- Gold futures cleared the $1,800 psychological resistance as a weak US dollar and a shock from the Bank of Japan (BoJ) supported the metals market.

- Accordingly, gold prices have rebounded considerably in recent weeks after flirting with the bear market last summer.

- Now that the Fed has slowed the pace of its rate hikes, investors are reconsidering safe-haven assets amid fears of inflation and recession.

Gold (XAU/USD) price gained, reaching the resistance level at $1821 an ounce. In general, the price of the yellow metal has increased by about 5% this month, raising its performance for the year 2022 to date to the positive region. In the same performance, silver prices, the sister commodity to gold, rose above the $24 barrier, with gains to $24.255 an ounce. Accordingly, the price of the white metal also rose by nearly 15% in December, which raised silver’s gains since the beginning of the year 2022 to date to 4%.

All in all, the Bank of Japan shocked the global financial markets when it raised the target range for 10-year government bond yields by 50 basis points to 0%. The purpose of the BoJ's move was to "improve market performance and encourage smoother shaping of the entire yield curve, while maintaining accommodative financial conditions."

Policymakers left the benchmark interest rate unchanged at -0.1% and promised to raise the yield on its purchases of ten-year government bonds to support the institution's ultra-loose monetary policy stance. Accordingly, the Asian markets were affected by the news, while the US stocks rebounded during Tuesday's session.

The US Treasury market was mixed, with the 10-year yield rising 9.4 basis points to 3.677%. The value of the bond value for one month fell 4.9 basis points to 3.787%, while the yield for the 30-year bond rose 10.9 basis points to 3.732%. Meanwhile, the greenback slipped as the US Dollar Index (DXY) fell 0.74% to below 104.00. The index, which measures the performance of the US dollar against a basket of major currencies, has been trending lower since the Eccles Building revealed it would slow the pace and magnitude of US interest rate hikes. The DXY peaked at 114.78 and has since fallen by about 5.6%.

A weaker dollar is good for dollar-denominated commodities because it makes them cheaper for foreign investors to buy.

In other metals markets, copper futures rose to $3.806 a pound. Platinum futures advanced to $1014.70 an ounce. Palladium futures rose to $1,710.50 an ounce.

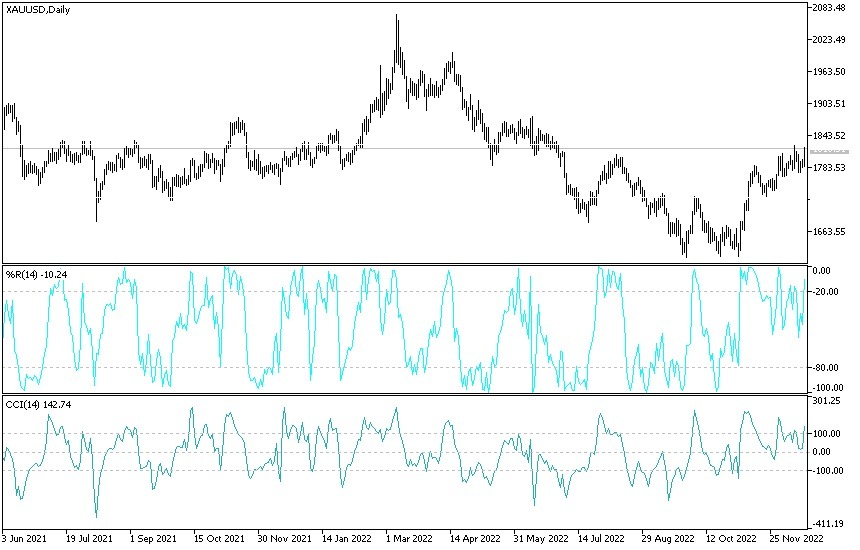

Gold (XAU/USD) Forecast

As I mentioned before, the return of the Gold price movement above the psychological resistance at $1800 an ounce will support the bulls for more movement upwards. The resistance levels at $1817 and $1828, respectively, will be the next targets.

By buying, gold investors may consider switching to profit-taking sales in the event that the metal does not gain new momentum. On the downside, the trend will not turn downwards, as is the performance on the daily chart, without moving towards the support level of $1775 an ounce again.

Ready to trade today’s Gold prediction? Here’s a list of some of the best Gold brokers to check out.