GBP/USD

The GBP/USD has rallied significantly during the week, reaching towards the 1.2450 level. The area just above there, focusing on the 1.25 handle, remains very difficult to overcome, and therefore I think we’ve got a situation where we could pull back in the short term. However, if we were to take out the 1.25 level, then the 1.2666 level could happen going forward. On the other hand, if we do pull back, I think there is significant support nearly 1.20 level.

EUR/USD

The EUR/USD has been slightly positive for the week, but just like the British pound, it may be running out of momentum. I think the correction in the US dollar is getting a bit overdone, so we will have to wait and see how this plays out. The European Central Bank suggests that it is going to continue to be very hawkish, but at the same time the Federal Reserve is going to keep its monetary policy type for the foreseeable future. I suspect this next week is probably going to be more of the sideways action that had been this past week.

USD/JPY

The USD/JPY has rallied rather significantly during the trading week, piercing the ¥130 level. At this point, the market could continue to see a lot of noisy behavior, as the Bank of Japan continues to fight interest rates. Because of this, we could see that the bond markets continue to drive where we go next. The 50 basis point cap on the 10-year note in Japan will continue to have major influence. If the market sees the Bank of Japan continuing to print unlimited yen to defend that level, we could see the trend take off to the outside, especially if we break above the 50-Week EMA. On the other hand, if we were to break down below the ¥127 level, then there is a huge air pocket just below that could send this market much lower.

AUD/USD

The AUD/USD has gone back and forth during the course of the trading week, losing just a touch of ground in the end. At this point, the 0.70 level continues to keep its influence felt in the market, because as we broke above there, then we broke back down. The shape of the candlestick is not quite a shooting star, but it certainly shows that we are starting to run out of momentum. On a break down below the 50-Week EMA, I see we could pull back to the 0.66 level, perhaps even down to the 0.62 level. On the other hand, we break above the top of the candlestick, then we could go looking to the 0.72 level.

EUR/GBP

The EUR/GBP has broken down rather significantly against the British pound during the trading week, as we have seen the consolidation region of the last 3 weeks get smashed through. At this point, it looks like we could drop down to the 0.86 level if the momentum continues. On the other hand, it looks as if the 0.8850 level continues to offer major resistance above.

USD/CAD

The USD/CAD initially tried to rally during the week but continues to see the 1.35 level as resistance. Ultimately, the market is now trying to figure out where it wants to go next, and if we can break above the top of the candlestick from this past week, then it’s likely that we could go to the 1.37 level. On the other hand, if we turn around and break down below the bottom of the candlestick from the week before this one, then we could go down to the 1.31 level. All things being equal, this is a market that I think remains choppy, and of course the Canadian dollar will retain its correlation to the crude oil market.

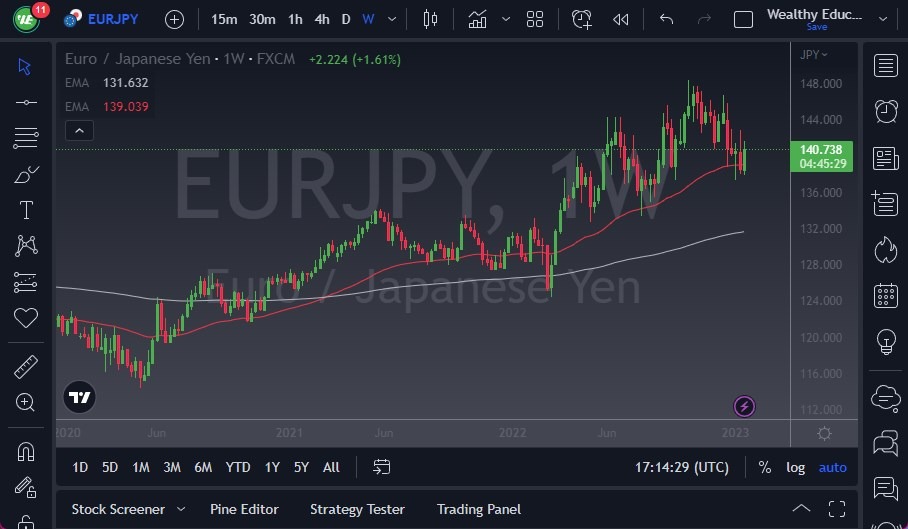

EUR/JPY

The EUR/JPY bounced significantly from the 50-Week EMA, as we continue to see overall upward momentum. The Bank of Japan will continue to work against the value of the Japanese yen, albeit indirectly. This is because they are buying bonds in order to keep the 10 year yield down to 50 basis points. If we break above the top of the candlestick for this week, then it’s possible that we could go looking to the ¥145 level. On the other hand, we break down below the lows of the last couple of candlesticks, it opens up the possibility of a move down to the ¥135 level.

NZD/USD

The NZD/USD has rallied significantly during the course of the week to break above the 0.65 level. The 0.65 level is a major resistance barrier based upon previous action, and of course the fact that it is a large, round, psychologically significant figure. If we were to break down below the bottom of the candlestick, then it’s likely that we could go down to the 0.6350 level, and perhaps even lower than that. We break down below that hammer from a couple of weeks ago, then it’s likely that the New Zealand dollar will go looking to the 0.60 level.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.