My previous GBP/USD signal on 24th January was not triggered, as none of the key levels were reached that day.

Today’s GBP/USD Signals

Risk 0.75%.

Trades may only be entered between 8am and 5pm London time today.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 timeframe immediately upon the next touch of $1.2301 or $1.2230.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade Ideas

- Short entry following a bearish price action reversal on the H1 timeframe immediately upon the next touch of $1.2368 or $1.2437.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

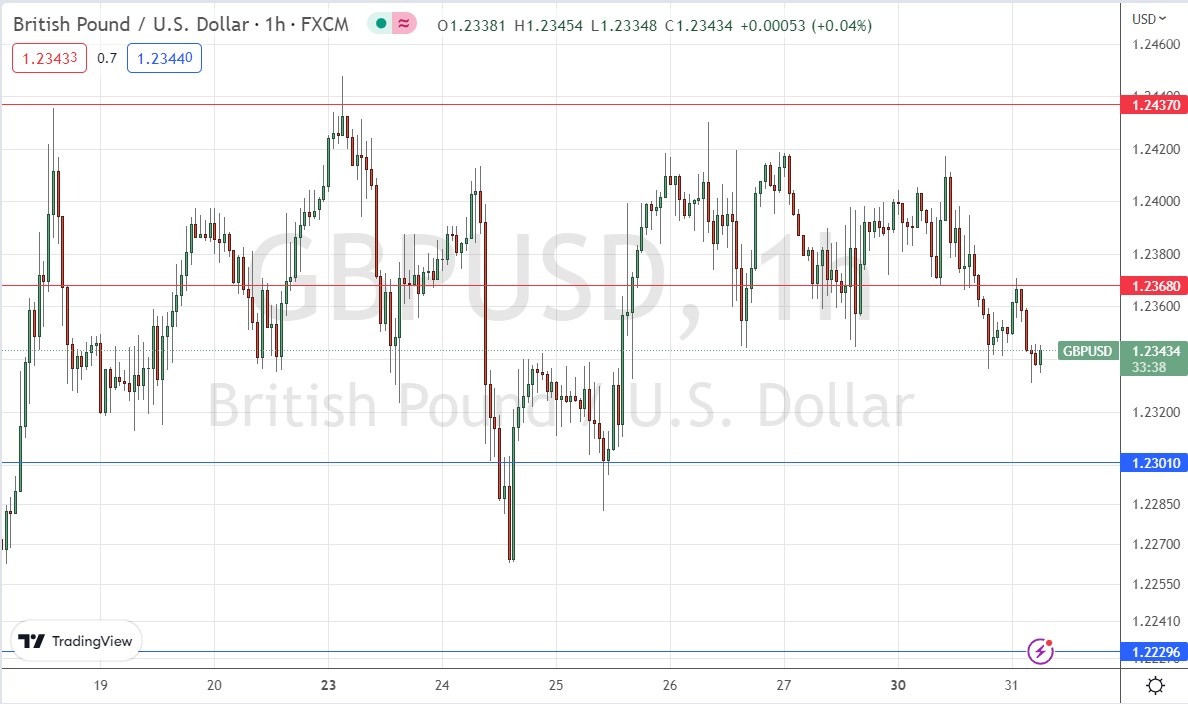

I wrote in my previous forecast for the GBP/USD currency pair that the weak bullish momentum would likely persist, but that bulls would be unable to push the price much higher than $1.2437 today.

I was wrong about the bullish momentum persisting that day, but right about the price not being able to get past the resistance level at $1.2437.

That resistance level has continued to hold, and we have seen the price continue to make a fairly choppy consolidation below it. However, yesterday the picture turned a little more bearish as a new lower resistance level was clearly printed at $1.2368 as the US Dollar finds support and begins to make a bullish reversal. The resistance at $1.2368 is pushing the price lower.

This downwards movement is against the long-term trend so could be unreliable. The British Pound is not the weakest currency against the US Dollar, as although the British economy is not in good shape, more rate hikes are now widely expected from the Bank of England as annualized UK inflation remains above 10%, and this is stopping the Pound from falling by a lot.

I do not think we are going to see any dramatic price movements in the Forex market until tomorrow’s FOMC release, so all key support and resistance levels in this currency pair are likely to hold today. Therefore, the best strategy for trading this pair today will likely be scalping reversals from either support or resistance. I most prefer a short scalp from $1.2368 if it is reached during the London session.

Concerning the USD, there will be a release of CB Consumer Confidence data at 3pm London time. There is nothing of high importance scheduled today regarding the GBP.

Ready to trade our free Forex signals? Here is our UK Forex brokers list for your review.