The US dollar has continued to sell off since the US job numbers were announced at the end of last week. The downward correction of the US dollar against the Japanese yen currency pair (USD/JPY) continued with losses towards the 145.31 support level, its lowest in two weeks.

Reactions Ahead

The currency pair may find a strong reaction from investors to the announcement of the results of the US elections and inflation figures, which will have a reaction to the future expectations of raising US interest rates.

Japan's cabinet is set to approve an additional budget of 29.1 trillion yen ($198 billion) to fund an economic stimulus package aimed at mitigating the impact of inflation on individuals and businesses. The second supplementary budget for the year ending in March will be partially funded by 22.9 trillion yen from the issuance of government bonds, according to documents obtained by Bloomberg. The latest plan adds to the country's already bloated debt burden. These measures are largely an attempt by Japanese Prime Minister Fumio Kishida to limit the impact of rising prices on households and businesses that have been exacerbated by the yen's drop to its lowest level in three decades. Public discontent with inflation helped reduce Kishida's popularity to levels that had put previous administrations at risk.

Accelerated price gains are starting to spread beyond energy, suggesting that inflation will last longer than initially expected, but growth in paychecks has failed to keep pace, hurting households' ability to spend. By providing some relief from the higher costs, the prime minister hopes to bolster his support while enabling the Bank of Japan to maintain ultra-low interest rates for a longer period despite the impact of those policies on the currency.

Country’s Growing Debt

The bulk of the extra spending, about a quarter of the budget, will be used to boost price relief measures, including electricity and gasoline subsidies, and measures to encourage businesses to raise wages. About one-fifth of the budget will provide funding for Kishida initiatives to distribute wealth more widely. An additional 7.5 trillion yen will fund measures to improve disaster resilience and adapt to the changing national security environment. The additional budget is expected to be approved by the Council of Ministers. It will then be submitted to Parliament where it is likely to be passed given Kishida's ruling coalition majority. For his part, Japanese Finance Minister Shunichi Suzuki said that he aims to secure his passage by the end of this year.

By issuing more debt to fund the package, the government is extending the spending spree that has accelerated during the pandemic. Efforts to keep the additional issuances under tight control likely reflect the ministry's interest in showing that the country's growing debt is being kept under some degree of control.

Japan has the highest public debt burden in the developed world, and while it can rely largely on domestic debt makers to issue its debt, including the central bank, policymakers recognize the need to maintain market confidence in its fiscal discipline. The recent collapse of UK Prime Minister Liz Truss is a timely reminder of the dangers of announcing massive spending plans without adequately considering all the funding requirements. However, one survey showed that more than half of Japanese want to review the Bank of Japan's ultra-easy monetary policy, as the yen struggles to hold its own against the dollar.

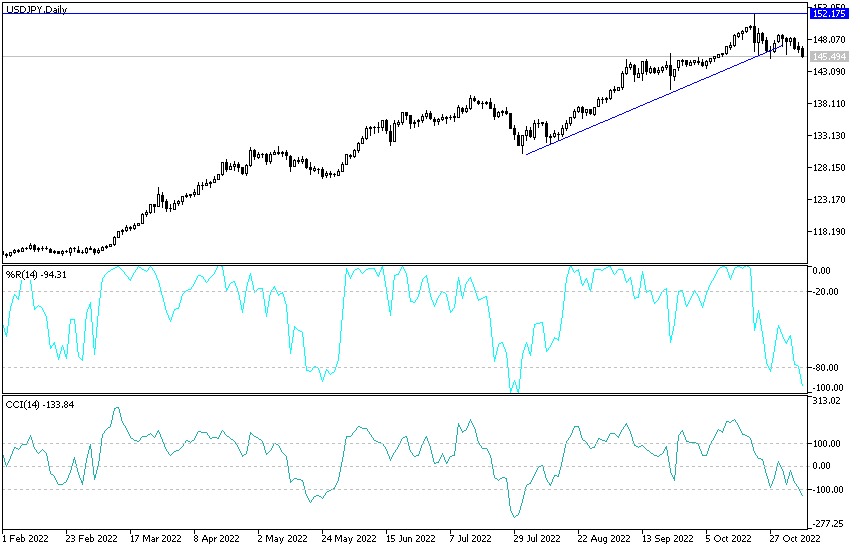

Analysis of the US dollar against the Japanese yen today:

- According to the performance on the daily chart below, the bears succeeded in pushing the USD/JPY currency pair below the support level of 145.00.

- This paves the way for a strong break of the general upward trend.

- The overview may turn to the downside if the currency pair moves towards the support levels 144.10 and 142.00, respectively.

- At the same time, it is sufficient to push the technical indicators towards oversold levels.

On the other hand, according to the performance over the same period, the movement of the bulls above the resistance 147.75 will be important for the return of their control over the trend.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.