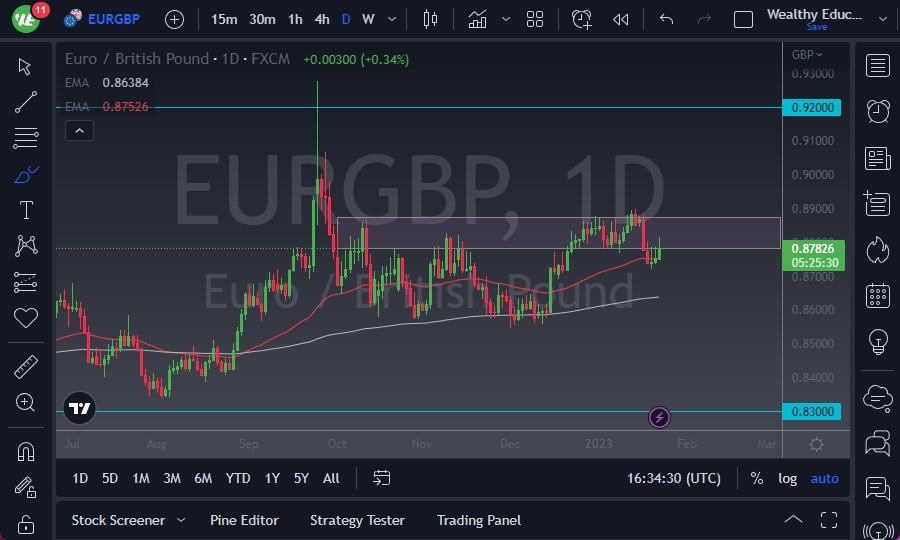

- The EUR/GBP rallied a bit during the trading session on Monday, to break into the previous bearish candle that had traders shorting.

- At this point, it looks like the sellers are starting to become a little bit more stringent, but at the same time, it’s worth noting that we have broken above a pair of shooting stars so that in and of itself shows that there is a lot of resiliency.

- Because of this, I think you’ve got a situation where you have to look at this as a market that is going to continue to be very choppy, but as things stand right now, we are technically in an uptrend.

It’s also worth noting that the 50-Day EMA has offered a little bit of support, and therefore I think you have to look at it as a potential reason to be involved. If we were to break down below the lows of the last couple of days, then the Euro will probably go looking to the 200-Day EMA underneath, which is near the 0.8650 level. After all, the 200-Day EMA is an indicator that a lot of people use as a trend-defining indicator.

See this Pair as a Tertiary Indicator

Any break below there would obviously be very negative, and perhaps in this pair back down to the bottom of the longer-term consolidation area, reaching down to 0.83 level. That being said, we turn around and take out the 0.89 level, then I think this pair of eventually finds its way to the 0.92 level. Based upon the price action of the last couple of days, I think you get a situation where that is the most difficult move to make, but a lot of times markets will “climb a wall of worry.”

My favorite use for this pair is as a tertiary indicator of what I should be doing with the EUR/USD and the GBP/USD currency pairs. Quite frankly, if one of these currencies is doing better or worse than the other, I will use that to extrapolate what to do over there. In other words, you triangulate the 3 currencies, with an eye on the US dollar. If the US dollar is rising in value, and this pair is falling, that means the EUR/USD pair, at least in theory, should fall quicker than the GBP/USD pair. It’s a simple mathematical equation.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers in the UK to choose from.