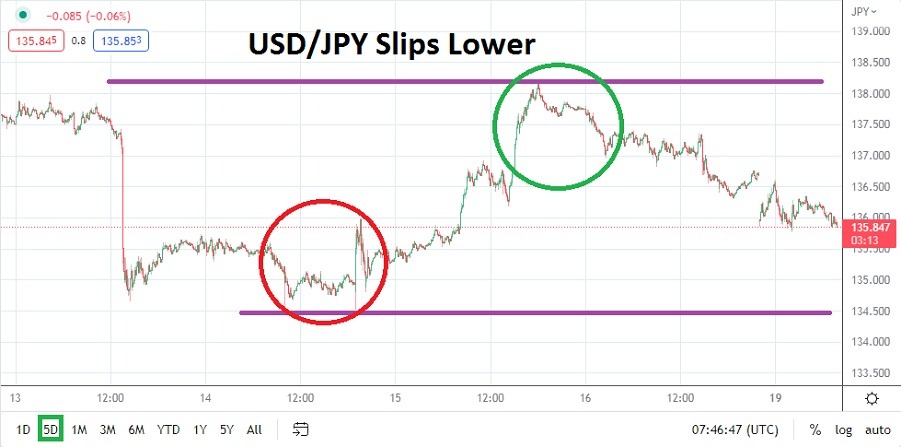

The USD/JPY continues to flirt with lower values but has also suffered from reversals upwards which makes its lower trajectory potentially attractive to speculators.

The USD/JPY is near the 135.900 ratios as of this writing with the currency pair’s typical fast price action abundant for day traders who want to pursue wagers. The Bank of Japan will release its Monetary Policy Meeting Minutes early on Tuesday, along with its Policy Rate, and conduct the BoJ Press Conference.

However, the Bank of Japan is expected to remain stubborn and not make any major changes to its interest rate policy, which remains at a negative -0.10%. With no change of policy in sight, financial houses are clearly relying on behavioral sentiment and technical bias to guide their decision-making processes regarding the outlook. The USD/JPY has been able to achieve a rather solid trajectory lower since the end of the third week in October.

On Friday the 21st of October the USD/JPY was trading near 152.000 momentarily

Since achieving its apex high nearly two months ago the USD/JPY has shown a bearish trend. Yes, the Bank of Japan also got involved by intervening in the USD/JPY by purchasing massive amounts of Japanese Yen to counterweigh the buying of the USD/JPY. Whether the BoJ’s tactics worked can be debated, but technically the currency pair has certainly traded lower. The fact the U.S. Federal Reserve is also being portrayed as less aggressive is helping to sell too.

With No Major Changes Expected from the BoJ, the USD/JPY will become Speculative

- The 136.000 ratios should be monitored by short-term traders; if this resistance level proves durable it could continue to spark a bearish attitude and a test of this region could spark selling.

- This morning’s lows in the USD/JPY still remain above the lows traversed on the 14th of December when the USD/JPY traded below the 135.000 ratio.

Today and tomorrow will prove impactful for speculators, this as the USD/JPY starts to see lighter holiday trading volumes ensue this week as financial houses begin to close their desks. While the lower move in the USD/JPY has certainly been a solid trend, it does not come without dangers due to reversals higher. Traders who choose to pursue downward momentum should seek quick-hitting trades which do not linger too long. Risk management will be a key, and later tonight volatility could be demonstrated.

Looking for the USD/JPY to challenge short-term support levels and flirt with lower values may prove worthwhile for day traders. However, technically the USD/JPY would have to break below the 135.000 mark and sustain the lower depths for its short-term price to create even more bearish behavioral sentiment. Until then traders should be wary of the potential for a choppy test of its current short-term range.

USD/JPY Short-Term Outlook:

Current Resistance: 135.985

Current Support: 135.720

High Target: 136.690

Low Target: 134.440

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.