My previous USD/JPY signal on 20th February produced a losing short trade from the bearish rejection of the resistance level at ¥134.66.

Today’s USD/JPY Signals

Risk 0.75%.

Trades may only be taken prior to 5pm Tokyo time Thursday.

Short Trade Ideas

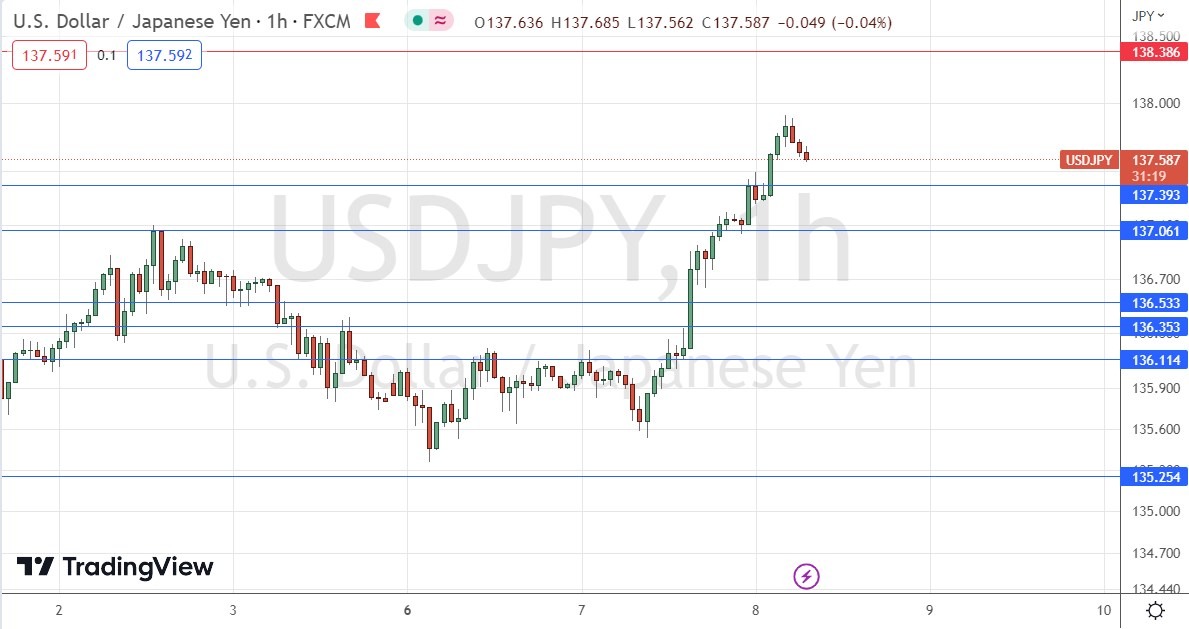

- Short entry following a bearish price action reversal on the H1 timeframe immediately upon the next touch of ¥138.39 or ¥139.00.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 50 pips in profit and leave the remainder of the position to run.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 timeframe immediately upon the next touch of ¥137.39, ¥137.06, or ¥136.53.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

USD/JPY Analysis

In my previous forecast for the USD/JPY currency pair, I wrote that the price was likely to keep moving lower, but it could find minor support if it reaches the lows at about ¥133.60. This was not a good call, as it found support some 30 pips before that.

The technical and fundamental picture now in this pair has become considerably more bullish following yesterday’s testimony before the US Senate by the Chair of the Federal Reserve, who said the Fed would likely have to raise rates higher and more quickly than was currently expected, leading economists to except a terminal US interest rate of about 6%, a considerably upwards revision. These comments saw the US Dollar strengthen notably, with the US Dollar Index breaking above 105 and a confluent strong resistance level to trade at its highest price in over 3 months.

The US Dollar made firm gains across the board, but it is notable that the strongest gains were against more “risky” currencies such as the British Pound and the commodity currencies (AUD, NZD, CAD). The Yen lost ground but has held up better, probably because higher rates from the Fed increase the chance of a recession and as such lead to stronger general risk-off sentiment, and the Yen benefits from that.

Technically, we saw a strong upwards move followed by a bearish reversal just below ¥138. However, we see some short-term price action which continues to suggest bullishness.

I think we may see another up day in this currency pair, but I don’t think any rise will be very high. For this reason, I think the best trade opportunities here today will likely be a long trade from any bullish reversal we get following a retracement to any of the support levels identified.

A strong jobs data and forecast later today in the US will likely send the US Dollar even higher, so keep an eye on the data releases during today’s New York session.

Traders may find being long of the US Dollar more fruitful against the British Pound or commodity currencies than against the Japanese Yen.

Regarding the USD, there will be a release of the ADP non-farm employment change forecast at 1:15pm London time followed by Fed Chair Jerome Powell’s testimony before the House of Representative at 3pm, when there will also be a release of JOLTS job openings data. There is nothing of high importance due today concerning the JPY.

Ready to trade our free Forex signals? Here is a list of the best online Forex trading platforms worth reviewing.