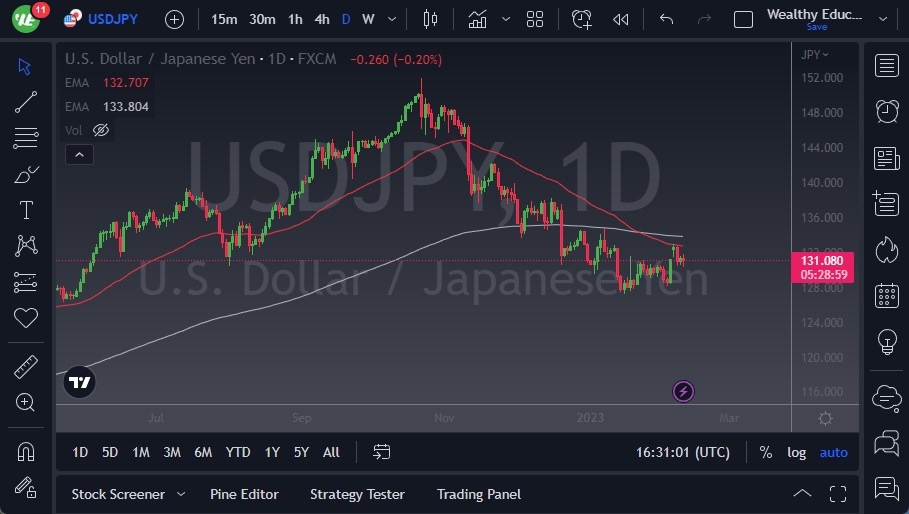

- At this point, the market did pull back just a little bit of distance to reach down below the ¥131 level, but it has seen a little bit of support underneath there. With this, the market could get looking to the 50-Day EMA, which of course attracts a lot of attention.

- Above the 50-Day EMA opens up the possibility of a move to the 200-Day EMA as well.

- That being said, we get above those moving averages, then we could have a bigger move. In that scenario, we could have the market go looking to the ¥137.50 level.

Breaking down below the bottom of the candlestick for the trading session on Thursday would open up quite a bit of selling pressure, down to the ¥128 level. Underneath there, the ¥127 level is a significant support level, and if we could break it down below there, then you would see a complete breakdown in this market, and perhaps a run all the way down to the 1.15 level.

We Could See a Bigger Move

That being said, keep in mind that the Bank of Japan continues to keep a 50 basis point limit on the 10-year yield, so in order to do so, they have to print currency, meaning that it will continue to work against the value of that currency. That has been the reason why the market shot straight up in the air all of last year. We’ve had a nice pullback at this point, and now it looks as if we are trying to fight back and continue to go back up in the air.

Keep in mind that the Federal Reserve also has its part to play in this market, so if they continue to be very tight with monetary policy, then it’s possible that we could see the US dollar continue to strengthen in general. In that scenario, we could see a bigger move, but right now I think we are just simply trying to stabilize after that massive gap at the beginning of the week. Whether or not we take off remains to be seen, but if we do, this may have just been the bottom of the massive pullback that we had seen. Either way, you need to be cautious with a position size, because this pair is always choppy under the best of circumstances.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.