The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are just a very few valid long-term trends in the market right now, which might be exploited profitably. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 12th March that the best trade opportunity for the week was likely to be short of the AUD/CHF currency cross. Unfortunately, the price rose over the week by 2.25%.

The news is dominated by three major issues:

- A continuing banking crisis. Credit Suisse shares plummeted to an all-time low as the bank neared collapse earlier in the week, following the failures of Silicon Valley Bank and Signature Bank in the USA. Credit Suisse secured a $54 billion bailout from the Swiss National Bank and will now likely be taken over by Swiss giant UBS, which is seeking another $6 billion in guarantees from the SNB. Banking stocks have had a very tough week, with First Republic in the USA now rumored to be in trouble.

- Fall in US inflation, PPI, and retail sales. US CPI data released last week showed another fall in the annualized rate from 6.4% to 6.0% as expected, and lower than expected PPI and Retail Sales data. This suggests a cooling US economy and considerably reduces pressure on the Federal Reserve ahead of their policy meeting this week on 22nd March. US stock markets ended the week higher, and a technical golden cross was seen in the NASDAQ 100 Index, while 2-Year US Treasury Yields dropped dramatically to end the week below 4%.

- ECB rate hike by 0.50%.

Markets will now be turning their attention to the Federal Reserve’s policy meeting this Wednesday, having moved from expecting a 0.25% or even a 0.50% rate hike just a few days ago, to a consensus expectation narrowly in favor of a rate hike of 0.25%, while almost half of analysts are expecting no hike at all.

There were a few other significant data releases last week:

- UK Budget – there were no major surprises, but the government is now forecasting no recession in the UK, and a rapid decline in inflation. This helped strengthen the British Pound.

- New Zealand GDP – this came in much worse than expected, showing a decline of 0.6% over the previous quarter when a decline of only 0.2% had been expected.

The Week Ahead: 20th March – 24th March 2023

The coming week in the markets is likely to see an even higher level of volatility than last week, due to ongoing fear of bank contagion and the US Federal Reserve’s policy meeting which may bring yet another rate hike. This week’s key releases are, in order of importance:

- UK CPI (inflation) data

- Canadian CPI (inflation) data

- US Federal Funds Rate, FOMC Statement & Projections

- SNB Policy Rate & Monetary Policy Assessment

- UK Official Bank Rate & Monetary Policy Summary

- US Unemployment Claims

- Flash Services & Manufacturing PMI data for USA, UK, Germany, and France

- It will be a public holiday in Japan on Tuesday.

Technical Analysis

US Dollar Index

The weekly price chart below shows the U.S. Dollar Index printed a bearish candlestick continuing the rejection of the key resistance level at 105.36.

The candlestick is a bit small but has a substantial higher wick, suggesting bears are decisively in control here. Another bearish sign is that the Dollar is trading below its levels of both 3 and 6 months ago.

The US Dollar is likely to face conflicting pressures and high volatility over the coming week, due to ongoing fear of US bank contagion, but also a cooling US economy and the Federal Reserve’s rate hike decision which will be announced on Wednesday. For the time being, trades against the US Dollar are most likely to be successful, but traders should follow the news closely and beware of volatility events.

NASDAQ 100 Index

We saw a firm rise in the NASDAQ 100 Index over the week after a golden cross was made on the daily chart at the end of the previous week. Stock markets have been shaken by the ongoing banking crisis, but we are seeing many tech shares making big rises as US inflation continues to fall, taking pressure off the Federal Reserve to continue hiking rates as the US 2-Year Treasury Yield declined by more than 1% in about a week. However, this is tempered by the recent strong fall seen by the S&P 500 Index after it made a golden cross a few weeks ago, from which historically there have been no similar recoveries over the past century.

There is a clear resistance level shown in the price chart below at 12820. A daily close above that level will be a further bullish sign.

It seems that we have some bullish signs, but overall, we are seeing a split stock market with select tech stocks doing well while other sectors are not.

