Gold markets have fallen rather hard during the day on Thursday as the US dollar has had a strong session. With central banks around the world raising interest rates, one would think that gold should do well, but at the same time, economic projections look rather sinister. Because of this, there is a certain amount of fear out there that restrictive monetary policy into a slowdown could cause a bit of a mess. That has people running to the US dollar, not to mention the fact that Jerome Powell was so hawkish during the FOMC statement and press conference during the previous session.

Nonetheless, gold probably does well go forward, and I anticipate that at the very least, this will probably be a “buy the dip” scenario. However, if the US dollar starts to get out of hand and starts acting like a wrecking ball again, gold will not be spared, at least not in the short term. However, it’s worth noting that gold and the US dollar can both go up at the same time, that was essentially what the 1980s were all about. That was the last time when we saw slowing growth and inflation, so we do have the history to think that both can benefit.

Gold May Be Erratic Because of a Lack of Liquidity

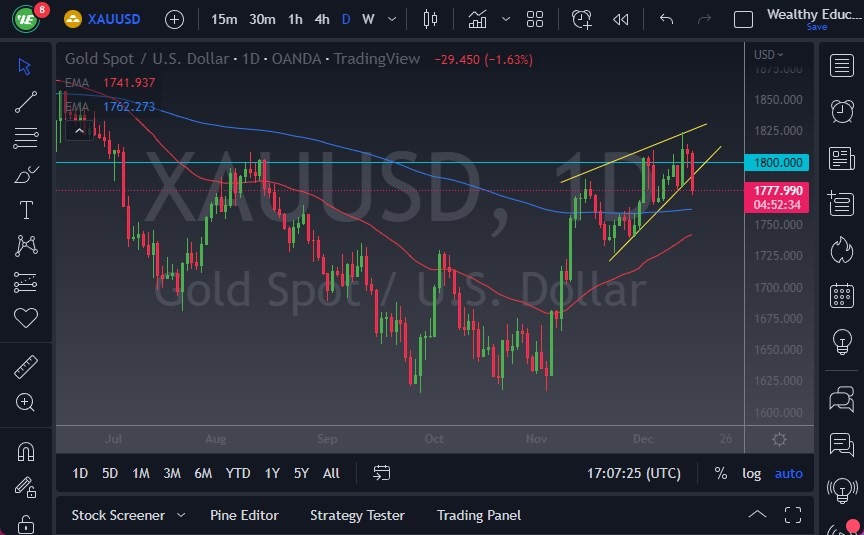

- At this point, the 200-Day EMA sits just above the $1750 level and should offer a little bit of support. The 50-Day EMA sits just below the same area, and it looks as if we may be getting ready to get the “golden cross” if we can bounce a bit.

- I don’t read too much into that, but longer-term traders do tend to look at it as a potential signal.

- Breaking through both of those moving averages would be very negative, and could send gold right back down to $1700, perhaps followed by the $1625 level.

Keep in mind the end of the year has a severe lack of liquidity, and the gold may be somewhat erratic. Under the best of circumstances, it can be choppy, so the next couple of weeks could be very difficult. Pay attention to the moving averages underneath, because they may offer a buying opportunity, but I would not get overexposed gold at this point, because quite frankly with the lack of trading volume you could lose a lot of money and what would ostensibly be noise.

Ready to trade today’s Gold prediction? Here’s a list of some of the best Gold brokers to check out.