- Gold markets have been back and forth during the trading session on Tuesday, as we are trying to figure out what to do with it.

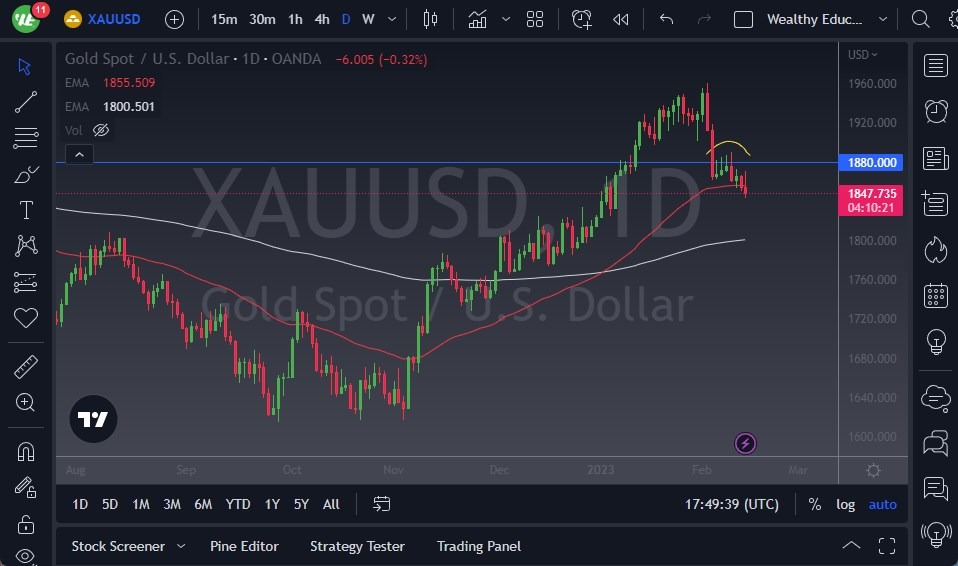

- Ultimately, we are hanging around the 50-Day EMA, and therefore it’s worth paying close attention to this region. If we were to break down below the bottom of cancer, then it has the possibility of a move down to the 200-Day EMA in the gold spot market, which happens to be at the $1800 level.

- The $1800 level is a large, round, psychologically significant figure that a lot of people will pay close attention to, so therefore I think you get a situation where a breakdown below there could open up a move down to the $1750 level.

If we do rally from here, it’s very likely that we could see quite a bit of resistance above, especially near the $1880 level, and extending to the $1900 level. We have seen a lot of resistance above that area, as there have been multiple inverted hammers in that general vicinity. If we can break above that area, that is likely that the market will try to go fill the massive selling pressure that we did see from the top. That is obviously an area where a lot of people will be paying close attention, but it’s also worth noting that we formed a couple of very nasty candlesticks that very rarely happen in a row very often. In other words, it’s very likely that short-term rallies would see a lot of hesitation.

Market to Continue to See a Lot of Volatility

On the other hand, if we were to break down from here, then it could offer longer-term traders an opportunity to pick up “cheap gold”, as a lot of people had gotten forced out of this market as the FOMO just kept accelerating. Whether or not that ends up being the case remains to be seen, but at this point it’s likely to continue to see a lot of volatility more than anything else. Generally, when you see this type of volatility that normally means lower pricing, at least in the short term.

If we were to turn around and break above the inverted hammers that formed last week, that would be extraordinarily bullish and could lead to something much bigger, despite the fact that there is a significant amount of resistance.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.