USD/JPY

The US dollar has plunged against the Japanese yen again during the previous week, and it does suggest that we are getting close to an area that we have to make some serious decisions. A lot of this is going to come to forward expectations on the Federal Reserve, and as usual, this past week Jerome Powell was as clear as mud. That being said, it looks like there is significant support just below so I would expect a little bit of a recovery for the week but if we give up the ¥133.50 level, we could see a trend change at that point.

AUD/USD

The Australian dollar has broken toward the 0.68 level during the course of the trading week, showing signs of life again. At this point, we are threatening previous support, so I do think that if there is going to be a pullback, it’s probably going to be soon. It’s also worth noting that we got here in a hurry, so the choppiness in this area is probably not a huge surprise. We continue to see a bit of hesitation, and if we get any hawkish behavior at all coming out of the Fed, or perhaps a “risk of rally”, this might be the pair to start shorting again.

USD/CAD

The US dollar has rallied significantly during the course of the week gave back those gains to break below the 1.35 level. By doing so, the market looks as if it is going to continue to see a lot of noisy behavior, and therefore I think we’ve got issues ahead. Keep in mind the crude oil is trying to recover, so that might put a little bit of pressure on this market. We had both countries reporting jobs figures on Friday, so that of course has thrown quite a bit of volatility into the mix as well. I believe that the 1.32 level underneath should be rather significant support though.

EUR/USD

The EUR/USD has had yet another bullish week, breaking above the 50-Week EMA. Furthermore, the market broke above the 1.05 level as well. This obviously is a very bullish turnaround, based upon the idea that the Federal Reserve may slow down the rate of interest rate hikes. I suspect that we probably still have further to go to the upside, one would have to think that we are almost certainly due for some type of pullback. The support I see most prominent on the chart right now is that the 1.03 level.

GBP/USD

The GBP/USD initially fell during the week but then turned around to break toward the 1.23 level. We are sitting at a major resistance barrier right now, and therefore I think it’s a bit clumsy to try to jump into the market at this point. I would not be surprised at all to see the British pound drift a little bit lower, or at least underperform the Euro, due to the fact that it is so overbought. This has been a vicious bear market rally, but the question now is whether or not we can continue to see momentum jump into this market? If we do, the 1.25 level will be the next target. A breakdown below the 1.20 level would be catastrophic, but I don’t see that happening in the short term.

NZD/USD

The NZD/USD has rallied significantly during the trading week to break above the 0.64 level on point. This is a very bullish move, but certainly one that is overdone. It looks as if we may attempt to go higher from here, and quite frankly the New Zealand dollar has been a bit more aggressive to the outside than a lot of other currencies, as the central bank has maintained its extreme hawkish behavior. If there’s one currency that can give the US dollar a real run for its money right now, it might be this one. A pullback at this point is nothing to be concerned about until we break down below the 0.62 level.

Gold

Gold markets have rallied again during the week, testing the $1800 level in the spot market. Futures markets are already above there and look ready to try to break out as well. With that being said, it’s likely that gold will have a very noisy week, but I also believe that the hammer from the previous week is very supportive. In other words, this probably remains a little bit of a “buy on the dip” market, but extraordinarily volatile and dangerous so don’t jump “all in.”

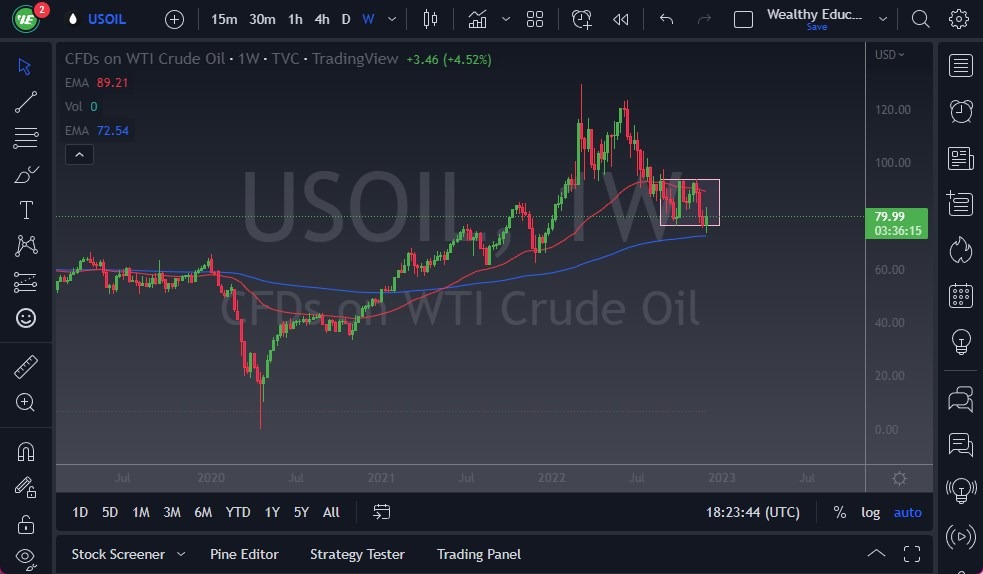

WTI Crude Oil

The West Texas Intermediate Crude Oil market has tested the 200-Week EMA during the last couple of sessions and has bounced quite nicely. However, it still seems to be struggling with the $80 level, and quite frankly on the daily chart, it looks like it’s already starting to roll over again. Because of this, I think oil continues to underperform in general, but I don’t necessarily think that we are going to fall apart. Rallies that show exhaustion, will probably offer short-term selling opportunities.