The strong decline in the price of the US dollar during last week’s trading had the strongest and most important impact on the gold bulls in moving prices towards the resistance level of $1824 per ounce, the highest price of XAU/USD gold six months ago.

- Accordingly, XAU/USD gold price moved downwards and quickly towards the support level of $1773 an ounce, before closing the week's trading around the level of $1793 an ounce.

- The $1775 support level is still the bears' control over the trend.

- I still prefer selling gold from the psychological resistance above $1800 an ounce.

Gold Fundamental Analysis

The XAU/USD gold price is trading affected by the announcement of the monetary policies of the recent global central banks led by the US Federal Reserve. This is along with the announcement of a decline in the Standard & Poor's Global Manufacturing Purchasing Managers' Index for December, expected at 47.7 with a reading of 46.2. On the other hand, the Services PMI failed to match expectations at 46.8 with a reading of 44.4.

The US Retail Sales for November fell short of the expected change (MoM) of -0.1% with a change of -0.6%. On the other hand, the Retail Sales Monitoring Group data returned a change of -0.2% compared to the expected change of 0.3%, while Retail Sales excluding automobiles slipped 0.2% with -0.2% (MoM). Elsewhere, US Initial Jobless Claims last week outperformed the expected claims number at 230K with an overall decrease of 211K. Ahead of that economic data, the Fed raised the US interest rate by 50 basis points in line with expectations to 4.5%. The US CPI excluding food and energy for November also missed expectations (MoM) and (YoY) at 0.3% and 6.1% with readings of 0.2% and 6% respectively.

Economic Outlook

This week, new data will be released on the Fed's preferred measure of US inflation, consumer spending and income. The November PCE price index will be closely watched after a separate measure, the Consumer Price Index, came in lower than expected for two consecutive months to indicate that the worst of inflation is likely to have passed. Inflation-adjusted personal expenditures will provide insight into consumer spending and demand patterns in November, with a breakdown of spending on goods and services. US incomes may continue to rise amid a still strong labor market.

The economic data comes after the Federal Reserve raised its benchmark interest rate last Wednesday by 50 basis points, and officials indicated that borrowing costs will trend higher than what investors expect in 2023 before the cycle of rally ends. For his part, Federal Reserve Chairman Jerome Powell said in a press conference, “We still have some way to go.” And, “I wouldn't see us considering cutting interest rates until the committee is confident that inflation is coming down to 2% in a sustainable way.”

Among other economic data, the Conference Board's December gauge of US consumer confidence, and November's new and existing home sales reports.

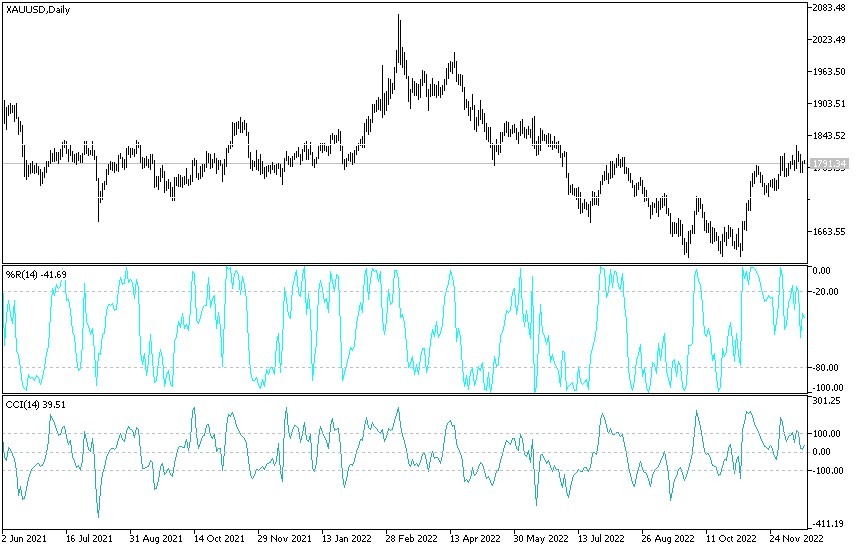

Technical outlook for XAU/USD gold prices today:

In the near term, and according to the performance on the hourly chart, it appears that the XAU/USD gold price is trading within a bullish channel formation. This indicates a significant short-term bullish momentum in market sentiment. Therefore, the bulls will look to extend the current gains towards $1,799 or higher to $1,807 an ounce. On the other hand, the bears will target short-term gains at around $1,784 or lower at $1,770 an ounce.

On the long term, and according to the performance on the daily chart, it appears that the XAU / USD gold price is trading within a bullish channel formation. This indicates a significant bullish momentum in the long-term market sentiment. Therefore, the bulls will target the long-term gains at around $1827 or higher at $1870 an ounce. On the other hand, the bears will target potential pullbacks around $1,764 or lower at $1,721 an ounce.

Ready to trade today’s Gold technical analysis? Here are the best Gold brokers to choose from.