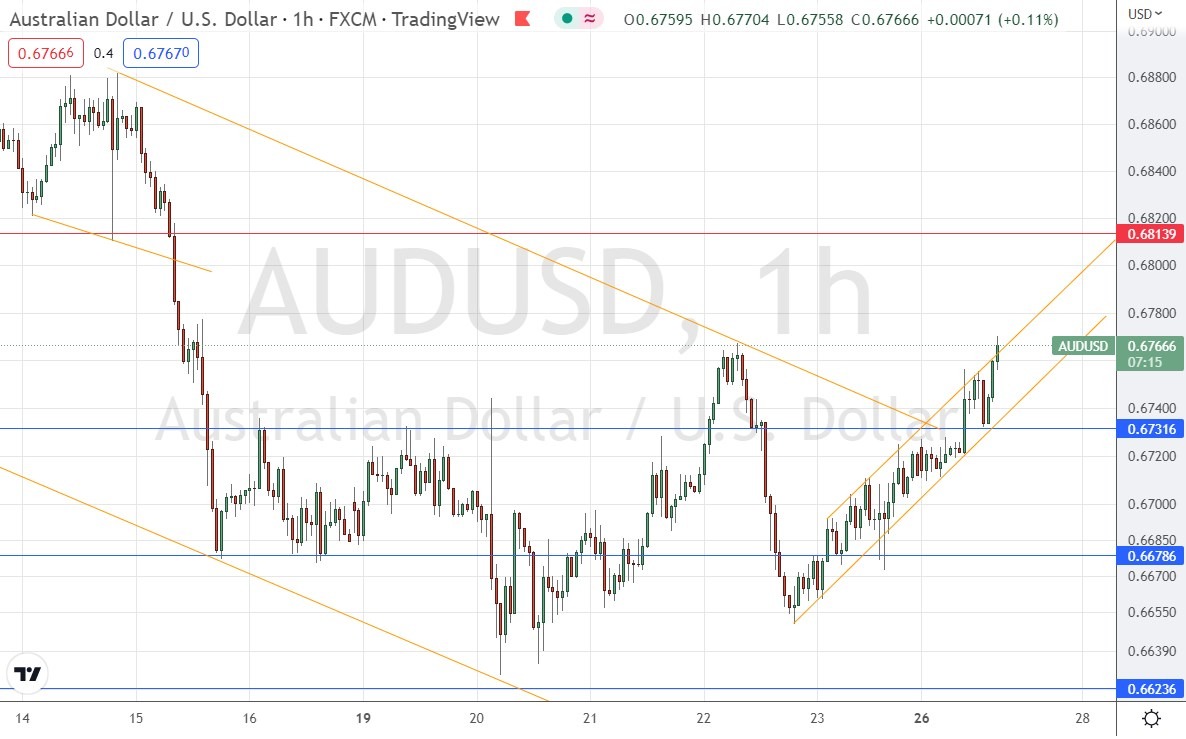

My previous signal on 20th December were not triggered as there was no bearish price action when the price first reached the resistance level which I had identified at $0.6675.

Today’s AUD/USD Signals

Risk 0.75%

Trades may only be entered before 5pm Tokyo time Wednesday.

Short Trade Idea

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of $0.6814.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of $0.6732, $0.6553, or $0.6679.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote in my previous forecast that the AUD/USD currency pair was likely to reach the next support level at $0.6624 during the coming hours. I was correct insofar as the price did continue to fall for the first part of that day, although I was wrong that $0.6624 would be reached as the price made a low about 10 pips above that support level.

We have just seen a change in the technical picture from bearish to bullish as the price has made a bullish breakout within a narrow ascending price channel from a wider bearish price channel – all can be seen within the price chart below.

We also have established new higher support at $0.6732 which looks like a firm level.

At the time of writing, the price was also rising with healthy momentum and starting to break out from its current steep, narrow bullish channel, showing momentum is rising exponentially.

The Australian Dollar is the strongest major currency and the US Dollar the weakest, so this pair is at the heart of the Forex market right now.

Everything points towards a likely continuing rise in the price.

Swing traders and some scalpers might prefer to wait for a retracement to $0.6732 for a long trade entry after a bullish bounce rejecting that level.

Scalpers may prefer just to buy dips already on a short time frame.

There is nothing of high importance due today concerning either the AUD or the USD.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex brokers in Australia to check out.