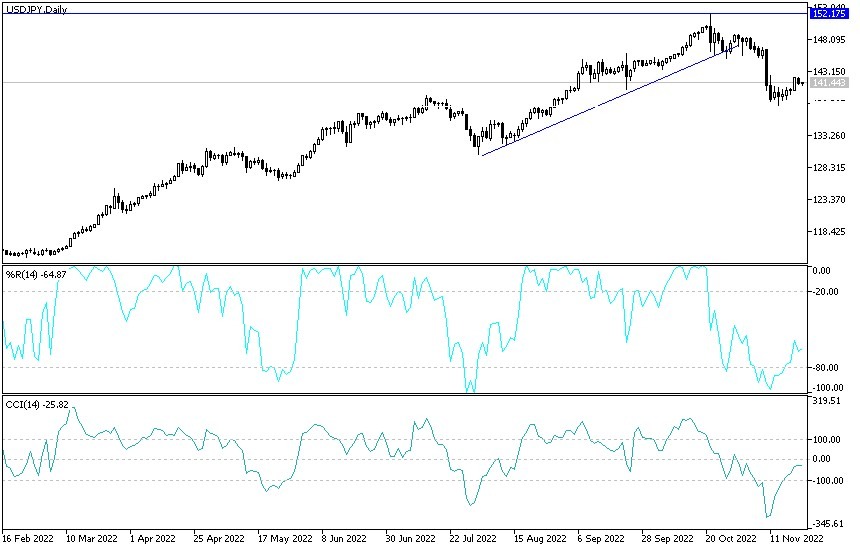

- The rebound gains for the currency pair this week, and prior to today's events, reached the resistance level of 142.25, and it settled around the level of 141.22 at the time of writing the analysis.

Prior to announcing the minutes of the US Federal Reserve meeting

There were statements by a number of US Federal Reserve officials. Yesterday Loretta Mester, President of the Federal Reserve Bank of Cleveland, said she and her colleagues are fully focused on tackling high inflation and will use their tools to get the job done. “Given the high level of inflation, restoring price stability remains the number one focus of the FOMC,” she said at a virtual event on Tuesday hosted by her bank, referring to the Federal Open Market Committee (FOMC), which sets interest rates. Inflation is on a sustainable downward trajectory to 2%.”

For its part, the US central bank raised interest rates by 75 basis points for the fourth time in a row this month, bringing the target on the benchmark interest rate to a range of 3.75% to 4%. Investors expect the Fed to fall to a smaller half point, increase when it meets on Dec. 13-14, and for the benchmark rate to peak at around 5% next year, according to contract pricing in futures markets.

Mester said on Monday that monetary policy is entering a different "rhythm" now that rates are at the beginning of constraining territory and that she has no problem with the Fed slowing the pace of interest rate increases at next month's meeting. Inflation fell more than expected in October, according to the latest reading of consumer prices, a shift that could give Federal Reserve officials more leeway to slow interest rate increases. But policymakers warn that they do not want to read too much in one monthly report and say they want to see more convincing evidence that inflation is heading down.

Yesterday, Mester said labor demand remains out of balance with supply, although there was no evidence of a wage and price spiral that could lead to higher inflation on the scale of the 70s. “At this point, the demand for labor still exceeds the supply of labor,” she said during the virtual event. But, she added, "in most sectors and categories, wage growth is not keeping pace with inflation and long-term inflation expectations have remained reasonably constant, so the dynamics today are different from the 1970s."

Forecasts of the US dollar against the Japanese yen today:

According to the performance on the daily chart, the price of the USD/JPY currency pair is trying to move inside an ascending channel supported by stability above the psychological resistance 140.00. The bulls need momentum to confirm control. This will happen if the currency pair moves towards the resistance levels 142.70, 143.60, and 145.00, respectively. On the other hand, and for the same period of time, the movement of the currency pair towards the support level of 138.80 will have significance for the bears to have strong control over the trend. The dollar yen pair will be greatly affected by the announcement of US data, durable goods orders, jobless claims, US consumer confidence, and then, most importantly, the content of the minutes of the last meeting of the US Federal Reserve.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.