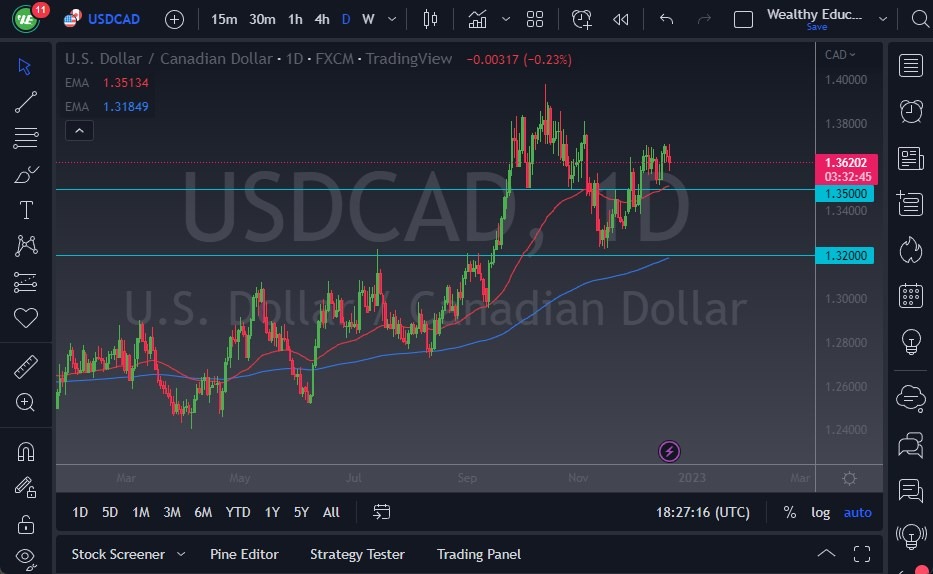

The USD/CAD initially tried to break out to the upside during the trading session on Tuesday but gave up gain again near the 1.37 level, an area that has been very resistive over the last week or so. Because of this, I think we continue to try to find buyers underneath the breakout to the upside, but we also must deal with the fact that the oil markets are trying to bottom, so that could have something to say here as well.

Keep in mind that global growth is something that a lot of people were concerned about, so that will influence the US dollar, as it is a safe currency, and of course the Canadian dollar, as it is so highly levered to the oil market. Oil of course is levered to the global economy and growth, so it all comes into play at the same time. The 50-Day EMA sits right around the 1.35 level and is rising. After all, the market is more likely than not going to see a situation where buyers will be attracted to this market on dips, as the US dollar has been strengthening in general.

Keep Your Position Size Reasonable

- Keep in mind that this is a market that will continue to be noisy, and of course have a lot of trouble when it comes to liquidity, since the holidays are upon us, that will course have a major influence as to where we go next.

- We may have a market that does nothing, but at the same time, we could have a market that ends up being very noisy due to some type of headline as it will take less to move the market.

- Quite frankly, this time of year is very difficult and dangerous to trade in, so you should keep your position size reasonable.

I do believe that at this point the market is likely to see when an attempt is made to find some type of equilibrium, which right now seems to be around the 1.35 level, but it also seems as if it is rising over time. On the upside, if we can break above the 1.37 level, then it’s likely that this market could go looking to the 1.39 level, perhaps even the 1.40 level after that.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.