At the end of last week's trading, the US dollar fell against the rest of the other major currencies. This is especially after the release of US labor market data that confirmed, although still strong, the trend of slowing employment gains and wage growth.

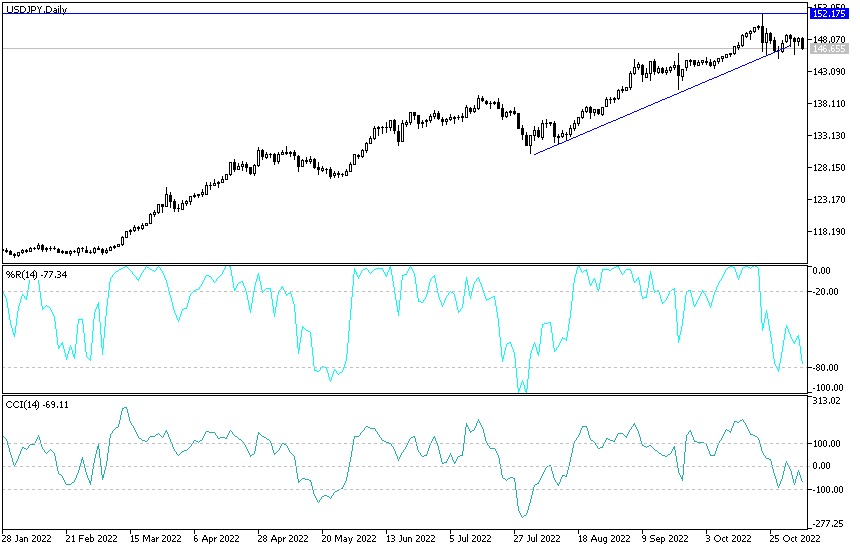

In the case of the USD/JPY currency pair, it fell to the support level 146.55, which closed trading near it. The highest price of the currency pair last week was the resistance level of 148.85, and despite the recent performance, the direction of the dollar-yen pair is still bullish. This is according to the performance on the daily chart below. The divergence of the policy of the Bank of Japan and the Federal Reserve will remain an important factor for the general direction of the currency pair.

According to official figures, the US economy added a total of 261 thousand jobs in October, a solid victory over the consensus forecast of 193 thousand, while the September figure was revised upwards to 315 thousand. Average hourly earnings rose 0.4%, beating expectations of 0.3%, and confirming continued wage dynamics that will support domestic inflationary pressures going forward. Thus, this data aligns with the US Federal Reserve's message since midweek that it is too early to consider ending the US interest rate hike cycle, a view that has boosted the dollar's exchange rates against other currencies.

Commenting on this, Daniel Vernazza, chief economist at UniCredit Bank says, “The Fed will certainly judge that job gains are very strong, and wage growth is very high. It supports Fed Chair Jerome Powell's assessment that the final interest rate is likely to be higher than the Fed had previously forecast," he said. Thus, US dollar weakness may represent profit taking after Wednesday's gains as there is nothing in this data that would indicate that the themes of recent months are about to turn in a dramatic fashion. However, dollar sellers may be relieved that the November release confirms a downward trend in employment growth that will inevitably extend as the economy slows in response to the Fed's rate hike.

“We believe this quasi-structural source of labor demand and the cyclical component is now slowing, and we expect job growth to dip below 200,000 per month over the next few months,” says Ian Shepherdson, analyst at Pantheon Macroeconomics. He adds that the 0.4% increase in average hourly earnings is not large enough to offset the unexpected weakness in August and September. "The three-month average increase, 0.32%, annually to 3.9%, the slowest increase since the chaos of 2020 and well below the annual rate, 4.7%," he added.

The Fed will welcome the yen in wage dynamics as it looks for signs that the increases it has already made are having an effect. Accordingly, the analyst adds, “Most of the survey-based indicators are that pressure on wage gains is easing, so solid data should follow suit.”

For its part, the Federal Reserve raised US interest rates by another 75 basis points, and while signaling the end of such huge hikes, it also made clear that more increases were needed in 2023, disappointing some market participants who had expected clearer signals. ready to finish the hike. The dollar weakness seen in the wake of Friday's payroll release is unlikely to represent a turn in trend, something that is only likely to happen after a series of decidedly weak employment data and surprisingly weak inflation data.

USD/JPY Technical Analysis:

- It appears that the USD/JPY is trading within the formation of a sharp descending channel in the near term.

- This indicates a strong short-term bearish bias in market sentiment.

- Therefore, the bears will look to extend the current decline towards 146.21 or lower to the 145.72 support.

- On the other hand, the bulls will look to rebound at around 147.22 or higher at the 147.72 resistance.

In the long term, and according to the performance on the daily chart, it appears that the USD/JPY is trading within the formation of a descending channel. This indicates a significant long-term bearish bias in market sentiment. Therefore, the bears will look to pounce on the extended dips at or around 143.97 or below the 141.51 support. On the other hand, the bulls will target long-term profits at around 148.77 or higher at the 151.8 resistance.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.