The recent pressure on the US dollar price allowed the GBP/USD currency pair to bounce upwards. Due to this it tested the resistance level 1.2322 and closed the week’s trading stable around the level of 1.2260.

This week is important as the monetary policy announcement will be announced for both the Federal Reserve in America and the Bank of England, along with a package of important and influential economic data from Britain and the United States, which is an unconventional trading week in particular for the sterling currency pair against the dollar.

The bleak economic outlook is set for Britain, leaving BoE policy makers ever more divided on how much to raise interest rates, with the first-ever quadrilateral likely to occur. So investors are betting that the nine-member Monetary Policy Committee led by Governor Andrew Bailey will raise the key lending rate by half a point to 3.5%, the highest rate in 14 years.

However, growing concern about a recession and historical cost-of-living pressure has opened up a debate about how aggressively the BoE should respond to inflation, which remains at a 41-year high. This would see Governor Andrew Bailey fight for a consensus on a resolution scheduled for December 15 and possibly use his vote to tip the scales. That would mark the deepest split in the MPC since the Bank of England gained the authority to set interest rates in 1997. Before that, the British Chancellor of the Exchequer set rates after hearing advice from the Bank of England.

UK inflation at 11.1% is more than five times the Bank of England's target of 2%. But the British Central Bank expects a recession that will lead to a decline in demand, which will eliminate price growth and increase unemployment even if rates remain at their current level of 3%.

The Bank of England, the Office for Budget Responsibility, the Organization for Economic Co-operation and Development, the CBI and the British Chambers of Commerce all predict a recession next year, as high inflation hits incomes and investment soars. Markets and economists expect the Bank of England to raise interest rates to between 4% and 4.5%. Complicating matters is a tight labor market, where participation has fallen so sharply that employers are forced to pay employees higher wages, and unions are encouraged to call strikes in order to raise wages. With weak supply capacity in the economy, experts fear that it will be more difficult to tame inflation than anywhere else.

Meanwhile, global central banks are showing signs of pivoting now that inflation appears to have peaked, with the US Federal Reserve recently signaling that it plans to slow the pace of tightening. The Bank of England is unlikely to talk about rate cuts for the time being before inflation drops. At the last two meetings, the BoE committee has been divided into three ways. Some members were concerned about continued malaise in the UK labor market and signs of rising inflation expectations. Others feared that an 18-month delay for the policy to take effect would mean the impact of the rate hike would hit just as the economy needed a boost.

In November, the majority of members indicated that further tightening was needed. Bank of America and Investec expect interest rates to rise by half a point this month. Nomura expects a three-quarter point increase, matching November, which was the largest increase since 1989. Contributing to the uncertainty at this meeting are key economic data points that will be released ahead of this week's vote.

GBP/USD forecast today:

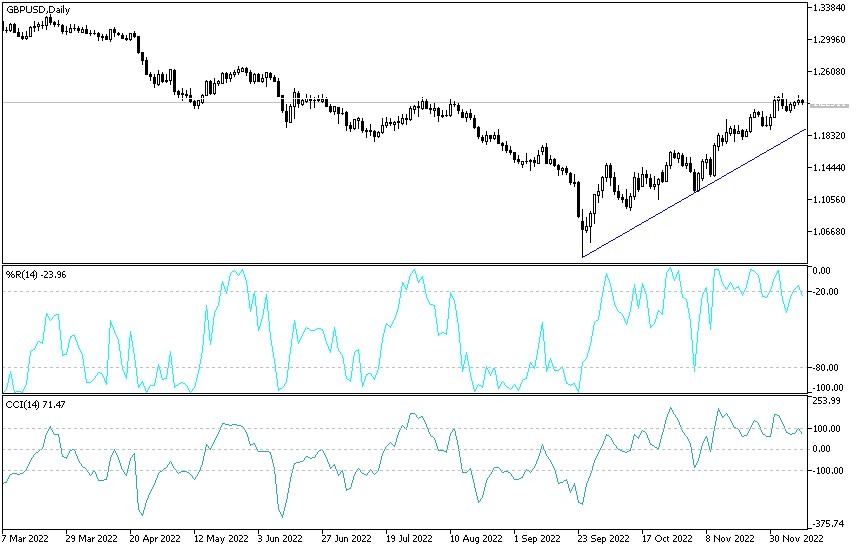

- The general trend of the GBP/USD currency pair is still bullish.

- According to the performance on the daily chart below, the bulls control lacks momentum to complete the rebound instead of being exposed to profit-taking sales that may occur at any time.

- I believe that the negativity of the results of the British economic data is an opportunity to sell the Sterling / Dollar.

- The nearest important resistance levels for the current trend are 1.2300, 1.2385, and 1.2420, respectively, which is strongly enough for the technical indicators to move towards overbought levels.

On the other hand, the success of the bears in moving the sterling-dollar pair towards the support levels 1.2160 and 1.2045 is important for changing the general direction of the currency pair to bearish. I still prefer selling GBP/USD from every upside. Today, the British economic growth reading will be announced.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.