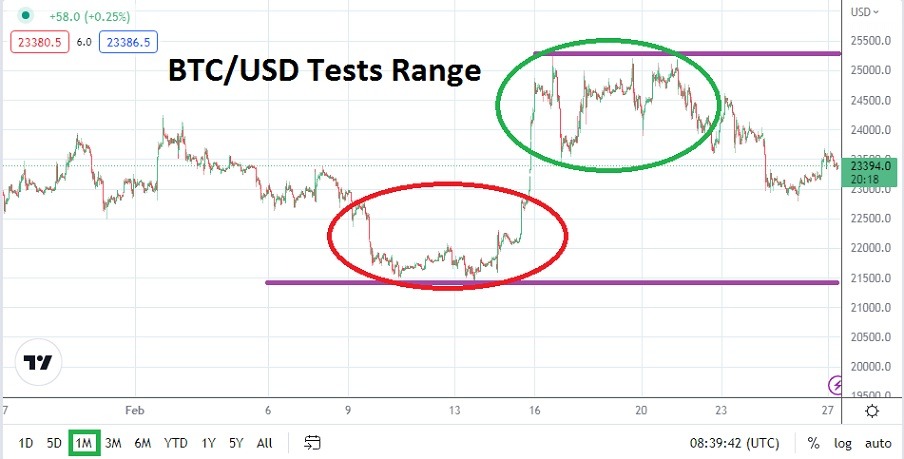

BTC/USD seems ready to begin the month of March having been able to produce upwards monthly values again. On the 1st of January BTC/USD was slightly above the 16,500.00 price. When January ended the price of BTC/USD was near the 23,000.00 juncture, and as March gets set to begin and the sun sets on February the world’s most famous digital asset is around the 23,390.00 level.

From the 16th until the 21st of February BTC/USD Challenged the 25,000.00 Ratio

Bullish speculators who continue to bet on higher moves of BTC/USD need to remain nimble and vigilant as always. If a trader is able to place a solid take profit and stay away from getting knocked out of reversals lower, there is a chance buying wagers have produced profits. BTC/USD in the middle of February pressed higher with good price velocity and challenged the 25,000.00 mark a few times. Yes, a reversal lower has taken place and BTC/USD is now within the middle of its range for the past month, but it must be admitted the digital asset has held onto its upper range when mid-term charts are examined.

- Negative news remains a rather consistent part of the cryptocurrency landscape, as investigations are made public by the U.S government into various exchanges and decentralized finance operations, but this has not stopped speculators from pursing Bitcoin.

- Skeptical bearish traders certainly still exists within the BTC/USD wagering landscape, but they have likely found betting conditions difficult without any sustained moves downwards and no major selling trends to point to recently.

Volatility is certain to flourish in BTC/USD Again, but when?

The results from February have lacked the drama of the past few months when Bitcoin was taken to steep lows in late December 2022, and then seemingly found support which developed into a rather powerful buying trend in January. However, as experienced traders within the cryptocurrency world know, you should not go to sleep on BTC/USD and expect calm conditions to be there when you wake up.

Volatility is one potential day away, always. The ability of BTC/USD to produce a rather middling price range doesn’t change the fact that moves of 1,000.00 USD still remain a potential daily risk. Risk management is a command in the cryptocurrency world, not a suggestion for speculators.

BTC/USD Outlook for March 2023:

Speculative price range for BTC/USD is 19,980.00 to 26,250.00

Skeptics of BTC//USD may be watching the 23,000.00 ratio with careful eyes. If this level lower is found to be vulnerable the 22,800.00 to 22,700.00 ratios may prove rather enticing for wagers seeking lower support levels to target. Behavioral sentiment remains a cornerstone of trading in Bitcoin and the ability of the digital asset to remain above the 22,500.00 realms appears important psychologically. If for some reason momentum downwards is generated and the 22,500.00 falters this could set off alarm bells that may tell folks who bought at lower values in January to cash out profits when they still exists.

Day traders of BTC/USD need to remain hyper vigilant. What appears to be a quiet market and one that is attractive to wager within can turn violent without any significant reasons that are known. Solid stop loss and take profit orders remains important for speculators who do not want to hold onto the digital asset overnight, but merely want the opportunity to try and capture a trend.

If BTC/USD is able to climb above the 23,600.00 ratio and sustain this value, this might attract buyers in larger numbers again. After falling below the 24,000.00 mark late last week, some speculators may want to see this number challenged and penetrated higher before seeking upwards bullish bets again. If BTC/USD does topple 24,000.00 and shows the ability to sustain these highs it could certainly add to the notion Bitcoin can move towards the 24,500.00 and 25,000.00 junctures like it did in the middle of February.

Bitcoin remains a betting landscape for traders who want to gamble on the potential of generating fast profits. They need to understand the ability to gain quickly, also allows for the potential to lose money in a rapid fashion. The middling ground of BTC/USD remains for the moment, but March could produce more surprises.

Ready to trade Bitcoin in USD monthly forecast? We’ve shortlisted the best MT4 crypto brokers in the industry for you.