The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are a few valid long-term trends in the market right now, which might be exploited profitably. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 12th February that the best trade opportunity for the week was likely to be long of the S&P 500 Index (potentially for a long-term investment). Unfortunately, the S&P 500 Index fell by 0.43%.

The news is dominated by higher than expected US CPI (inflation), PPI (purchasing power index), and retail sales data released last week, which has had the cumulative effect of making higher and longer rate hikes by the Federal Reserve more likely over the near term. This has boosted the US Dollar and cooled down the stock market, despite the S&P 500 Index having made a golden cross during the previous week.

The other major items were inflation data in the UK and Switzerland which showed inflation falling in the UK a little faster than expected, while in Switzerland the opposite was the case.

There were a couple of other data releases concerning the UK and Australia, but none of them contained any major surprises or moved the market significantly.

Global stock markets ended the week mostly lower, with the notable exception of European markets such as the UK FTSE 100 Index, which made a new all-time high price. The Forex market saw the greatest strength in the US Dollar last week, with the Japanese Yen the weakest major currency.

Rates of coronavirus infection worldwide again dropped last week for the eighth consecutive week according to official data, with the lowest overall numbers seen since June 2020, shortly after the start of the pandemic.

The Week Ahead: 20th February – 24th February 2023

The coming week in the markets is likely to see a similar level of volatility as last week, as there are a few major data releases due. They are, in order of importance:

- FOMC Meeting Minutes

- US Preliminary GDP data

- US Core PCE Price Index data

- Canadian CPI data

- RBNZ Official Cash Rate & Monetary Policy Statement

- US Flash Services PMI

- UK Flash Manufacturing & Services PMI

- Australian Wage Price Index data

It is a public holiday on Monday in the USA and Canada, and in Japan on Thursday.

Technical Analysis

US Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bullish near-doji candlestick, a few weeks after having convincingly rejected the support level shown at 101.07, which typically signifies a continuing reversal of direction.

Despite these bullish signs, the Dollar remains within a long-term bearish trend, with the price continuing to trade well below its levels of both 3 and 6 months ago. It may be that the resistance level at 104.93 will start to make its presence felt.

I do not like to trade against long-term trends, but there are increasing signs that the bearish trend is now going to reverse or make a deeper bullish retracement, so traders should be cautious and watch out for this. Any trading against the US Dollar should probably only be taken once we see bearish price action in the daily time frame.

