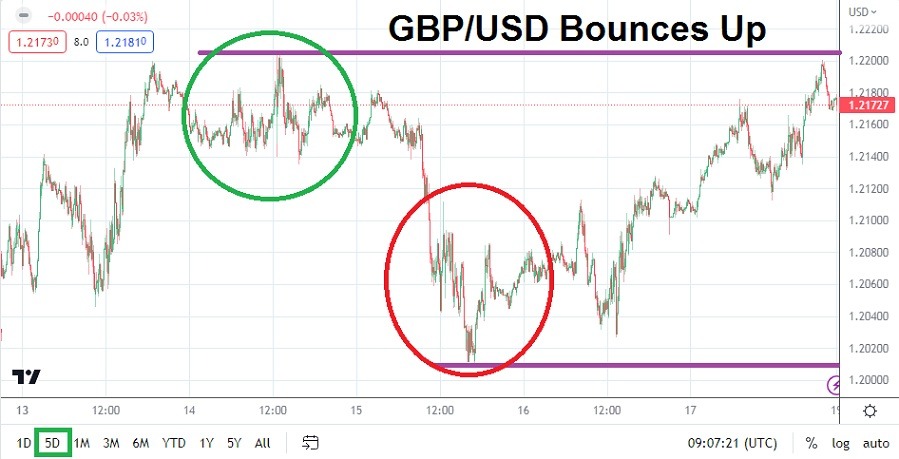

The GBP/USD finished last week’s trading around the 1.21725 ratios. Having started the week essentially near the 1.20700 mark the bullish outcome for the GBP/USD should be given attention by speculators. Yes, volatility did hit the GBP/USD last week and a low of 1.20085 was touched approximately on Wednesday. However, the currency pair was able to incrementally trade higher after this depth and came within sight of highs near the 1.22000 ratios before going into the weekend and suffering a slight reversal lower.

GBP/USD Traders should brace for the U.S Federal Reserve and the BoE

The crisis in banking confidence will no doubt continue into this week and that will certainly make for nervous trading GBP/USD conditions. However, from a speculative point of view, the rather robust results upward within the GBP/USD are intriguing. The currency pair finished its trading within the upper part of the weekly price range and was able to maintain a rather steady pace higher, which started on the 8th of March. Yes, global concerns regarding Credit Suisse and U.S. regional banks will continue to be heard in the coming days, but the buying in the GBP/USD which has been generated the past week and a half of the trading is worthwhile to consider.

The U.S. Federal Reserve will announce its interest rate decision this coming Wednesday and the Bank of England will follow on Thursday. Having taken a rather aggressive stance only two weeks ago, the U.S. Federal Reserve is now in a murkier position regarding what it will do with the Federal Funds rate on the 22nd of March. It is highly unlikely the Fed will hike by 0.50% this coming week, while it does seem possible a rise of a quarter of a point is potential. What does seem almost certain is that the Bank of England will hike the Official Bank Rate by 0.25% this week as forecast to 4.25%. There are no guarantees, but it is these estimates which are likely the power behind the GBP/USD moves recently.

- The GBP/USD has likely gained because financial houses which felt the U.S. Fed would be overly aggressive a couple of weeks ago are now reconsidering their outlooks.

- However, if the U.S Federal Reserve ‘only’ raises its interest rate by 0.25% this might have already been digested by the Forex markets.

Inflation is Important but the Health of the Global Banking Sector is Vital

The GBP/USD may continue to find some upwards movement based on the notion that financial houses may still be trying to get out of their overly aggressive USD positions. Meaning the GBP/USD two weeks ago may have been oversold based on the prospect the U.S Fed would increase by 0.50 on the 22nd of March because of its emphasis on inflation. However, the shadows now being cast by the banking sector crisis have made a large hike by the U.S central bank highly improbable. This likely set the stage for buying of the GBP/USD, but now speculators need to consider if the buyer has been overdone in the currency pair.

GBP/USD Weekly Outlook:

The speculative price range for GBP/USD is 1.20530 to 1.23010

Nervous market conditions are certainly going to continue this week as financial institutions try to find their equilibrium within equities and Forex. If the GBP/USD sells off this coming week it does appear technical support around the 1.20600 to 1.20500 may be able to prove durable. Having made solid gains the past few days and enjoyed a relatively strong bullish trend the past week and a half, the GBP/USD may see some selling as a short-term reaction.

However, traders who want to pursue bearish positions should not be overly ambitious. The ability of the GBP/USD to remain above rather moderate support levels last week indicates some bullish sentiment still may be possible in the currency pair. Traders looking for more upside potential in the GBP/USD would certainly get a boost if the U.S. Fed says it is going to pause its aggressive interest rate stance this week. While a 0.25% hike is a potential, the possibility that the U.S. Feds delivers an unclear message regarding near-term monetary policy this Wednesday could cause nervous and choppy conditions in the GBP/USD too.