The GBP/USD exchange rate reached multi-month highs last week after the US Federal Reserve and Chinese health officials appeared to inspire investors' appetite for risk assets. It remains to be seen if the rally can continue this week as the rest of the economic data comes out. The recent bullish rebound gains for the GBP/USD pair reached the 1.2344 resistance level, its highest in months, before settling around the support 1.2185 at the time of writing.

- The US dollar has been broadly sold off again while US bond yields have come under further pressure.

- Risky assets have extended recent gains with the pound-dollar price reaching the halfway point in a two-year reversal of the ongoing downtrend.

- The market looked at the continued upside risks of US interest rates to bet on the global economic recovery after the sudden relaxation of measures to contain the Corona virus in China.

Commenting on this, Joseph Capurso, an analyst at the Commonwealth Bank of Australia, says: “It was reported that Chinese President Xi downplayed the seriousness of the current virus strain. And if this is true, the markets will be buoyed by the prospect of China reopening its economy.” “The GBP/USD pair may test its highest level in 6 months this week if the dollar continues to decline as we expect,” the analyst added.

Overall, the easing of containment measures in China is a boon for the world's second-largest economy and a boon for the renminbi, which has boosted other currencies and was a meaningful trigger for the risk appetite that re-emerged in the Asian session on Monday. But the global recovery is still some way off, and reopening in China will not bridge the energy supply deficit in the British economy or lead to lower prices, which are currently the main driver of the recession that began in the third quarter.

Valentin Marinov, Forex Analyst at Credit Agricole CIB, says, “In fact, we believe that the fiscal austerity measures recently announced by the UK government will exacerbate the current recession in Britain. The latter could hurt the Bank of England's ability to meet market expectations which remains very hawkish," he added. Somewhat amid the ongoing recession and recent fiscal austerity measures in the UK. Therefore, we recommend selling GBP/USD.”

Other Drivers of GBP/USD Recovery

The decline in US bond yields that followed Fed Chairman Jerome Powell's recent speech during which he reiterated that US interest rates were unlikely to rise as quickly as they did in the future. However, the Fed chair also warned of continued risks of a potential peak in borrowing costs and the market was reminded on Friday by the November non-farm payrolls report that a resilient US economy may force the Fed to raise interest rates again in September higher than was suggested.

Sterling forecast against the US dollar:

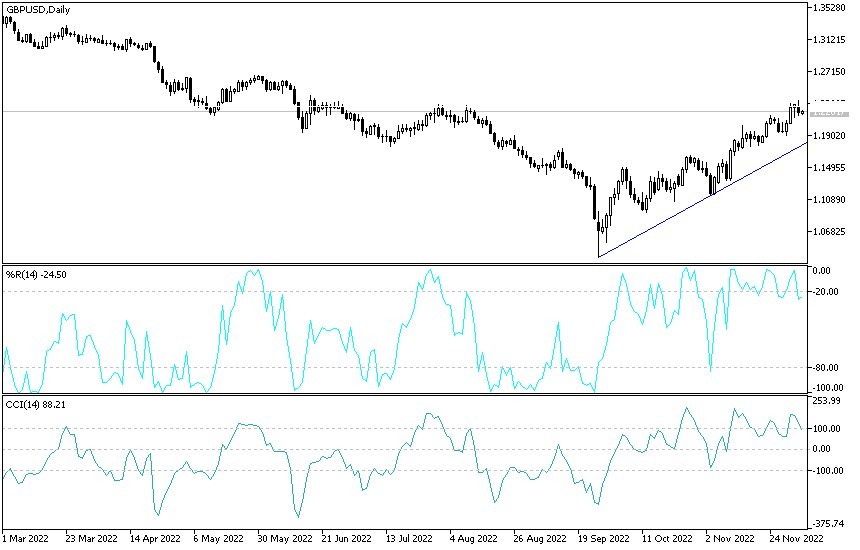

I still see that the recent gains of the GBP/USD currency pair are sufficient to push the technical indicators, according to the performance on the daily chart, to overbought levels. The pair is preparing for profit-taking sales at any time, especially since the pound itself does not currently have a catalyst for it to achieve more. In the event that the results of the US economic data are strong, this may help to accelerate the selling operations. The closest resistance levels for the Sterling Dollar are currently 1.2285 and 1.2330, respectively. On the other hand, the general direction of the sterling dollar will change once it breaks below the 1.2000 level. The currency pair does not await important and influential data, and therefore the sentiment of investors will be the most important to determine performance.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.