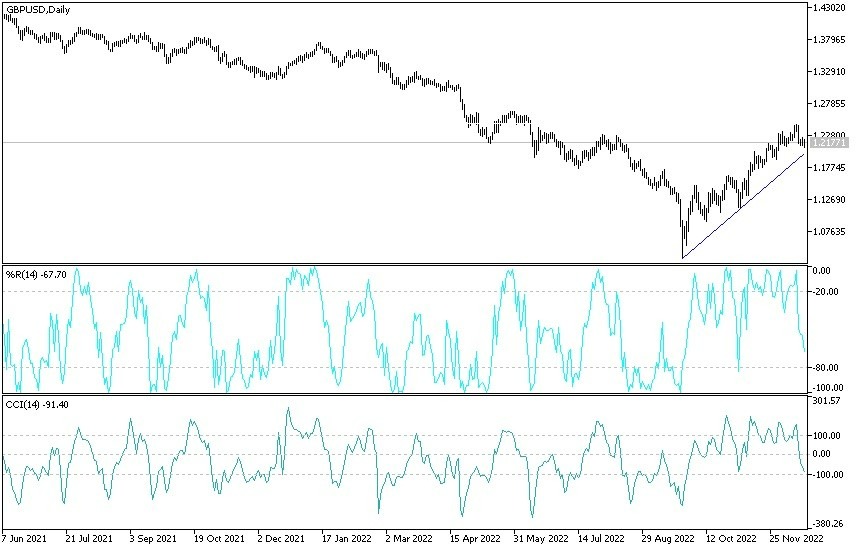

- Amidst continuous downward momentum, the price of the GBP/USD pair has moved since the start of trading this week, with losses, towards the 1.2085 support level. This happened before settling around the level of 1.2165.

- The currency pair is in the stage of breaking the general trend and turning into a bearish situation.

- In light of this performance, forex market analysts are studying the possibility of a near-term decline in the GBP/USD exchange rate, back below the psychologically important level of 1.20, where the last three-month bounce faces a challenge.

Commenting on this, Kenneth Brooks, an analyst at Société Générale, said that “The GBP/USD met bullish expectations at 1.2450. It returned back towards the 200-DMA at 1.2100. Failure to maintain this could lead to a deeper move down towards 1.1900 and the October high of 1.1645.”

The GBP/USD has been trending higher since it fell to an all-time low in September and is now up 8.85% over a three-month period. The rally peaked at 1.2450 on Dec 14, but a drop near 2.0% on Dec 15 sounded a warning bell that the recovery might be in jeopardy.

For his part, Fouad Razakzadeh, an analyst at City Index, said that “It is likely, in my view, that the GBP/USD pair will head lower again, possibly below $1.20 in the coming days and weeks.”

The pound's rise largely reflects its "beta high" status, which makes it quick to respond to global investor sentiment. The post-September rally in the Sterling coincided with a rally in global equity markets as investors bet the Fed was nearing a point at which it would abandon its rate-hiking cycle. Thus, from a fundamental point of view, the behavior of the global markets over the coming days and weeks will be instrumental in determining the direction in the GBP.

“The cautious opposition by the Monetary Policy Committee of the Bank of England last Thursday and the decline in stocks after the European Central Bank pegged the GBP / US dollar back below 1.22 from the high of 1.2446. Equity correlation and the fading appeal of the dollar/sterling are helping to challenge weak domestic economic fundamentals. However, Cable must defend the 200dm at 1.2094 to avoid returning below 1.20,” stated an analyst.

GBP/USD Forecast

Last week saw the GBP/USD record for the second week in a row as it fell by 1.0%. Analysts widely cited the BoE's rate hike and policy update as being behind the move, although there is evidence to suggest that the "downbeat" BoE is in fact acting as a support for sterling as the lower top in the bank rate holds steady. Instead, it was the hawkish surprise from the European Central Bank - who said 50 basis points more hikes were needed - that rattled the markets, thus contributing to the drop in the pound.

On the daily time frame, analysts note that the area around 1.2100 has been supportive of GBP/USD in the past, where we also have the 200-day moving average converging. A possible break below this area would push Cable below the 200-day mark, which is another bearish development in itself. Let's see if that happens now and if we see acceptance underneath it. If that is the case, then we should see some subsequent technical selling towards the 1.20 handle and perhaps even lower thereafter.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.