EUR/USD speculators likely ran into what can be described as turbulent short-term trading conditions last week with choppy results making the pursuit of the currency pair a difficult endeavor. However, going into the weekend the EUR/USD was able to produce another higher result compared to the week before. Day traders needed solid risk-taking tactics and strong stomachs last week, but if they were pursuing upwards momentum while trying to ignite buying positions via technical support the results may have been good.

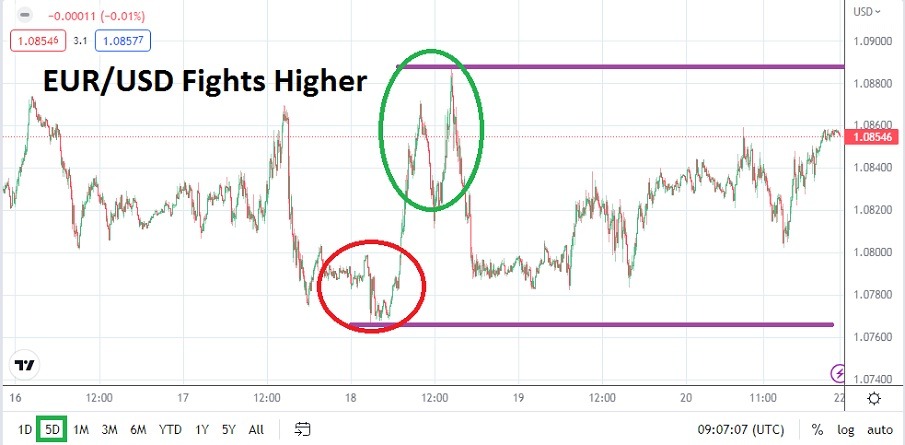

The EUR/USD will start this week near the 1.08550 vicinities, the high for the currency pair last week was on Wednesday when the 1.08880 ratios was flirted upon. Intriguingly, the high for the EUR/USD was made after the Forex pair touched a low of nearly 1.07675 early on Wednesday. The move higher in the EUR/USD mirrored the results seen in the broad Forex market. The reaction higher in the EUR/USD was largely caused by the weaker expected U.S Retail Sales figures.

Having enjoyed a Bullish Run the EUR/USD Produced Selling last Week too

The upwards trend in the EUR/USD has been evident over the mid-term, but choppy conditions in the currency pair last week were a good reminder momentum is never a one-way street. Having produced a solid week of gains the week before, choppy trading early last week and even after the highs demonstrated this past Wednesday, may have been an indication some financial houses think the EUR/USD has gained too strongly. Solid stop losses should be practiced by traders.

The 1.08000 level was a definite beacon for the currency pair last week. The ability of the EUR/USD to fight and sustain value over the 1.08000 ratio is significant for bullish perspectives. Going into the weekend near the 1.08550 is a solid result too for technical bullish speculators, and finishing above the prior week’s close near the 1.08375 mark on the 13th of January can be viewed as a good result. Intriguingly for EUR/USD speculators, the currency pair has been able to maintain its higher price range without suffering a lingering reversal downwards.

- The U.S. will release GDP numbers and inflation statistics later this week which will certainly affect the EUR/USD.

- The ability of the EUR/USD to remain within eyesight of highs recently attained may lead some speculators to believe if U.S. fundamental data delivers more evidence that recessionary pressures exist and inflation is moderating, the currency pair could generate higher values.

EUR/USD Weekly Outlook:

The speculative price range for EUR/USD is 1.07910 to 1.09230

Support near the 1.08350 mark should be watched early this week, if this level can hold it may be another additional bullish signal. However, a move that challenges the lower ratio would not be a surprise, particularly if volatility increases before the important U.S Gross Domestic Product data readings. Speculative positions will no doubt play a part in the EUR/USD this week, based on the notion the currency pair has done remarkably well regarding its bullish trend which has generated positive value over the mid-term. A lower move towards 1.08000 and below might scare off some bullish traders, but it can also be viewed as a potential ground to ignite speculative buying positions of the EUR/USD.

If the EUR/USD is able to maintain the current price range it has displayed before the U.S growth numbers (GDP) this could prove not only to be volatile in the following hours but dynamic regarding values for the currency pair. Having flirted with the 1.08880 mark last week, if U.S. data signals that the U.S. Federal Reserve should become less aggressive regarding interest rate policy another leg upward in the EUR/USD would not be a major surprise. Traders should remain realistic and use conservative leverage, but if the 1.08900 ratios is surpassed the 1.0900 juncture will certainly become a target for some.