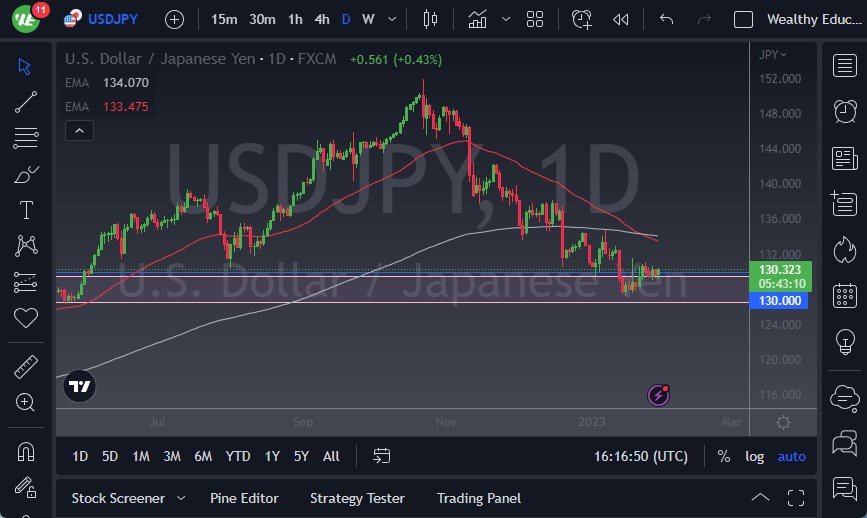

- The USD/JPY currency pair has rallied a bit during the trading session again on Monday, as we continue to form a basing pattern.

- Whether or not we have actually formed a bottom against the Japanese yen will more likely than not be determined sometime this week, as we have the Federal Reserve announcement on Wednesday that a lot of people will be paying close attention to.

- Recently, a lot of people have suggested that the Federal Reserve is going to ease its aggressive attitude, and therefore we have seen the US dollar get hammered.

Bank of Japan VS Federal Reserve

In this particular pair, there’s been a bit more noise due to the fact that the Bank of Japan is so highly manipulative when it comes to the currency markets. The entire time that this pair had rallied last year, it was due to the fact that the Bank of Japan had settled on a 25 basis point rate cap in the 10 year JGB. In order to make that happen, they have to buy unlimited bonds, and therefore print unlimited yen. They then acquiesced and allowed for a 50 basis point rate cap on that same pond, and since then we have seen the Japanese yen pick up a little bit of strength. However, we are now at a point where some bigger decisions have to be made.

A lot of traders believe that the Federal Reserve is going to relax some of its monetary policy tightening, and this has had a major influence on this pair. However, now that we are getting closer to the actual event, it will come down to the attitude and the speech by Jerome Powell during the question and answers phase. Recently, the Bank of Japan reiterated its desire to keep its interest rate of 50 basis points, and we ended up forming an inverted hammer last week as a result. That inverted hammer will be crucial to pay attention to because we can break above it, then it would confirm that we just formed the base in this pair, and I would almost certainly get aggressively long at that point. However, if we fall from here, I believe that the ¥127 level absolutely has to hold, or the bottom will fall out as I see huge air pocket just underneath.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.