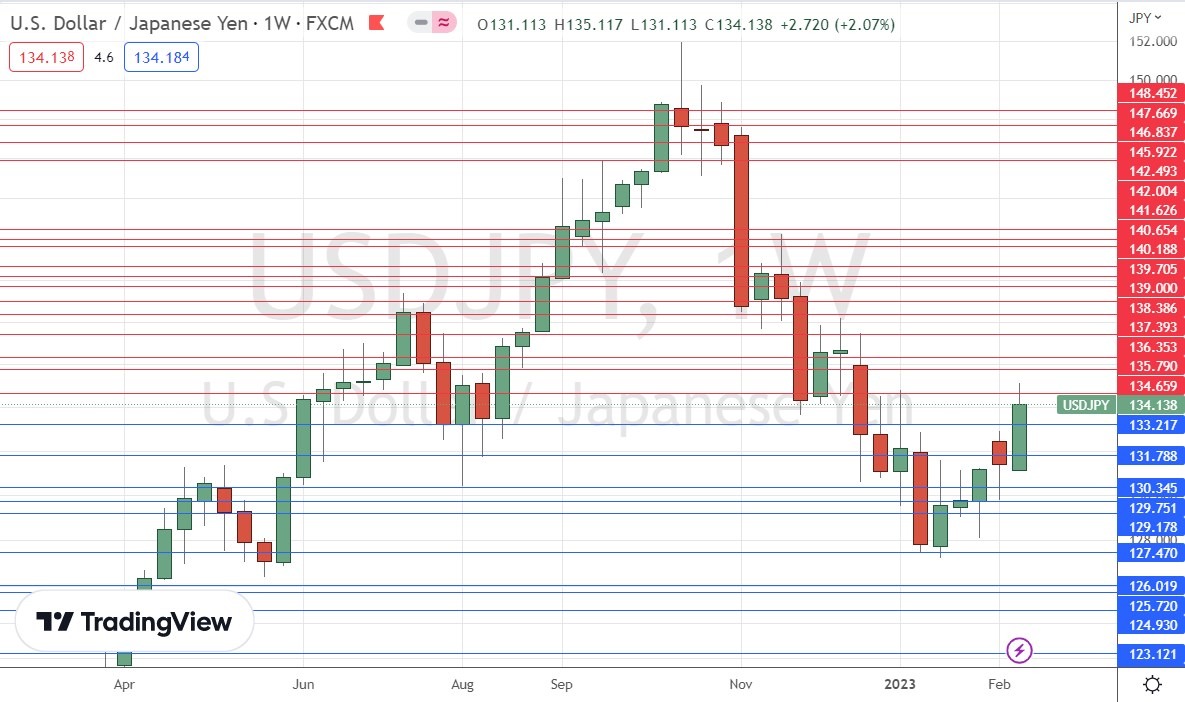

USD/JPY

Last week saw the USD/JPY currency pair print a firm bullish candlestick. The US Dollar was the strongest currency over the past week, while the Yen was the weakest, putting this pair in focus. The movement was mostly driven by Yen weakness.

Although we are clearly seeing a short-term bullish trend, there is no long-term trend. Therefore, the important takeaway here is volatility in the Yen, which could give some good day trading opportunities. It might be wise to look for strong reversals from key levels in either long or short directions, and trade them over the short term accordingly.

S&P 500 Index

Last week again saw the S&P 500 Index fall, printing a small bearish doji inside candlestick which was also nearly an inside candlestick. This again signifies directional indecision, although the chart pattern here is a flag which is usually seen as bullish.

The daily price chart still shows a valid golden cross (or bull cross), where the 50-day MA crosses over the 200-day MA, valid since Thursday the week before last. Such a cross historically indicates the beginning of a major bull move, so it could be a great long-term buy signal.

A key feature is the support level shown in the price chart below which is just above the very large round number at 4000. A daily close below 4000 could be taken as a bearish sign if it happens, and if the price trades well below 3900 that would suggest, based on historical data, that a bull market is not going to take off any time soon.

I am not sure whether the Index is likely to rise or fall over the coming week. On the bullish side, we have seen firmer upwards movement over recent weeks indicating a more bullish market. However, we also see higher rate expectations and rising US treasury yields which tend to indicate flat or falling stock markets ahead.

NASDAQ 100 Index

Last week saw the NASDAQ 100 Index print a bearish inside candlestick, as the price again failed to make a bullish breakout beyond the key resistance level at 12820.

It is worth noting that while the NASDAQ is very positively correlated with the wider S&P 500 Index, the NASDAQ is not showing a golden cross, unlike the S&P 500, and is being held by an obvious resistance level. This suggests that the NASDAQ is looking relatively weak, so a bullish play should use the S&P 500 Index as a more appropriate vehicle. If you think the US stock market is about to break down and you want to trade short, the NASDAQ is likely to be a better bet, following a daily close below the 12200 level.

2-Year US Treasury Yield

Us Treasury Yields rose last week, notably the 2-year yield, after US CPI and PPI data showed a hotter economy than had been expected, raising expectations for rate hikes.

Technically, the chart looks very bullish: we see a bullish near-doji inside candlestick, followed by a bullish pin bar, and then two bullish candlesticks. The yield ended the week quite close to its highest daily close made in years at 4.729%.

I will not enter a long trade here until we get a daily close above 4.729%.

Bottom Line

I think longer-term traders may be wise to sit on the sidelines this week. However, I see a long-term investment opportunity as valid in the S&P 500 Index, and potential day trading opportunities in the USD/JPY currency pair if the high volatility persists. I also see a long trade in the US 2-Year Treasury Yield if we see a daily close above 4.729%.

Ready to trade our weekly Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.