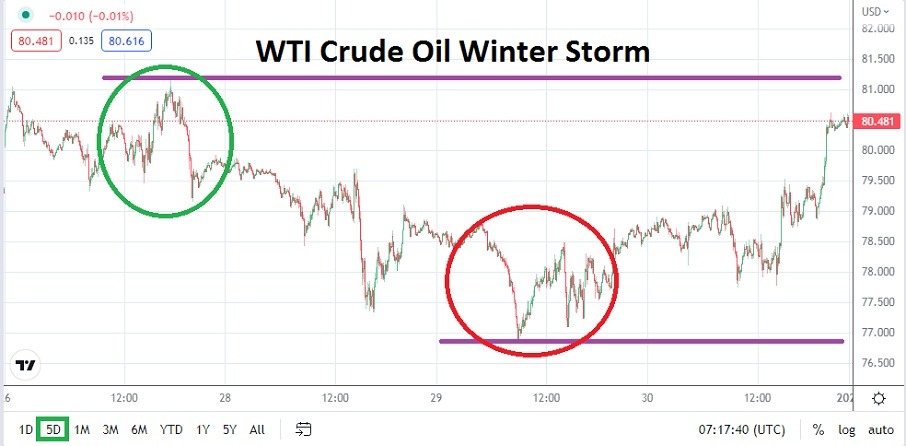

The cash price for WTI Crude Oil finished near the 80.480 mark before going into the weekend. The finish above 80.000 is notable taking into consideration that Crude Oil was near lows of 70.000 USD on the 9th of December. The rise in value for the commodity came on the heels of colder-than-normal winter weather hitting much of the U.S., which certainly added a variety of speculative factors for WTI Crude Oil buyers.

The rise in price however also occurred during light holiday trading, the highest ratio for WTI Crude Oil happened on the 27th of December when the commodity touched the 81.300 level. Intriguingly and perhaps highlighting that strong speculative forces were involved in the bullish activity last week, was the reversal lower which hit approximately the 76.790 mark two days later on Thursday. Topping off the wagering landscape was the climb higher again which finished the week within sight of solid higher values.

Holiday Trading Remains a Topic in WTI Crude Oil this Week

The New Year's day celebrations may be complete, but full trading this week will remain rather challenging as many large trading companies remain rather quiet as they allow employees to wrap up their holidays. Traders should be ready for some volatility when WTI Crude Oil opens via its cash price early on Tuesday as positions are placed and potentially look for technical corrections lower. The winter cold blast in the U.S. has lessened which should eliminate the notion of speculative buying based on last week’s storm.

Of interest now is if WTI Crude Oil can remain above the 80.000 support level for a sustained amount of time in the near term. While the energy has certainly climbed in price since its lows during the second week of December, WTI Crude Oil remains well below its peak number seen in early November when it traded above 92.000 USD. It is likely fundamental questions of global demand will start to become part of the conversation quickly. The opening of China per its removal of tough coronavirus restrictions may spark some additional speculative demand.

- December’s lows near 70.000 may prove to be the bottom depth for WTI Crude Oil and support looks technically interesting this week near 77.000 USD.

- Traders should remain cautious the first couple of trading days this week in WTI Crude Oil because thin transactional volumes could still spark volatility.

Short-Term Traders should be cautious and use Conservative Leverage in WTI Crude Oil

The inability of WTI Crude Oil to remain above the 81.000 level last week at the height of its speculative buying may be a signal large traders of the commodity believe there is enough supply. A belief that supply is plentiful and demand remain questionable because of rather murky economic outlooks could cause WTI Crude Oil to traverse a range that is rather choppy this coming week, particularly when you add the ingredient of light holiday trading into the puzzle.

WTI Crude Oil Weekly Outlook:

The speculative price range for WTI Crude Oil is 77.100 to 82.800 USD.

Speculators in Crude Oil this week should have a full arsenal of risk-taking tactics ready to guard against the chance of fast price velocity. While the range of the commodity was rather compact in some respects, the swiftness of rather large reversals indicates traders were active and they still may have positions that are working coming into this week. WTI Crude Oil above 80.000 should be looked at carefully early this week.

If the price drops below 80.000 a test of the 79.000 to 78.000 ratios would not be a surprise. The price range of the commodity remains intriguing as a wagering tool to sell WTI Crude Oil potentially near the 80.500 to 81.000 marks and aim for reversals lower. Buying WTI Crude Oil on moves lower near the 79.500 to 79.100 levels may prove attractive too. Traders need to use the solid risk management and not be overly ambitious in WTI Crude Oil this week.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.