Throughout last week’s trading, the price of the euro currency pair against the US dollar, EUR/USD, was in an upward trend range. As a result, the bulls moved towards the resistance level 1.0736, the highest level for the currency pair in six months and closed the week’s trading stable around the level of 1.0586. The decline of the US dollar against the rest of the other major currencies was after signs from the US Federal Reserve, as well as the European Central Bank's threat to continuously tighten its policy, are important factors for the bulls to control the trend.

Economic Outlook

EUR/USD is trading on the back of the announcement that the S&P Global/BME Preliminary Manufacturing PMI for December exceeded expectations at 46.3 with a reading of 47.4. On the other hand, the services PMI beat expectations by 46.3 with a reading of 49, while the composite PMI beat expectations at 46.5 with a reading of 48.9. Elsewhere, the global EU S&P preliminary manufacturing PMI for the period beat estimate at 47.1 with a read of 47.8, while the composite PMI and services PMI beat expectations by 48 with a reading of 48.8 and 48.5 with a read of 49.1 respectively.

In the United States of America, the global Standard & Poor's Manufacturing and Services PMI fell to expectations with readings of 47.7 and 46.8 respectively with readings of 46.2 and 44.4. Prior to that, the US Retail Sales Watch Group for November missed expectations by 0.3% with a change of -0.2%. On the other hand, US General Retail Sales for the period came in lower than -0.1% with a change of -0.6% (MoM).

For its part, the European Central Bank raised interest rates for the fourth time since July, raising the negative deposit rate from -0.5% to 2.5% during that period, while warning at the same time that it intends to raise interest rates significantly “once in the new year.” In addition, the bank also said it intends to start the process of reversing quantitative easing, which previously pushed large sums of capital out of the eurozone into other markets including stock and bond markets.

This may be why the Euro did better than the Pound and many other currencies over the course of the week. Commenting on this, Brad Picktel, FX Analyst at Jefferies says: “The ECB is taking a very hawkish stance on slowing growth. Similar to the US Federal Reserve, but the US economy is likely to have more resilience. This is why the euro could not hold onto its gains.”

Technical expectations for the Euro-dollar pair for this week:

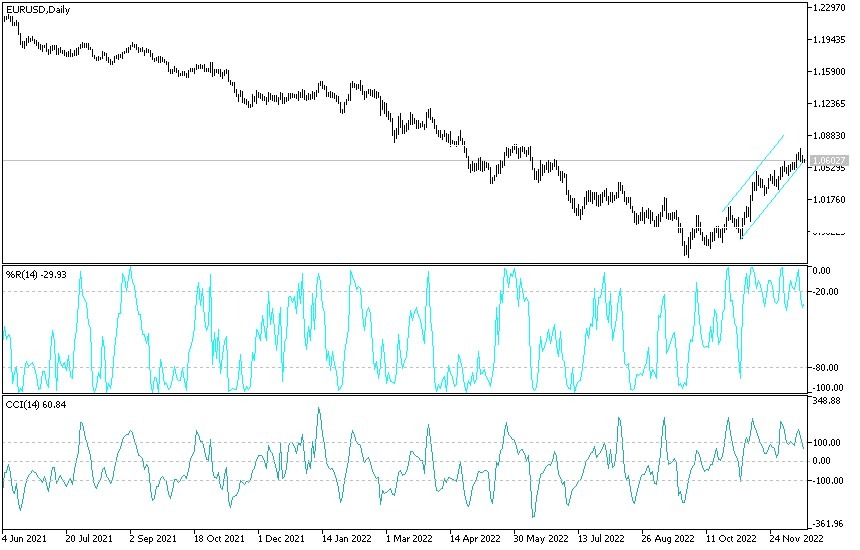

- It appears that the EUR/USD is trading within a bearish channel formation.

- This indicates significant short-term bearish momentum in market sentiment.

- Therefore, the bears will be looking to extend the current declines towards 1.0594 or below to the support at 1.0570.

- The bulls will be looking to pounce on profits around 1.0637 or higher at the 1.0661 resistance.

On the long term, and according to the performance on the daily chart, it appears that the EUR/USD is trading within a bullish channel formation. This indicates a significant bullish momentum in the long-term market sentiment. Therefore, the bulls are looking to extend the current rally towards 1.0690 or higher to the 1.0774 resistance. On the other hand, the bears will target potential pullback profits around 1.0529 or below at support 1.0437.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.