Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.50 level.

- Place a stop loss point to close below the 18.25 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best-selling entry points

- Entering a sell order pending order from the 18.99 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

The TRY/USD has stabilized, as the lira has become trading in real isolation from economic data on the ground. Deposits are due in pounds for a period of one month, for the first time in about three years. This means that these banks will provide free loans because of the policy of reducing the interest rate, which may increase the burden of inflation, which has already reached its highest level in about 25 years.

Where the Turkish Central Bank carried out a series of interest rate cuts over the last four meetings, in which it reduced interest rates from 14% to 9% levels, based on the Turkish president's desire to pursue a new monetary policy. Despite the expected halt in the policy of reducing interest rates, the Central Bank of Turkey follows some indirect measures aimed at restricting commercial banks in the issue of granting loans. In general, the problems of the Turkish economy continue due to the conflicting financial and monetary policies with which the ruling party aims at the present time to pass the expected elections during the middle of next year.

TRY/USD Technical Analysis

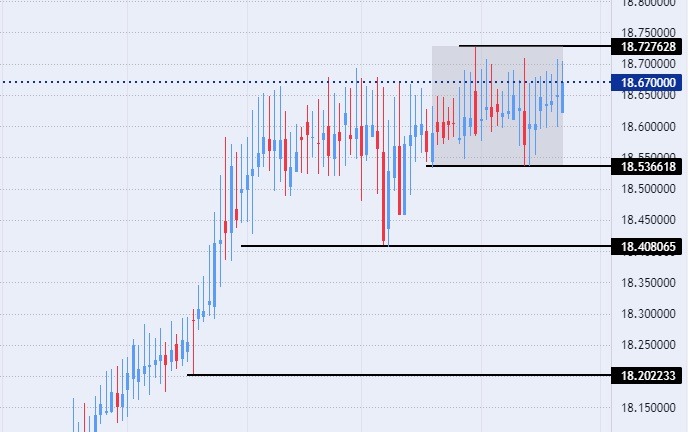

On the technical front, the dollar pair stabilized against the Turkish lira, without major changes, during early trading on Thursday morning. The pair traded at the same levels at which it opened at the beginning of the current month. With trading within a limited range, the pair has settled within it for a period of more than two months since mid-October.

Currently, the dollar pair against the lira is trading above the support levels of 18.53 and 18.40, respectively. On the other hand, the pair is trading below the resistance levels at 18.72, which represents the highest price for the pair recorded during the current year. The pair is also trading below the psychological resistance levels at 19.00. The dollar pair against the lira trades above the moving averages 50, 100, and 200 on the daily time frame, in a sign of the general bullish trend of the pair, while the price trades between these averages on the four-hour time frame, as well as the lower time frames, in a sign of the divergence recorded by the pair in the medium term. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex brokers in the industry for you.