- The gold price stabilized, after its recent rise, as the Bank of Japan's unexpected policy to control the yield curve shook the markets and put pressure on the dollar.

- Accordingly, XAU/USD gold prices jumped 1.7% to the $1823 resistance level after the Bank of Japan's move.

- It is trading near the highest level since June.

- The precious metal often moves in the opposite direction to the US dollar as it is priced in the US currency.

Investors will be looking at a slew of US economic data scheduled for this week, including the Fed's preferred inflation measure, which may shed more light on the path of interest rate hikes.

Market movements may be exacerbated by lower liquidity as the holiday season approaches. Yesterday, it was announced that US consumer confidence rose more than expected to the highest level since April, as inflation eased and gasoline prices fell. The data showed that the Conference Board index rose to a reading of 108.3 this month from an upwardly revised reading of 101.4 in November. The median forecast in a Bloomberg survey of economists was 101.

The expectations gauge - which reflects consumers' six-month expectations - rose to 82.4, the highest level since January. The group's measure of current conditions advanced to 147.2, the highest level in three months. The worst of inflation may have passed, and gas prices, which have fallen to their lowest levels since mid-2021, provided some relief to consumers. Conference Board data showed that the expected average inflation rate over the next 12 months fell to 5.9%.

Consumers were slightly more optimistic about current and future labor market conditions. The share of consumers who said jobs are currently "plentiful" rose to 47.8%. The percentage of people who expect more jobs in the next six months has also increased.

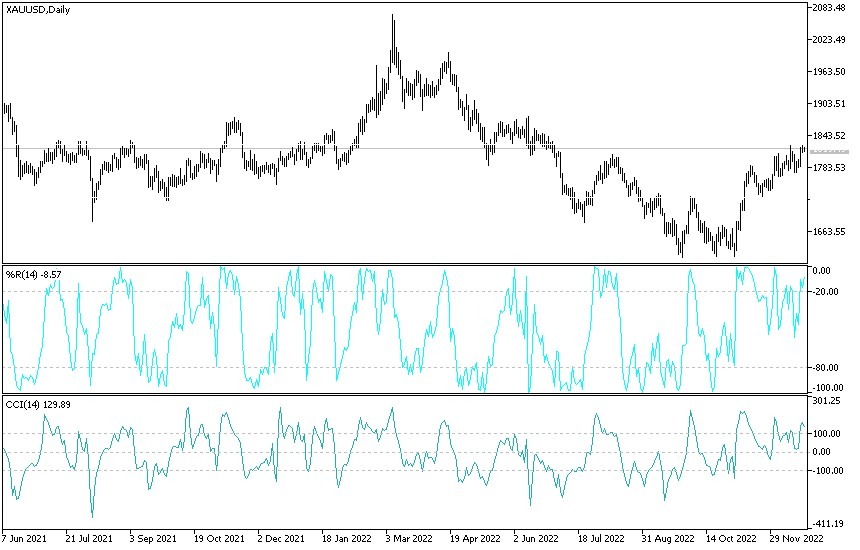

XAU/USD gold price forecast today:

The bulls’ control is still the strongest on the performance of the XAU/USD gold price so far. As I mentioned before, the stability is higher than the psychological resistance at $1800 an ounce, which supports the bulls and reached the levels that we set in the event of reaching them. This strongly contributed to pushing the technical indicators towards overbought levels. We expect activation of selling operations of gold to take profits from the $1828 and $1840 resistance levels, respectively.

According to the performance on the daily chart, there will not be a downward shift in the path of the gold price without moving towards the $1775 support again. The price of gold will be affected today by the level of the dollar, following the announcement of the growth rate of the US economy and the number of weekly jobless claims.

Ready to trade our Gold prediction today? Here’s a list of some of the best XAU/USD brokers to check out.