- The USD/JPY has fallen apart during trading on Friday, just as everything else did.

- After all, the Bank of Japan is still trying to fight interest rates going above 50 basis points on the 10-year note, which happened overnight for a moment.

- This has had the Japanese yen strengthening, as it looks like the Bank of Japan may be running out of firepower to print currency.

- If that does in fact end up happening, the Japanese yen is going to strengthen quite drastically.

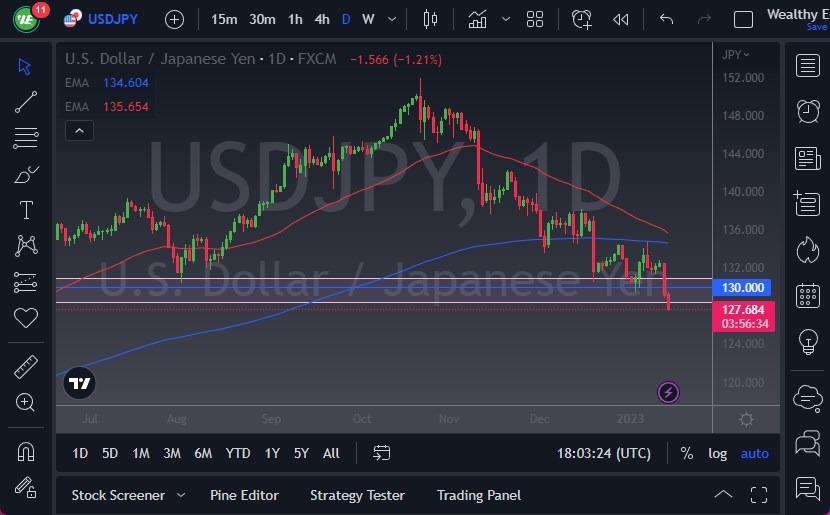

When I look at this chart, the ¥127 level is very important. When you look at the longer-term charts, that’s essentially the next cluster, and if we get below there, we very well could have nothing short of an air pocket underneath, possibly opening the next 1000 pips. Turning around now is very possible since we had sold off so drastically, but you now must look at rallies with suspicion because quite frankly, no matter what the Bank of Japan ministers do, the market is bigger.

Looking for Value in the Yen

Interest rates need to come down quite drastically to relieve some pressure on the Japanese, as global bonds continue to offer a nice yield. Regardless, we are closing at the bottom of the daily candlestick, which does suggest that we have a bit of a follow-through coming. Rallies at this point will be looked at with suspicion, and I believe that the ¥130 level now offers a short-term ceiling in the market. Ultimately, this is a situation where I’m looking for value in the yen, meaning that I’m willing to fade the US dollar on rallies that show signs of exhaustion.

We also have the 50-Day EMA starting to drift lower, ready to break down below the 200-EMA. This is the so-called “death cross”, which is longer-term in its nature, and very negative as well. At this point, the market is likely to be very noisy, but it still has a decidedly “one-way attitude” built into it. I have no interest in buying this market, at least not until we clear the 200-Day EMA on a daily close, something that’s very unlikely to happen anytime soon. The fundamentals still favor more downside before it’s all said and done.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.