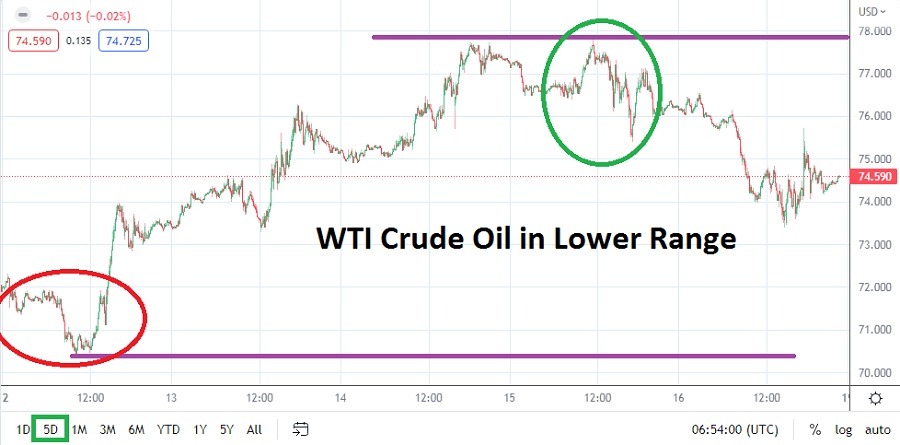

West Texas Intermediate Crude Oil went into the weekend near a value of 74.59, which was a stronger close than the previous Friday when the commodity was around 71.67 at the end of the day. However, WTI remains within the lower elements of its long-term range as demand for the commodity has decreased likely due to the slowdown in the global economy and other complexities.

The low in last week’s trading occurred on Monday the 12th of December when WTI Crude Oil challenged the 70. 43 mark, which came within sight of the previous Friday's low of nearly 70.25 before reversing higher. Prior to those low ratios, WTI Crude Oil had not seen those values since the 22nd of December 2021. Yes, last year almost exactly, and this point makes things interesting.

At this time last year, the Russian Invasion of Ukraine had not begun

In the middle of October 2021, the price of WTI Crude Oil climbed to around 85.00 before losing value and falling below the 62.00 mark on the 29th of November 2021. This level should be interesting to current-day traders because the technical range via chart considerations looks like a price of 70.00 to 81.00 may be the wide support and resistance levels when trying to perceive potential moves in the coming week.

The demand for Crude Oil has slipped likely based on the notion; the prospect of supply remains relatively attainable, even as the Ukraine war continues without an end in sight. Economic data globally shows that recessionary pressures are strong in many nations and this is certainly causing demand to weaken. However, there are interesting aspects to consider for speculative buyers, because WTI Crude Oil appears rather close to support levels too.

- There has been talking from the U.S. government about purchasing more Crude Oil to replenish its strategic reserves, which it has used in the past year to make sure supply was steady. Resupplying the U.S. reserves may increase buying demand.

- Concerns remain regarding the energy supply due to the Ukrainian war.

- And there is also the fact that the Northern Hemisphere is now entering winter which means more energy is needed to heat homes.

Yes, WTI Crude Oil has Traded Lower and Support could prove Vulnerable

Yes, lower WTI Crude Oil prices have certainly been seen before, the test of lows early last week is an indication the price of the commodity remains rather vulnerable. Traders this week should also acknowledge that holiday trading will go into effect, meaning trading volumes in the coming days will likely start to diminish and this will last until the New Year holiday has been celebrated in full. Trading this coming week will grow light and this could lead to potential volatility in the price of Crude Oil.

WTI Crude Oil Weekly Outlook:

The speculative price range for WTI Crude Oil is 69.90 to 80.10 USD.

Higher prices for WTI Crude Oil were seen this past Wednesday and Thursday when the 78.00 prices came within sight but were never really challenged. Those highs came close to prices seen on the 6th of December. However, the notion that WTI Crude Oil has been falling in price incrementally since June of this year cannot be hidden. Yes, reversals higher certainly do occur, but if the price of WTI falls below the 73.00 level and continues to show a lack of a truly sustainable reversal which suddenly starts to challenge 77.00 to 80.00 USD per barrel, speculators may continue to wager on the downside opportunity. Selling Crude Oil for the time being for quick-hitting wagers after it bursts higher may prove worthwhile if a seller is using tactical support levels as a take-profit target.

For the time being support levels appear to be the best method to speculate on WTI Crude Oil. Because the holiday season is rapidly approaching traders should be careful and ready for volatility to suddenly emerge, but if resistance levels are not penetrated it appears the lower range of WTI Crude Oil will remain rather durable and attractive.

Ready to trade our weekly Forex forecast? Here are the Top 5 Crude Oil platforms to choose from.