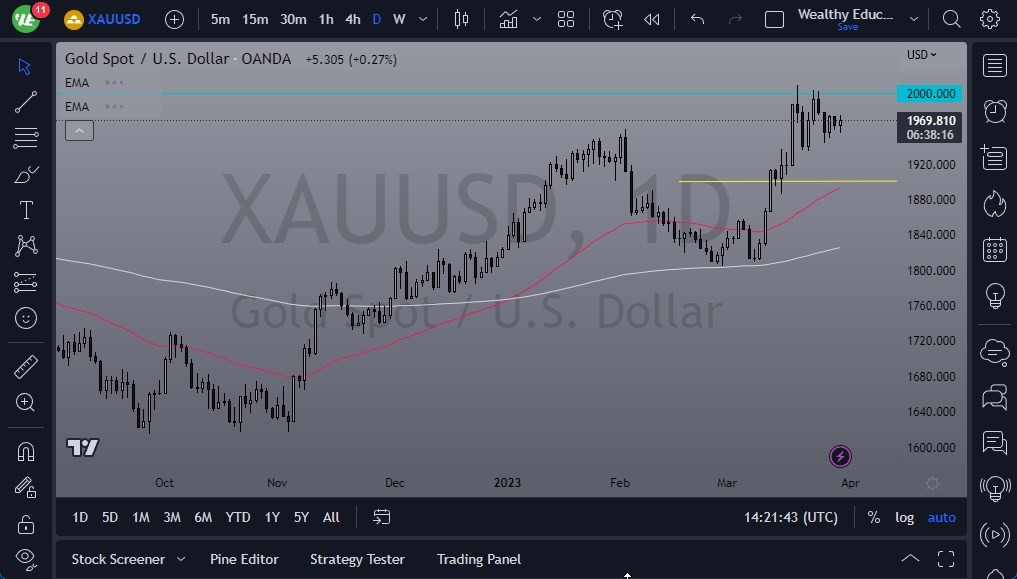

- The gold market has been experiencing a lot of volatility lately, with traders closely monitoring the $2000 level.

- This level is an important psychological barrier, and if it is breached, it could attract a lot of attention.

- Despite this, traders need to be cautious in their approach, and they need to consider whether momentum can continue in the market.

One of the factors that traders need to consider is the futures contract. There is a gap near the $1950 level that has yet to be filled, and this makes it likely that the market will revisit that area. If the market breaks down below $1900, that could trigger a deeper correction, which would be a cause for concern.

Despite these challenges, many traders still see gold as an asset that can help protect wealth. This is especially true if there are significant stresses in the financial system. In fact, if the market breaks out to the upside and clears the recent highs, it could go up to the $2050 level. If it surpasses that level, the $2100 level becomes the next target. However, traders need to be aware that anything above that level could signal a "buy-and-hold market," which suggests that there are significant stresses in the financial system.

The Market is Choppy and Uncertain

Another factor that is affecting the gold market is the bond market. This market has been volatile lately, and this adds an additional layer of complexity to the gold market. Traders need to be cautious in their approach, and one possible strategy is to use smaller position sizes, which can help manage risk and minimize losses.

TLDR; the gold market is currently choppy and uncertain, and traders need to be cautious in their approach. While a pullback is possible, many traders still see gold as a valuable asset that can help protect wealth. By using smaller position sizes and closely monitoring the market, traders can find opportunities to profit in this volatile market. The key is to stay informed about the market conditions and to make decisions based on a careful analysis of the available data. Looking at the charts, it’s obvious that there is plenty of buying interest out there, but at the end of the day, it’s going to be difficult to ride through this volatility if your position sizes are too big.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.