GBP/USD

The GBP/USD has fallen a bit during the trading week, as we start to head into the holidays. Quite frankly, the next week is likely not going to be very noisy and lackluster, because most traders will be focusing on those holidays instead of putting money to work. That being said, I think we’ve got a situation where the market may be best avoided, but it certainly looks like the British pound is starting to soften.

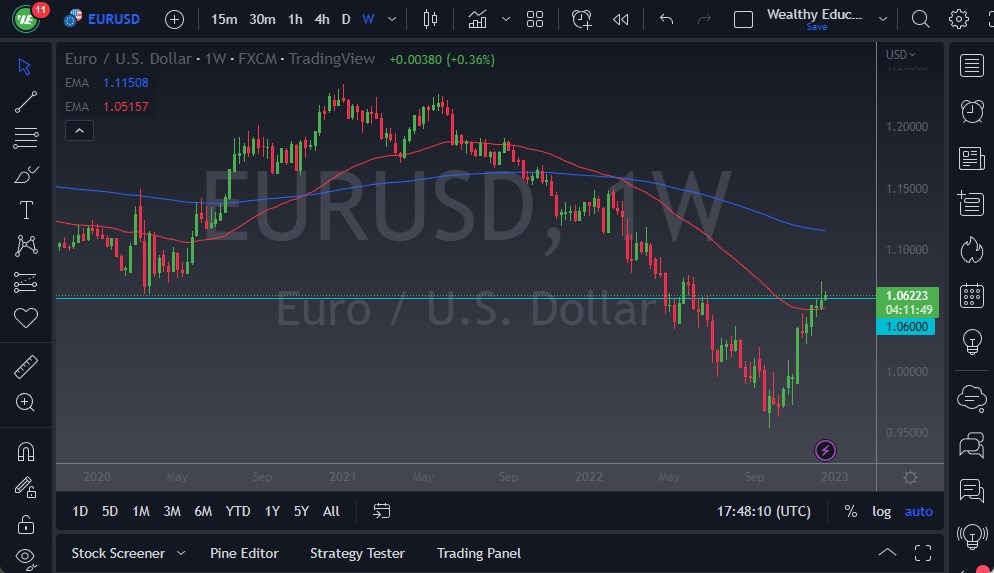

EUR/USD

The EUR/USD has gone back and forth during the course of the week, initially trying to rally but as you can see we continue to see a lot of volatility in this market, but we also see a lot of noise above the 1.06 level. That continues to be the case going forward, and therefore, we are getting closer to a pullback and a drop each day. If we break down below the 50-Week EMA, more likely than not will provide more downward pressure.

AUD/USD

The AUD/USD has been very noisy during the past week, as we continue to hang around the 0.67 level. The 0.67 level is an area that has been important multiple times, so it would not surprise me at all to see this market have to make a bigger decision. That being said, in the next week, I would not expect much, as liquidity will be almost nonexistent, and we are probably going to see more of the same kind of sideways nonsensical action over the next week. If we break down below the bottom of the candlestick for this past week, then we could see this market drop down to the 0.65 level, which I would not be surprised that as it has been like a magnet for prices in the past.

USD/CHF

The USD/CHF has fallen during the course of the week against the Swiss franc, but continues to find plenty of support just above the 0.92 level. Because of this, we have turned around to form a bit of a hammer and it is the 2nd one in a row. This typically means that there is a lot of support just underneath and I think traders will be more than willing to get involved at this point, as we would probably see this double hammer start to attract a lot of attention. Furthermore, the 0.92 level has been important in the past, so there is a lot of market memory in this region.

USD/CAD

The USD/CAD has fallen against the Canadian dollar during the course of the week, as we have seen oil try to recover. While it does look like the US dollar may be set up for strengthening again, it might be a little bit different over here if we see oil markets continue to try to recover. In this market, the 1.35 level will continue to be important and should offer a bit of support. If we were to break down below there, we could drop another 3 handles.

NZD/USD

The NZD/USD has fallen again during the week, as we continue to hang about the 50-Week EMA. We have formed a rather negative-looking candlestick after a shooting star from the previous week that failed at the 0.65 level. This to me looks like a market that is set up to pull back even deeper, so if we break down below the bottom of the candlestick I would not be surprised at all to see the New Zealand dollar try to reach the 0.60 level. Alternatively, if we can overtake the 0.65 level, then maybe we could go to the 0.67 level above.

AUD/NZD

The AUD/NZD has had a very strong week. At this point, it looks like we are trying to recapture the 1.07 level. If we can overtake the 1.08 level, it could cause a major turnaround. That being said, as we head into the week between Christmas and New Year’s Day, I suspect that we probably have a range set up within this candlestick that we have printed for this past week. Because of this, I think we got a range that might be able to be followed.

EUR/CAD

The EUR/CAD may finally be running out of momentum, as it got far ahead of itself. The 1.46 level seems to be like a significant resistance barrier, and the fact that we are closing at the very bottom of a week that was negative for the first time in several candlesticks just that we may get a little bit of a deeper correction. It’s also worth noting that oil was trying to recover, and the Canadian dollar is even holding its own against the US dollar. With the Euro looking overbought against multiple currencies, and the Canadian dollar strengthening, this might be the sleeper play off next week.