Advertisement

USD/JPY

The USD/JPY initially fell during the course of the week but turned around quite drastically to break up well above the ¥130 level. This is a market that has been beaten down for a while now, but we have seen the jobs never shock the markets on Friday, adding 518,000 jobs for the month of January. At this point, it looks like the market is finally starting to think that perhaps the Federal Reserve might be serious about keeping monetary policy type. We are on the verge of breaking above an inverted hammer candlestick from the previous week, so at this point, it looks like this pair will continue to go higher.

EUR/USD

The EUR/USD initially tried to rally during the week but got hammered on Non-Farm Payroll Friday, and now has given up a couple of handles since then. If the market were to break down below the 1.08 level, it’s likely that we could go down to the 1.06 level after that. The 1.06 level features a 50-Week EMA, and a breakdown below that would also add more downward pressure to this market. It’s worth noting that the market pulled back from the crucial 50% Fibonacci level from the huge move down.

GBP/USD

The GBP/USD has gotten hit hard during the week as well, as it is now threatening the 1.20 level. If the market rallies at all this week, I will be looking for short-term exhaustion signals to start selling. However, it would be just as plausible that we fall from here as it looks like we have found an intermediate top in this bear market rally. I believe that the jobs number being as hot as it is probably delivered a little bit of reality to the markets, and the bear market rally against the US dollar may be over.

AUD/USD

The AUD/USD pulled back from the 200-Week EMA during this past week, and now is looking likely to threaten the 0.69 level, perhaps sending this market down a couple of hundred pips. 0.67 level could very well be a target. However, for short-term rallies, I’ll be looking for signs of exhaustion to start selling again, as it now looks like the rally in the US dollar could start to commence again. It would take a daily close above the highs of this past week for me to become bullish on the Aussie dollar.

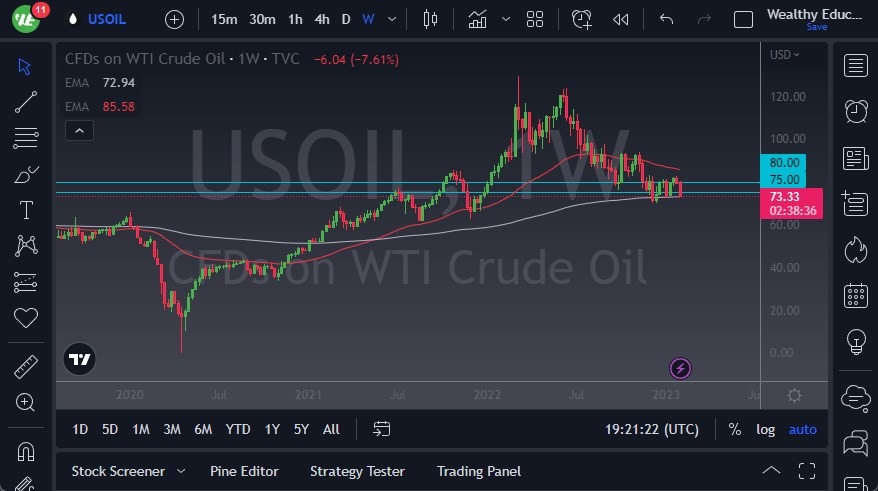

WTI Crude Oil (US Oil)

The West Texas Intermediate Crude Oil market has fallen during the week, as we continue to wonder whether or not there is going to be enough economic momentum to drive demand. At this point, it certainly doesn’t look like the economy is ready to take off as central banks around the world continue to tighten monetary policy. However, you can also point out that the US jobs number were gangbusters, so that will bring in a certain amount of demand. Regardless, we are sitting right at the 200-Week EMA, and therefore I think it makes a certain amount of sense that there might be a little bit of a pushback. I expect a very choppy week ahead.

Gold

Gold markets were absolutely decimated on Friday and ended up down over 3% for the week. At this point, it looks like we are making a beeline down to the $1800 level. This is all about the US dollar which suddenly looks very strong, and therefore I think we are ready for a deep correction. In fact, you have to ask now whether or not we ever going to hit that $2000 level that everybody else thought we were going to as well, or if we are going to simply continue the overall consolidation that we’ve seen for 3 years? Regardless, I think we have a little bit more downward pressure ahead of us.

S&P 500

The S&P 500 rallied significantly during the week to touch the 4200 level on Friday, but then turn around and give up the gain. This is an interesting turn of events because we are witnessing this new phenomenon called “zero-day expiration options” manipulation. In other words, traders are running into the market to push towards an options target to get paid, and then jumping right back out. At this point, I think we have asked serious questions about the market, and while the US dollar looks like it’s ready to take off, I would not be surprised at all to see this market had back towards the 50-Week EMA.

DAX

The German DAX has seen more bullish pressure during the week, and it now looks as if we are ready to go looking towards the €16,000 level. Whether or not we can break out above there is a completely different question, but it certainly seems as if we are in an area where short-term pullbacks will continue to be bought into, as we are seeing quite a bit of strength in Germany overall. Underneath, the €14,500 level would be a major support level, and breaching that support level would be rather negative.