Advertisement

GBP/USD

The GBP/USD has spent most of the week falling, but after the jobs number on Friday, we started to see bullish pressure again, as the jobs number showed that wages are seen less inflation in the United States, so, therefore, traders started to focus on the fact that the Federal Reserve may someday slow down its tightening cycle. That is not going to be true, so it’ll be interesting to see how this market plays out. In the short term, it looks like we continue to bounce around the 1.21 level as a pivot in the market.

EUR/USD

The EUR/USD has initially fallen during the week as well, dipping below the 50-Week EMA, only to turn around and show signs of life. The 1.06 level continues to be a significant magnet for prices, and I do think that it is probably only a matter of time before we see the market have to make a bigger decision. In the short term, it is going to be very noisy and back and forth, so I think that we continue to see a lot of range-bound trading. That being said, if we were to break down below the bottom of the candlestick for the week, that opens up a significant selling opportunity. Alternatively, if the market were to break above the 1.08 level, then we could see the Euro takeoff.

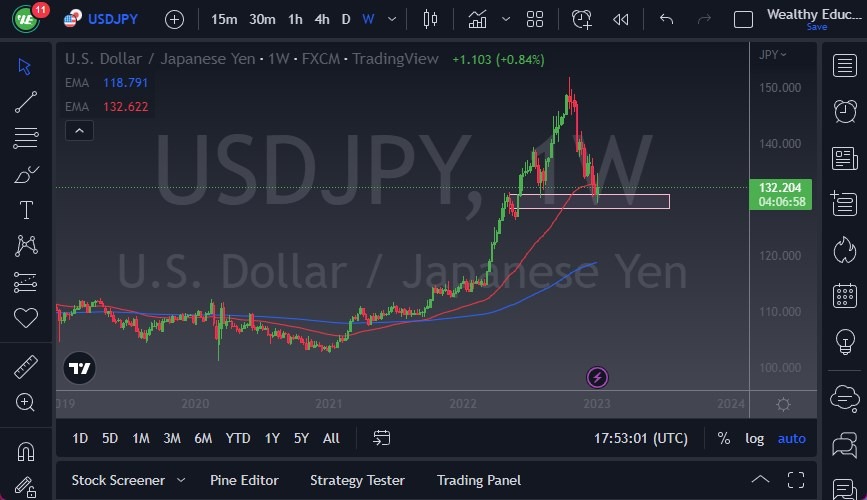

USD/JPY

The USD/JPY continues to see a lot of noisy behavior around the Japanese yen and the ¥130 level. At this point, it looks as if we are going to continue to see a bit of support, but if we were to break down below the ¥130 level, we could see the Japanese yen strengthened, sending the US dollar down to the ¥128 level. Rallies at this point breaking above the top of the candlestick for the week opens up the possibility of a move to the ¥140 level.

AUD/USD

The AUD/USD spent the early part of the week falling, but by the time we got to the jobs number on Friday, we had seen a complete turnaround. The resulting hammer candlestick suggests that there are buyers out there and looking to get long again. That being said, the 0.69 level will be a barrier that is sticky, but if we get above there, we could see the Australian dollar rally to the 0.70 level. Pullbacks of this point will more likely than not continue to be supported by the trend line underneath.

USD/CHF

The USD/CHF initially took off against the Swiss franc, but after the jobs number, gave back quite a bit of the gains that we had seen in what had been a very choppy week. Because of this, it looks as if we are going to threaten the 0.92 level. Breaking below the 0.92 level could open up a move down to the 0.90 level, but when you look to the left on the chart, there is a ton of support in this area. In other words, I think we chop in this general vicinity on short-term charts more than anything else.

EUR/GBP

EUR/GBP traders were bullish during the beginning part of the week but started to sell off again against the British pound. We are at the top of a consolidation area that focuses on the 0.88 level, so if we do see a selloff below the bottom of the candlestick, it could open up a move down to the 0.86 level. That’s an area that has been supportive in the past, so a selloff at this point probably sends us back into consolidation more than anything else. However, if we break above the highs of the last 2 weeks, we could see the Euro takeoff.

NZD/USD

The NZD/USD initially sold off during the week, but then turned around to show signs of life again. That being said, the New Zealand dollar has also faced a lot of resistance just above current trading, so it’ll be interesting to see all this plays out. The 0.64 level looks to be resistance, extending all the way to the 0.65 level. It may very well be that the New Zealand dollar is bullish at the beginning of the week, only to pull back later on.

GBP/JPY

The GBP/JPY initially fell against the Japanese yen but turned right back around toward the end of the week, forming a bit of a hammer. This was preceded by an inverted hammer, showing that we have a “fair fight” on our hands, as we continue to see a lot of noise in general. Overall, I think this is a market that will be very noisy and back and forth as we hover around the ¥160 level.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.