Much will now likely depend upon whether the US Treasury can restore faith that banking contagion will not spread, and what approach the Fed takes towards rates on Wednesday. It is important to bear in mind that the NASDAQ 100 does have a great record of producing outside returns, so the bullish signal here is worth considering.

Gold

Last week saw the strongest price rise by Gold seen since November last year. The price chart below shows an extremely strong and large bullish candlestick was printed, which closed right on its high, ending at an 11-month high price, which is usually a bullish sign.

The price ended the week below $2000 but within sight of its all-time high price made in March 2022.

Trend and breakout traders should seriously consider buying Gold even just on these technical indications. The deeper reason why Gold is rising is probably due to the decline in the US Dollar as a safe haven due to the banking crisis, and due to the banking crisis itself. Bitcoin also seems to be playing a similar rose to Gold now.

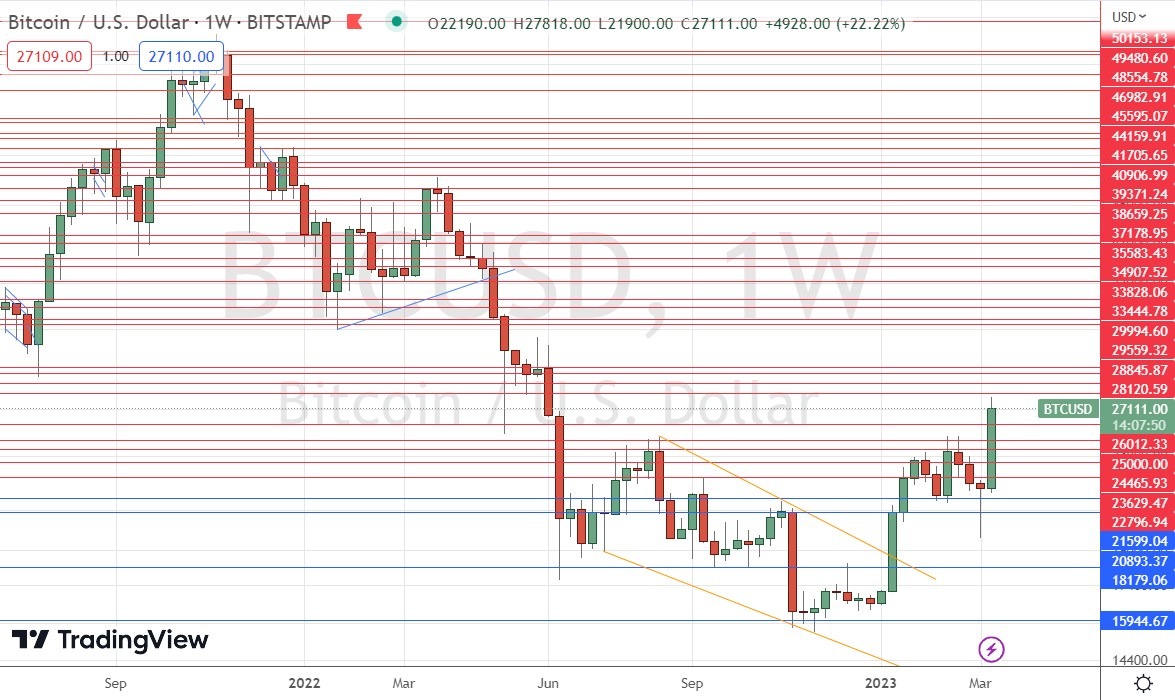

Bitcoin

Last week saw the strongest price rise by Bitcoin seen since January this year. The price chart below shows a strong and large bullish candlestick was printed, which closed not far from its high, ending at a 9-month high price, which is usually a bullish sign.

Trend and breakout traders should seriously consider buying Bitcoin even just on these technical indications. The deeper reason why Bitcoin is rising is probably due to the decline in the US Dollar as a safe have due to the banking crisis, and due to the banking crisis, itself. Gold also seems to be playing a similar rose to Bitcoin now.

