After a period of cautious stability in the performance of the price of the EUR/USD currency pair, the bears are preparing to launch the currency pair downward, as the US dollar recovers again, prior to announcing the growth rate of the US economy.

The results of a survey conducted by the market research group GfK showed that consumer confidence in Germany is expected to improve in January for the third month in a row, as the outlook for the economy, income and purchasing power improved amid government measures to curb rising energy costs. The forward-looking consumer confidence index rose to -37.8 in January from -40.1 in December. The expected score was -38.0.

Thus, the consumer climate continues to improve cautiously, as more moderate-than-originally-expected energy prices and the federal government's relief packages to reduce energy costs cause pessimism to subside. Rolf Birkel, consumer expert at GfK, said: “With the third consecutive increase, the consumer climate is slowly making its way out of the decline.” and “the light at the end of the tunnel is getting a little brighter.”

In December, income expectations rose for the third time in a row, with the respective index rising by 10.9 points, to -43.4. This improvement depended on moderation in energy prices. And despite the permanent downward trend between fall 2021 and fall 2022, the buying tendency seems to stabilize in December. The related index rose by 2.3 points and came in at -16.3 in January. Despite this, reluctance to buy among households remained high on the back of uncertainty caused by the pandemic, the Ukraine war and inflation. The index measuring income expectations rose for the second consecutive month by 7.6 points to -10.3 points, indicating that economic prospects are gradually regressing from their lowest levels. The consumer climate remains low, although slightly improved. Therefore, the lack of consumption will continue to be a burden on Germany's economic development in the next year.

“The recovery in consumer confidence, as we are currently seeing it, is still on shaky ground,” added Rolf Birkel. And that the geopolitical situation is getting worse again and leading to a significant increase in energy prices, and the light at the end of the tunnel will dim very quickly again or even go out completely. German consumers still believe the country will soon enter recession. However, it is likely to be less profound than feared a few months ago. GfK said that economists currently assume that GDP will decline by about half a percent in 2023, and that household consumption could be severely affected by the decline in purchasing power.

Euro predictions against the dollar today:

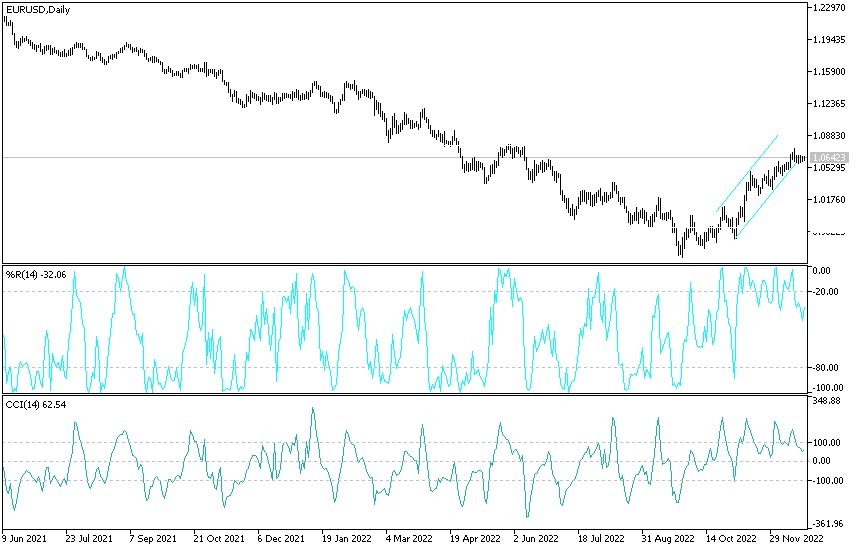

- According to the performance on the daily chart below, the EUR/USD exchange rate is moving downwards.

- A breach of the general trend may occur and change to bearish if it moves towards the support levels 1.0550 and 1.0440, respectively.

- On the other hand, the bulls will not have the strongest control without settling above the 1.0720 resistance over the same time period.

- I still prefer to sell the euro dollar from every bullish level prevailing for the US dollar.

This is supported by the demand for it as a haven, in addition to the US Federal Reserve leading the global central banks’ strict policy to control standard inflation, and to the good performance of the US economy compared to the economy of the euro zone so far.

The US dollar will interact today against the other major currencies with the announcement of the growth rate of the US economy and the number of weekly jobless claims.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.