Strong and continuous fluctuation was prominent for GBP/USD currency pair trading during last week as the currency pair moved in a range between the resistance level 1.2446 and the support level 1.2119. It closed the week's trading stable around the level of 1.2153, with a bearish bias, according to the performance on the daily chart.

The GBP/USD exchange rate fell further in the last session of last week's trading to end what was a bruising period for the British pound and several other currencies. It also appeared to settle above the nearby 200-day moving average ahead of the weekend. Accordingly, the US dollar was bought in front of almost everyone on Friday, amid more heavy losses for the stock and bond markets, but it seems that the price of the sterling pound has found its feet to some extent. Surveys of the global Standard & Poor’s Purchasing Managers’ Index indicated a deepening of the early decline in the manufacturing sectors. and services in the US in December.

The larger-than-expected declines for both sectors contrasted with better-than-expected figures from some parts of Europe where French and German indices rebounded enough to remain above those of the US in both groups of industries. “Job growth has meanwhile slowed to a crawl as companies in both manufacturing and services take a more cautious approach to hiring amid sluggish customer demand,” said Chris Williamson, chief business economist at S&P Global. Friday's PMI surveys were the ninth group this year to surprise on the downside of expectations in the US and came at the end of a week when the Federal Reserve raised interest rates to 4.5% this week and warned they could rise to 5.5% next year.

Similar surveys on Friday also suggested that the recession in the UK's manufacturing and service sectors eased in December. For his part, Abbas Khan, an economist at Barclays Bank, says: “We believe that the data clearly indicates upside risks to growth; However, our broader view of a European recession remains. While the pound-dollar rate appeared to stabilize late on Friday, it remained lower for the week with notable losses in the wake of interest rate decisions by the Bank of England and European Central Bank on Thursday.

The BoE raised the bank rate by half a percentage point to 3.5% in the ninth increase since last December but not all members of the Monetary Policy Committee (MPC) agreed with the decision due to a three-way split of views on how fast inflation should be. It is expected to fall next year. For his part, Jordan Rochester, a strategist at Nomura, says: “Since the Bank of England is the first major central bank to raise interest rates, it may be the first to end its cycle as well (we expect this in March).” "If markets continue to rally in growth data, that could offset the gloom in the near term," he added.

Two members of the Bank of England's rate-setting committee voted unchanged at all last week while one voted in favor of a bigger hike with losses for the pound sterling following the decision although it was the European Central Bank that stole the show with the biggest impact on the markets.

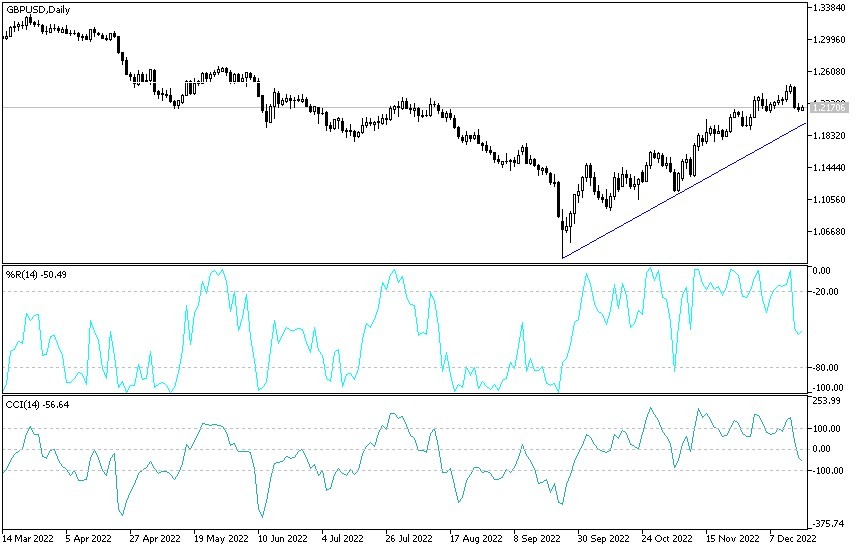

Technical expectations for the GBP/USD pair for this week:

On the near term and according to the performance of the hourly chart, it appears that the GBP/USD is trading within a highly volatile sideways channel formation. This indicates an intense battle between the bulls and the bears as they try to control the market. Therefore, bulls will target short-term rebound profits at around 1.2206 or higher at the resistance at 1.2240. On the other hand, the bears - the bears - will be looking to pounce on profits at around 1.2139 or below at the support at 1.2107.

- The GBP/USD is trading within a bullish channel formation. This indicates a significant bullish momentum in the long-term market sentiment.

- Therefore, the bulls will look to extend the current gains towards 1.2296 or higher to the resistance 1.2429.

- On the other hand, the bears will look to pounce on potential pullbacks around 1.2048 or below at 1.1907 support.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.