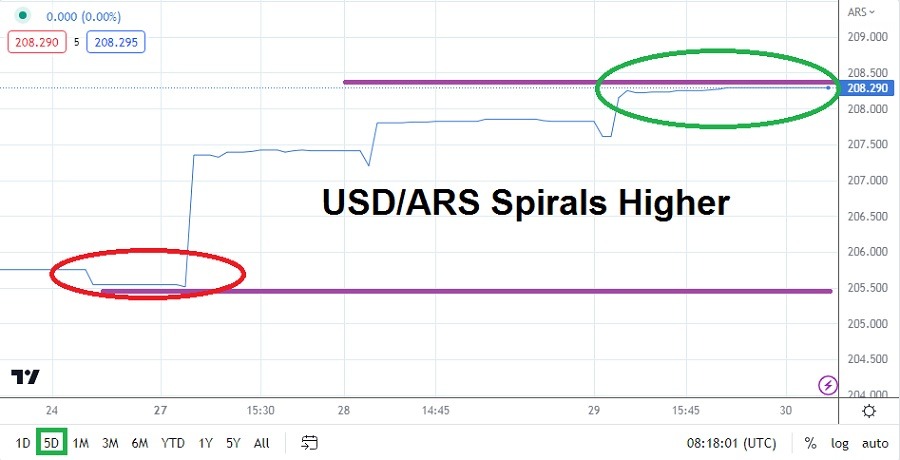

The USD/ARS consistently delivers upwards momentum as the Argentina Peso continues to be among the worst currencies in the world. The USD/ARS is now comfortably above the 200.000 price level and continues to wave goodbye to lower values. And let’s remember the ‘official’ government rate of the USD/ARS is not the rate that citizens can find on the streets of Buenos Aires, where the exchange of the currency pair often leads to double the official rate.

Pressure on the Value of the Argentine Peso Doesn’t Stop

- Argentina has issued a new currency note of 2,000 Argentine Pesos; this has led many to believe the government has no control over the loss of value in the ARS.

- Inflation statistics annually for Argentina have shown a percentage increase of over 100% in the past year.

Traders who can pursue the USD/ARS on their broker’s trading platforms are encouraged to make sure their transaction fees, including overnight carrying charges, are not astronomical. Brokers offering the USD/ARS know full well the value of the currency pair is going to go up, so in order to make money on the movement of the Forex pair, they likely charge much higher fees to pursue its upwards path. In other words, traders should remain cautious about buying the USD/ARS if they believe they will have to hold the trade overnight because it could diminish any chance of real profits if the costs of trading are simply too high.

The USD/ARS will continue to climb in Value but Trading is Time Sensitive

Buying the USD/ARS makes complete sense if you are able to afford the costs of the transaction fees likely associated with the currency pair via brokers. However, day traders are urged to be careful and not take anything for granted. Getting into the USD/ARS can also be costly regarding the spread via the bid and ask of the currency pair.

If you choose to buy the USD/ARS you are also urged to use an entry-price order and make sure the ‘fill’ is correct. Day trading the USD/ARS for only a handful of hours may prove difficult and costly, because the currency pair may not move enough to cover your trading expenses.

There is no free money when trading and the USD/ARS is a pair that should be treated with care. The USD/ARS is certainly within the grips a long-term bullish trend because the government of Argentina has shown no ability to deliver a viable currency for its citizens.

The USD/ARS is now within sight of the 209.000 ratios and it is not a question of if the official transaction rate will hit this mark, it is only a question of when. Traders who can buy the USD/ARS need to understand all of the costs involved in buying and not be fooled into the allure of an ‘easy’ trade.

Argentine Peso Short-Term Outlook:

Current Resistance: 208.400

Current Support: 208.010

High Target: 209.100

Low Target: 207.690

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.