The pound is poised to extend its recent gains against the dollar some analysts say, but global investor sentiment should remain supportive.

- According to the recent performance, the pound sterling against the dollar (GBP/USD) has retreated from its highest levels in six months.

- This occurred along with a reversal in the fortunes of global stock markets.

- Developments over the coming days are likely to depend on whether the decline deepens or not.

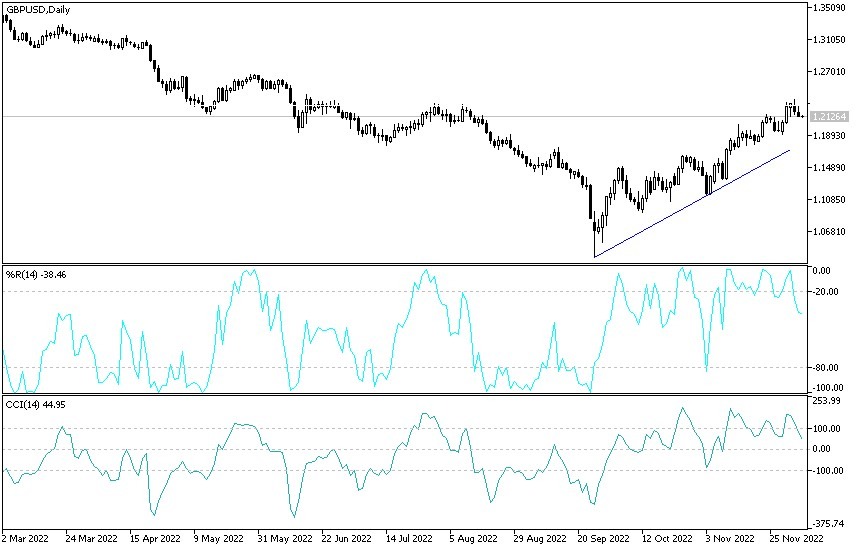

- The GBP/USD pair is settling around the support level at 1.2125, at the time of writing, rebounding from the resistance level at 1.2344.

Equity markets have pulled back from recent gains as investors worried that the rally may be overstretched and after data showed that service industry activity in the US unexpectedly rebounded in November. Tactically, investors will be looking to book some decent gains, so Michael Wilson, chief US equity analyst at investment bank Morgan Stanley, says clients should consider taking profits after the S&P 500 hits the 4000-4150 target. Fundamentals pushed the dollar higher with the US ISM Non-Manufacturing PMI reading at 56.5 in November, well ahead of analysts' expectations of 53.3 and an acceleration from 54.4 in October. The rebound in activity follows the better-than-expected US jobs report on Friday, and both versions of the data suggest the Fed has more work to do if it wants to cool the economy and bring down inflation.

Commenting on this, Joshua Mahoney, Analyst at IG says: “ISM PMI services are showing incredible strength in the face of rising rates. Inventories and new export orders are two areas of weakness as we see strength in many other items.” And “With strong PMI and NFP numbers, higher earnings could prompt further Fed tightening.”

Potential for Further Gains

Overall, the pound rose to its highest level in six months against the dollar amid a rally in stock markets as investors expect the Federal Reserve to slow the pace of raising US interest rates, as well as signs of continued easing of Covid restrictions in China. Despite the recent pullback from multi-week highs, analysts continue to predict the potential for further gains in the near term. Some analysts see that the pound has now rebounded more than 50% from its 2022 decline and may be looking to test the 61.8% retracement level which is currently near the $1.24 region.

According to some analysts, the prevailing theme in the markets is still the weakness of the US dollar, with the markets lowering interest rate expectations despite the continued hawkish Fed's statements and supportive data. The Chinese narrative is likely to maintain the risk mood in the markets and continue to put pressure on the US dollar.

BilL McNamara, analyst at The Technical Trader, says that the GBP/USD deserves a closer look from a technical analysis perspective, after its latest price move.

GBP/USD Forecast:

According to the performance on the daily chart below, if the GBP/USD price continues to move downward towards the support levels 1.2065 and 1.1975, the general outlook for the currency pair will change to bearish. Over the same period of time, the movement will return towards the resistance 1.2300, motivating more bulls to control the trend. I still prefer selling GBP/USD from every upside. In general, investor sentiment in global stock markets and the future of the US Federal Reserve policy are factors that strongly influence the performance of the sterling dollar in the coming days.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.