Traders should keep in mind that Bitcoin is riskier than Gold and has a poor record as a safe haven, while Gold’s record is better. Buying Gold is likely to be the better trade here.

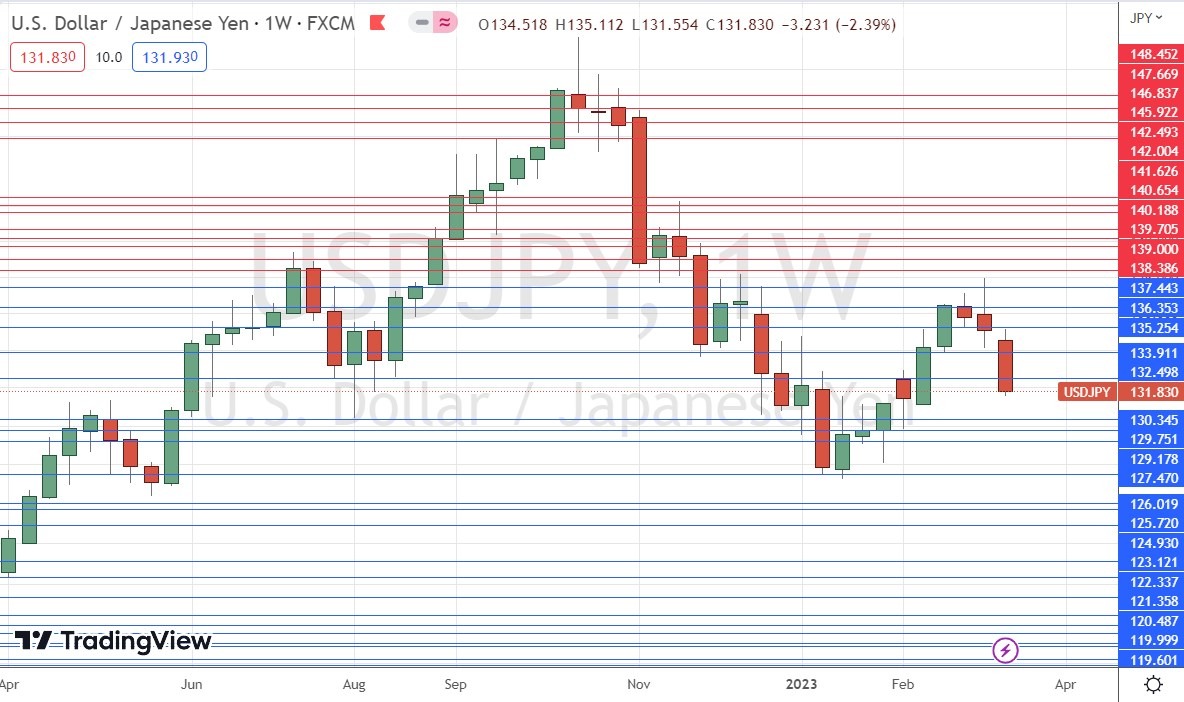

USD/JPY

The Japanese Yen strengthened very firmly over the past week, not due to any material change in policy by the Bank of Japan or any fundamental factor, but simply due to the Japanese Yen’s attractiveness as a safe haven currency at a time of a banking crisis in the USA.

The Yen gained by more than 2% against a basket of currencies, with the US Dollar one of the main losers as the Dollar is generally weak, and in a long-term downwards trend.

The price chart below shows the weekly candlestick is of a good size, looking very bearish as the close is very near the low.

If the perception of a banking crisis persists, we are likely to see the USD/JPY currency pair continue to decline.

Bottom Line

I see the best trading opportunities this week as:

- Long Gold against the USD

- Long Bitcoin against the USD

- Long Japanese Yen against the USD (potentially as short-term day trades due to support near ¥130.

- Long of the NASDAQ 100 Index following a daily close above 12820

Ready to trade our weekly Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.