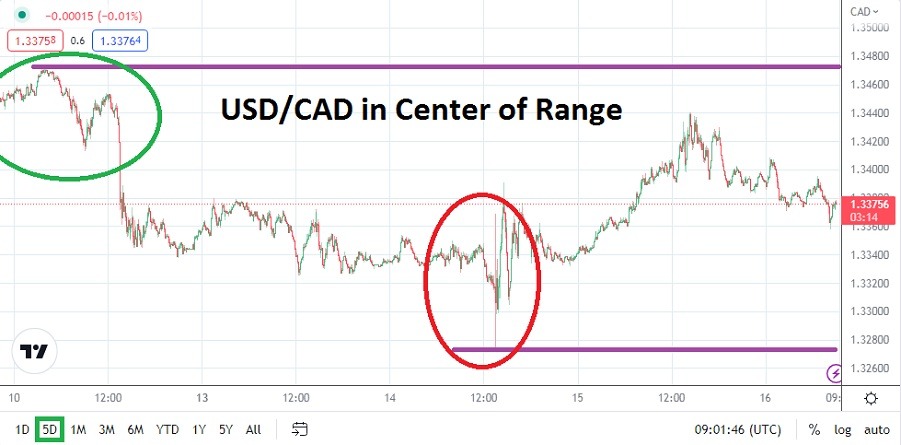

USD/CAD speculators should brace for crucial U.S inflation data coming today, which is certain to cause volatility and jolt the currency pair from its short-term middle ground.

The USD/CAD is trading near the 1.33700 ratios as of this writing. The currency pair touched a high of nearly 1.34100 earlier today and yesterday’s trading produced a high of around 1.34400. A short-term lower reversal has taken place in the past couple of hours as the USD/CAD seems to be attracted to the center of its five-day trading range. In a few hours, the U.S. will release important inflation numbers via the Producer Price Index reports.

USD/CAD Middle Ground almost certain to disappear in the Coming Hours

The comfortable technical perception of the USD/CAD trading in the center of its near-term range will likely vanish in a couple of hours. Economic data from the U.S. has caused massive volatility in the USD/CAD and across the Forex market since early February.

Following in the footsteps of stronger-than-expected rhetoric from the U.S. Federal Reserve two weeks ago, the U.S. jobs numbers came in higher than anticipated. This past Tuesday delivered another surprise for many when U.S inflation data via the Consumer Price Index statistics were more stubborn than forecasted.

Technical Range of the USD/CAD will be shaken before and after PPI Reports

- The short term may provide a testing ground for the USD/CAD within the 1.33650 to 1.33850 ratios.

- The broad Forex market is likely to start producing quick price velocity leading up to the release of the U.S Producer Price Index and risk management will be essential in USD/CAD.

- A stronger inflation number than anticipated would likely cause the USD/CAD to test the 1.34000 ratio and sustain this level.

- A weaker-than-expected number could cause a retest of lows seen in the USD/CAD where the 1.33250 to 1.33175 levels are challenged.

Choppy conditions have been seen in the USD/CAD, but since early February a bullish trend has managed to hold some power, which correlates to the broad Forex market. The near-term will be intriguing regarding price fluctuations, but today’s U.S PPI inflation numbers will likely cause momentum to track in a firm manner. Financial houses and traders remain nervous about the potential monetary policy from the U.S Federal Reserve and today’s Producer Price Index results are certain to have an effect on the USD/CAD.

Canadian Dollar Short-Term Outlook:

Current Resistance: 1.33960

Current Support: 1.33580

High Target: 1.34550

Low Target: 1.33210

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform Canada to choose from.